The Malaysian investment bank is seeking alternatives to revive its structured warrant activity.

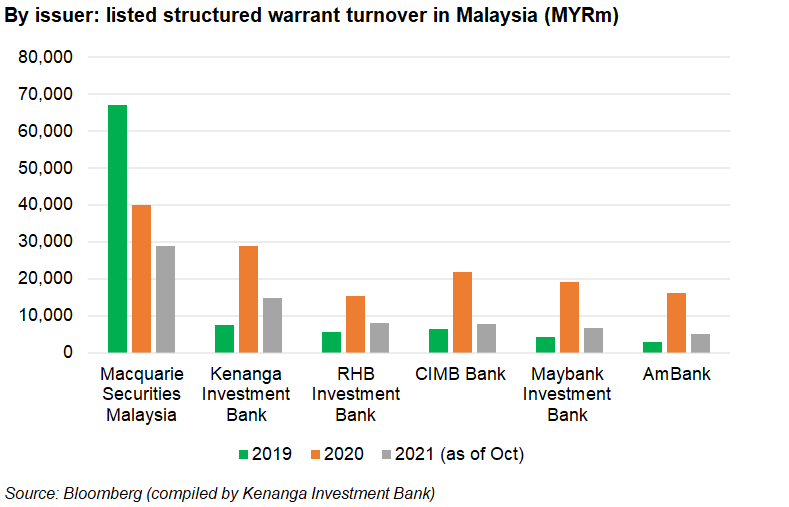

In the past 10 months, the turnover of Bursa Malaysia-listed structured warrants has reached MYR71.3 billion (US$16.9 billion), accounting for half of the turnover in 2020, and 76% down compared to 2019.

In an interview with SRP, Philip Lim (pictured), head of equity derivatives at Kenanga Investment Bank, reflects on the slow growth of structured warrant market in Malaysia and how the second largest issuer by turnover has adapted to it.

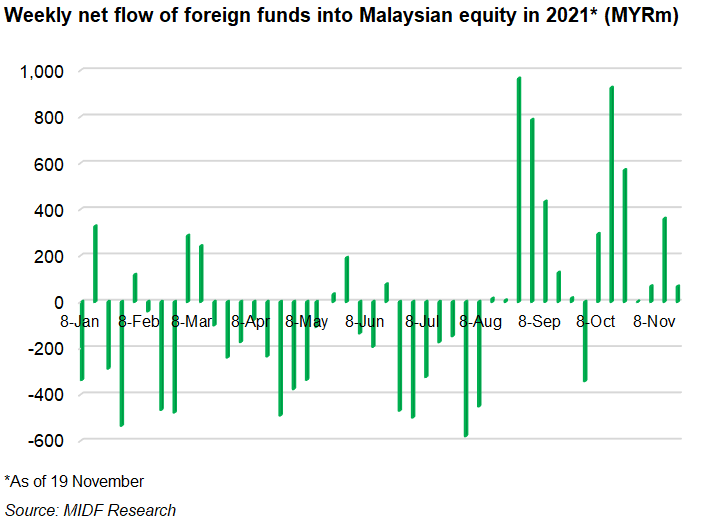

“Since the beginning of 2021, foreign fund outflow and lack of growth catalysts were clearly portrayed in the Malaysian equity space,” said Lim.

As of 19 November, retailers were the only net buyers of Malaysia-listed equities to the tune of MYR11.6 billion while local institutions and foreign investors were net sellers amounting to MYR9.9 billion and MYR1.68 billion, respectively, according to MIDF Research, the research arm of MIDF Amanah Investment Bank.

The hard brakes were directly related to 2020 being ‘an unusual year’ for the Malaysian equity market.

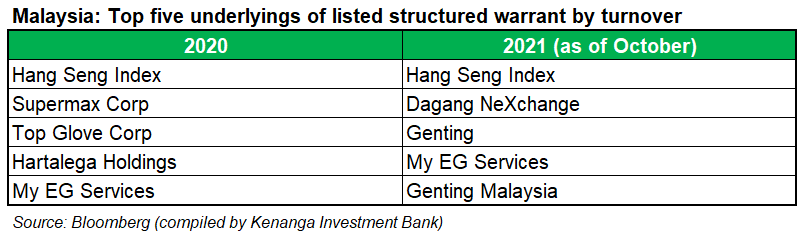

“Pandemic counters like stocks on Malaysian rubber glove makers were the outliers that lifted the FBM KLCI (FTSE Bursa Malaysia KLCI Index) upwards as they became the second largest in weighting after the banking sector,” said Lim, citing the soaring turnover of Supermax-linked warrants in 2020.

In addition, the social lockdown enabled stay-at-home day trading to boom, according to Lim.

Structured warrant investors were also attracted to the 0.1% stamp duty exemption from Bursa Malaysia - the promotion was valid for three years until the end of 2020.

Kenanga is the second largest issuer of Malaysian structured warrants with a 20.6% market share based on the turnover from January to October, following Macquarie Securities’ 40.3% market share.

Since its foray into the Malaysian market in 2014, the Australian house has been a dominant player as the main provider of structured warrants linked to Hong Kong equities, particularly the Hang Seng Index (HSI), which formed three quarters of its 10-month turnover, or MYR21.1 billion.

Meanwhile, Kenanga took the lion’s share of Malaysian equity-linked warrant issuance with a 30% market share by turnover, or MYR14.3 billion.

To cope with the sluggish domestic equity market, the investment bank in July debuted HSI-linked warrants.

“The timing of our launch was to appeal to sophisticated traders with higher risk appetites as volatile macro-economic conditions in July 2021 created great trading opportunities on the HSI,” said Lim.

The issuer expects to ‘aggressively grow’ its HSI warrant business and introduce new warrants on single foreign stocks with big market capitalisation in the first half of 2022. However, Lim noted the bank will continue to focus on its core Malaysian equity warrants.

Besides HSI, the foreign underlyings available in the structured market include the Hang Seng Tech Index, S&P 500, Tencent Holdings, Meituan Dianping, Geely Auto, BYD, Alibaba Xiaomi, SRP data shows.

Investor behaviours

“Retail warrant traders are like gastronomy fans with an appetite for farm-to-table offerings. Quick, fresh, creative and first to market,” said Lim.

Compared with other local issuers, Kenanga currently houses approximately 870 equity sales agents, and 150 dealers in the broking department. The house also features a wide coverage of stocks comprising 133 names by a group of 23 analysts.

“We tailor the sensitivity and ratio of our structured warrants based on trader demographics,” said Lim. “The put warrants are strategically issued when markets have overheated and valuations are overstretched. The warrants are tweaked even on the same counters based on the customers’ risk-return preference.”

Structured warrant investors in Malaysia used to be highly dependent on sales agents for trading advice and guidance, but social media has changed the landscape, according to Lim.

Nowadays Kenanga engages with its brokerage clients primarily through Telegram and WhatsApp while working closely with technical analysis academies and trading platforms, such as Rakuten Trade, ART Trading Systems and F1 Academy of Technical Analysis.

“We were also the first and only local issuer to develop a live matrix dashboard featuring a traffic light system for avid traders, which was revolutionary in the industry,” he said.

Challenges

Lim’s outlook for 2022 remains cautious as it will not be an easy year for the structured warrant market in Malaysia in view of the dim economic outlook, stagnant GDP growth post-pandemic and political uncertainties.

“A significant challenge has arisen in the form of Malaysia's Budget 2022 proposal of stamp duty on contract notes to be increased from 0.1% to 0.15%,” Lim added. “This an enormous deterrent as traders are well aware that this will make it harder to break-even on a position, let alone profit.”

What’s more, the budget has sought to remove the MYR200 stamp duty cap on contract notes for trading of listed shares, which was announced on 29 October.

“These proposed changes will have a negative impact on trading on Bursa Malaysia,” said Lim. “Warrants are a derivative of the underlying share with the lowest cost to entry for the Malaysian Rakyat [ordinary people].”

At Bursa Malaysia, the incentive scheme for structured warrants was also tightened this year. The bourse is offering an initial listing fee rebate of 40% for each of the first 100 structured warrant issuance in 2021 – the rate will drop to 20% for the onward issuance, the bourse told SRP in a statement.

To be eligible for the scheme, issuers must conduct no less than 15 retail seminars or roadshows per year, and at least 30% of their new issuances must be in any two combinations of single stock put warrant, warrants on local index/ETF or warrants on foreign stock/index/ETF.

Back in 2020, the rebate on the initial listing fee was 25% for the first 67 issuance, 35% for the 68 to 167 issuance, and 50% for the 168th issuance and above, subject to slightly different eligibility criteria compared with this year.

However, the expanded market marking frame updated by Bursa Malaysia in December 2020 is expected to have a positive impact. To improve market efficiency and promote liquidity, a new category has been introduced called ‘derivatives specialists’ who are allowed to utilise the Permitted Short Selling (PSS) framework for the purpose of market making.

“The PSS was introduced so that market makers like us are not subjected to previous rulings required under the old Regulated Short Selling [RSS] regime,” said Lim. “The at-tick rule hindered dynamic hedging and as a result, filled the market with call warrants.”

Before the new rule was introduced, Kenanga could only issue put warrants very selectively as it managed the hedge on an aggregate level.

During the past two years, the bank has not witnessed significant issuance of put warrants because the securities-based lending market has not provided deep enough buckets of securities to borrow from.

Additionally, the requirement of PSS trades to be conducted in a designated PSS account may create inefficiencies in trading and nullify some of the benefits touted under the new framework, said Lim. “We have some simple solutions which we would be excited to sandbox on.”