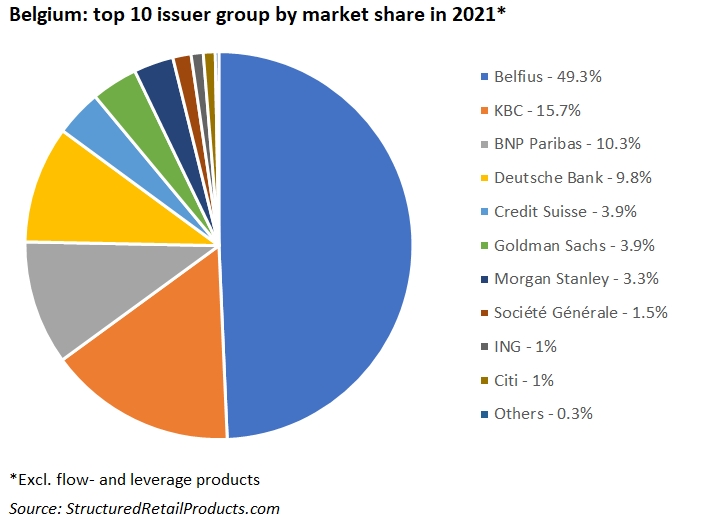

Belfius took the number one position in the Belgian structured products market for the first time, after years of domination from KBC.

2021 was not a great year for the Belgian market. Some 132 structured products worth a combined €1.4 billion were sold to Belgian retail investors between 1 January and 31 December 2021 – a significant decrease in issuance and sales volume compared to the previous year (FY2020: €3.3 billion from 212 products).

Belfius was the number one issuer with a 49% share of the market. The bank collected €680m from 49 products during the year. It was the first time since the launch of the SRP Belgium database in 2005 that Belfius came out on top, with KBC the main provider on all previous occasions.

The latter accumulated sales of €215m from just eight products (16% market share), which were all wrapped as structured funds. BNP Paribas, which achieved sales of €143m from 29 products (10% market share), finished third.

In total there were 11 different issuers active in the Belgian market.

The best-selling product of 2021, with sales of €46m, was Belfius’ Callable Interest 08/2031. The 10-year steepener offers a fixed coupon of 0.75% for the first five years of investment. The following years, the coupon is equal to the difference between the 30-year EUR CMS and the two-year EUR CMS. The minimum capital return at maturity is 100%.

KBC’s E-commerce 90 USD 3, which sold €13.5m at inception, was the best performing product of the year. The US dollar denominated product was linked to a weighted basket of 30 shares. It paid investors the maximum possible return of 160% after 5.7-years (8.55% pa).

Check out the below pie-chart to view the top 10 issuer groups in the Belgian market.