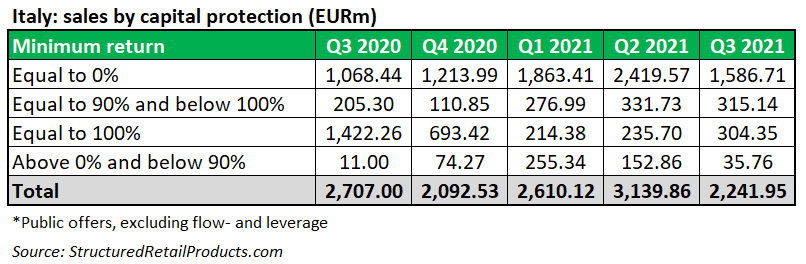

Products providing full capital protection continued to struggle in Q3 2021, with many investors opting for hybrid solutions of fixed income and equity instead.

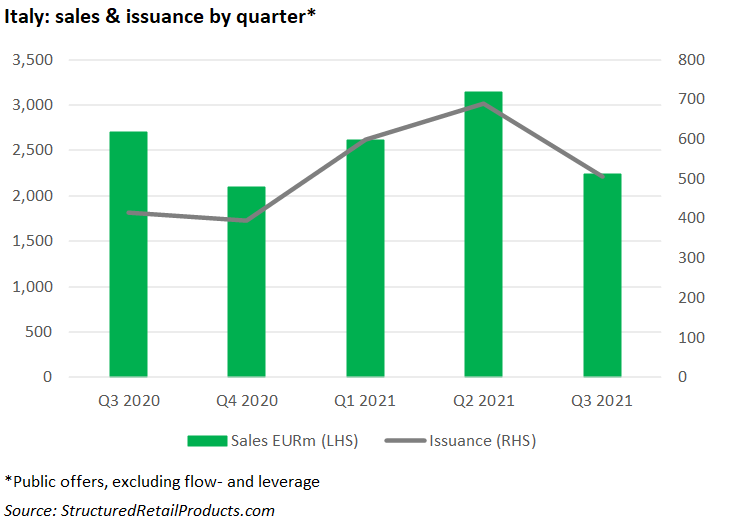

Some 505 structured products worth an estimated €2.2 billion had strike dates in Italy during the third quarter of 2021 – an increase in issuance but down in sales volume compared to the prior year quarter (Q3 2020: €2.7 billion from 416 products).

Two hundred and forty-one products matured during the period, releasing €1.5 billion back onto the market for reinvestment.

As of 30 September 2021, there were 4,931 live structured products worth an estimated €58.8 billion listed on the SRP Italy database (excluding flow and leverage).

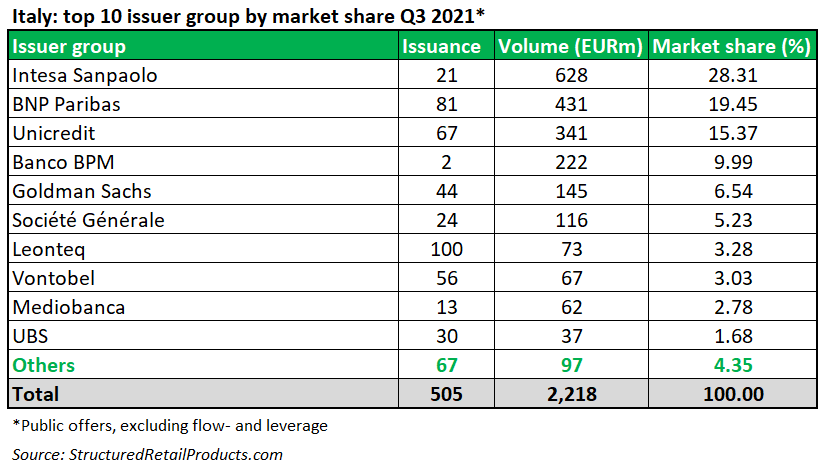

Intesa Sanpaolo was the number one issuer group in Q3, with a 28% share of the Italian market.

The bank collected €628m from 21 products (an average of €29.9m per product) during the period, including the Max Long Cap Certificate on the Euro iStoxx 50 Artificial Intelligence Tilted NR Decrement 5% Index that sold €80.6m. It offers annual income and minimum 90% capital return at maturity.

The best-selling product of the quarter, however, came from Banco BPM, which held a market share of 10%, despite issuing just two products in Q3.

Its capital protected Equity Protection con Cedola e Cap on the Eurostoxx Oil & Gas Index collected €132m during the subscription period while the bank’s only other product – a similar capital protected structure, this time on the Eurostoxx Utilities Index – achieved sales of €90m.

Leonteq, which issued 100 products worth an estimated €73m – equal to a 3.3% market share – was responsible for the best performing product. The company’s barrier express certificate on the shares of Ford Motor and Tesla returned 115% after just over six months, or 31.95% pa.

Sales volumes for 100% protected products, at €304m, decreased by 79% YoY, with just six such products issued in the quarter (Q3 2020: 28), despite the fact that Italians are often viewed as conservative investors who prefer capital protected solutions.

“This is a common vision for Italy,” said Jacopo Fiaschini, head of flow products distribution Italy, at Vontobel. “At the moment, global interest rates are zero or negative, and therefore they don’t allow us to issue interesting products with capital protection,” he said.

According to Fiaschini, the turnover generated by capital protected certificates on Sedex (Borsa Italiana market for securitised derivatives) is only 12.6%.

“This percentage used to be much higher in the past […] Italian investors loved bonds, loved coupons, this is something that fits well [with their mentality],” Fiaschini said.

Some 486 products issued between 1 July and 30 September put full capital at risk. The accumulated estimated sales of €1.6 billion, an increase of almost 50% compared to Q3 2020.

Most capital-at-risk products are reverse convertibles – often with a worst-of option feature – and with the exception of Unicredit, the top 10 issuers all comprise of foreign banks including Leonteq, BNP Paribas, Goldman Sachs and Vontobel.

The Swiss structured products specialist issued 56 memory cash collect certificates on a worst-of basket. They have average annual coupons of 12.6% while the barrier for conditional capital protection is on average 60% of the starting price.

“With the downtrend in yield, Italian investors did not feel comfortable in switching from total capital protection directly to equity, while at the same time, they were not satisfied with fixed income rates and that’s why the love Memory Cash Collect, because it is a hybrid solution.

“It’s a halfway house between fixed income and equity – a payoff that is very much appreciated by Italian investors,” said Fiaschini.

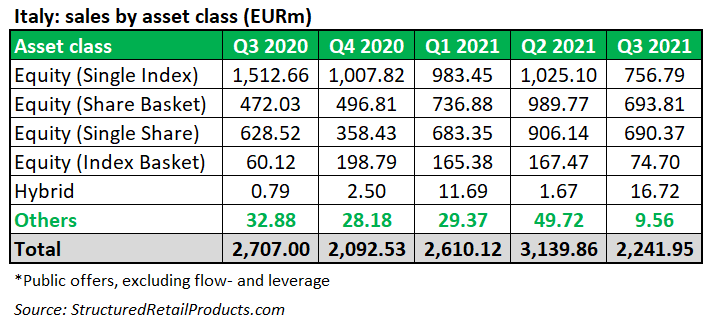

Despite the increase in demand for products linked to worst-of baskets, structures tied to single indices still generated the highest sales, even though volumes decreased by 50% YoY.

The 40 products linked to a single index were worth an estimated €756m, with the highest volumes coming from Eurostoxx Oil & Gas (€172m), Eurostoxx Utilities (€90m), and FTSE MIB (€60m).

Volumes for products on single stocks increased by 10% YoY. The 140 products that were seen in the period collected €690m and were linked to 80 different shares, of which those of Enel, Intesa Sanpaolo, Eni, and Unicredit were the most frequently used.

Index baskets were also in the plus, with 24 products issued in the period achieving sales of €75m compared to €60m (from 14 products) in Q3 2020. The local FTSE MIB was present in 16 products while the Eurostoxx Select Dividend 30 (six products) accumulated the highest sales (€57m).

Tenors focused on the short and medium-term. Two hundred and five products had a maturity of less than three years while a further 276 products had a duration of between three and six years. The remaining 24 products had an average investment term of 6.7-years.

Image credit: Jonathan Bean/Unsplash.