The firm is targeting the country’s pension funds with the first fund of structured products launched in Switzerland.

Finanzlab, a Swiss firm specialising in the design, selection and brokerage of custom structured products, has launched a new fund of structured products targeted at pension funds.

The Swiss company launched in 2018 as a specialist brokerage of tailor-made structured products.

“We support professional asset managers and institutional investors in identifying their investment needs and act as an independent player on the Swiss structured products market,” says Gilles Corbel, chief executive and co-founder of the firm, alongside Vincent Bonnard (below) who runs the risk and compliance side of the business.

We believe a fund of structured products will resonate with investors in Switzerland - Gilles Corbel

Corbel (pictured) discovered the structured products industry in 1991 whilst working for UBS which at the time was already selling index guaranteed linked unit, known as IGLU. After a master’s in finance, and a stint in bond trading at UBS, he moved to Waadtländer Kantonalbank (BCV) in 1999 to develop the structured products business for the bank.

“At that time, we had very high interest rates and you were able to do some very smart capital-protected products linked to indexes – you had money for the option and big leverage on the underlyings,” says Corbel.

Back then, there was an explosion of products with many kantonalbanks and private banks selling reverse convertibles, and other products issued by the French banks such as Napoleon and Himalaya structures.

He was also member of the Swiss Structured Product Association in 2008 when the Lehman Brothers collapse sent shockwaves to the structured products market.

Pension funds

Corbel always had the ambition to find a good wrapper to make structure products appealing for pension funds in Switzerland as this kind of investor had not traditionally been very interested in bespoke products.

“I have come to the conclusion that the only way to sell a structured product to a pension fund is with a fund,” says Corbel. “Their fund advisor knows how to do the due diligence of the fund and so on, but they don’t have the analytics schemes to offer structure products.

“For banks, it is very difficult to make a fund and is also a niche product for them; and with actively managed certificates of structure products you still had the main counterparty risk and above all you have no external supervision.”

The fund was launched in October 2021 under Swiss law. The firm wanted to have a low cost structure which meant it had to be the manager of the fund. The firm was licensed by the Swiss regulator (Finma) to be a portfolio manager which allows Finanzlab to manage up to CFH100m (US$108m) in the fund – this is not a hard limit as the amount can be extended by applying for another permit to increase the volume.

This is a way, provided by the Financial Institutions Act (FinIA), to start for smaller companies that want to bring innovation.

“We have spent a year working with Finma to get the authorisation,” says Corbel. “We believe a fund of structured products will resonate with investors in Switzerland. Our strategy is very simple and very robust.”

The fund

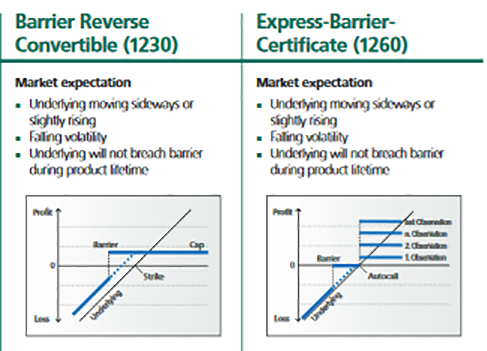

The fund only invests in indexes and has very strict rules about the payoff used within the fund - it only uses reverse convertible and express barrier structures, according to the Swiss Derivative Map - 1230 and 1260.

These are barrier reverse convertibles and conditional coupon barrier reverse convertibles with some fixed parameters - a three-year maximum tenor, a maximum 60% barrier and denomination in Swiss francs. It also includes a callable option.

Source: SSPA

“We want to reach a net absolute return of between four and five percent in Swiss francs per year,” says Corbel. “That means you need to have coupon in your product of six to seven percent to cover the cost and the small frictions in the fund.”

The fund comprises between 10 and 15 products issued by different manufacturers at any time, “to achieve issuer diversification and to diversify entry points into the market”.

The underlying universe is also fixed – with a maximum of 16 market cap indexes and no emerging markets indexes. The fund can invest in products linked to the Kospi 200 and Hang Seng but it mainly offers exposure to European and American indexes.

Most of the fund’s structures are listed in the Swiss market to provide transparency and avoid conflicts of interest. The fund has a fixed total expense ratio (TER) of 75 basis points which includes the costs of the fund management company, the custodian bank and the firm’s fees.

“There are no surprises for investors. We have a mechanism to protect the cost inside the fund and limit the fees,” says Corbel. “We have an entry fee of 50 basis points because we have a bid ask spread to cover when we buy products in the Swiss markets and the NAV of the fund is based on the bid of the products.”

Protection, best execution

Protection is a key feature of the fund because of the kind of investor it is targeting and is the reason why it also features roughly continuous barriers at 50%.

“We want to receive a premium based on an extreme value of movement of the market,” says Corbel. “It's a tail risk and we saw in March 2020 that many barriers were not breached - structured products offer that kind of extra protection.”

In the extreme case that the Eurostoxx 50 had a drawdown of 38%, for instance, the mark-to-market valuation of the product was at 50%.

“When you sell volatility in this scenario the mark-to-market is ugly and you can have this also in the bond markets with a shock on the spreads,” he says.

Best execution is also a key aspect of the fund as Finanzlab's core business is to find the best price for the product issuance.

“There is no conflict of interest - we don’t receive any commission for the negotiation of the products, we can put all our experience and pricing power for the benefit of the fund,” says Corbel. “But if you want to have best price, you have to stay with the big indices. If you want to offer best execution you have to receive different prices and you don’t have competition on illiquid indexes.”

For this reason, the fund will not invest in emerging markets or ESG indexes as the market “is not mature for those underlyings and we are very clear in our value proposition”.

“We offer something very simple 10 to 15 products with very clear payoff structures. That is already a lot of complexity for pension funds,” says Corbel.

Finanzlab was the first Swiss firm to join the Luma Financial Technology multi-issuer platform in the summer of 2021 in support of wealth managers and private banks across the market in Switzerland.

“Luma is neither a bank nor a broker company, but a technology provider,” says Corbel. “For us it is a very efficient and powerful way to make numerous price requests and to keep an audit capacity of all the requests that are made for the fund.”