In times of high volatility and with interest rate hikes on the horizon, the certificate is the instrument to turn to according to financial markets experts in Austria.

The market for structured products in Austria has grown significantly in 2021.

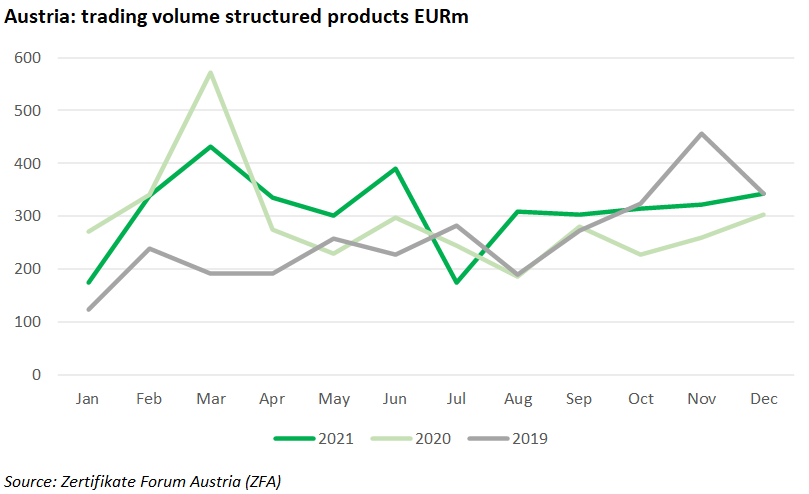

As of 31 December 2021, the outstanding amount for live structured products stood at €14.8 billion while the trading volume reached €3.7 billion during the year, according to figures from the Austrian certificate association (Zertifikate Forum Austria or ZFA).

Structured products are able to manage risk and seize opportunities in volatile or sideways markets - Frank Weingarts, ZFA

“Structured products have now become a well-established component in the portfolios of investors in Austria,” said ZFA chairman Frank Weingarts (pictured), speaking at Zertifikate Jahresauftakt 2022, the association’s annual kick-off event on 27 January 2022.

Volumes for investment products grew by 9.8%, or €650m, while certificates without full capital protection – such as minimum redemption products as well as bonus certificates, express certificates and reverse convertibles – were up by 26%, or €880m on the previous year. However, products with full capital protection, in Austria normally the strongest category, saw their volumes decrease by 6.9%, or €226.3m.

According to Weingarts, 2022 will be a year characterised by volatility.

“Geopolitical tensions, Covid-19-related declines in the profit growth of listed companies, as well as the expected changes in interest rates and monetary policy in the USA and in the eurozone, will trigger nervousness among market participants,” said Weingarts. “In this environment, certificates are simply the instrument of the moment [...] structured products are able to manage risk and seize opportunities in volatile or sideways markets.”

Turnover of all structured products, at €3.7 billion, increased by eight percent from €3.4 billion in 2020, with bonus certificates and equity-linked bonds increasing by 17% and 52%, respectively. Turbo certificates saw a decrease in turnover, due to the high volatility at the beginning of 2021.

Christoph Boschan (right), chief executive officer of the Vienna Stock Exchange, where the main certificate issuers are represented, expects the exchange to present record results this year, on the back of a strong performance of the Autrian Traded Index (ATX) in 2021 (+44%).

“After a strong setback when the corona pandemic broke out in March 2020, there was a very rapid turnaround […] against this background, certificates offer fantastic opportunities to participate in growth and reflect the different needs of investors,” Boschan said.

Thomas Wulf , secretary general of the European Structured Investments Products Association (Eusipa), took a look at the regulatory challenges for the financial and capital markets in his keynote speech.

“The withdrawal of quantitative easing and the end of the bond purchase program by the ECB from March 2022 will increase the pressure on interest rates,” he said.

Top of the to-do list for 2022 is green finance, in addition to the topics of banking and capital markets union and digital finance regulation.

Green finance

“With Green Finance, the euro zone is traveling with a high-speed train on old tracks. In 2022, many sustainability regulations are scheduled to come into force, but not all of the preparatory work has been completed. A lot of data is still missing,” Wulf said.

In general, when it comes to sustainability, Wulf (right) sees a strong trend away from qualitative assessments towards quantitative data collection and disclosure.

“Banks and companies will have to report how sustainable their products and balance sheets are. Customers are asked how sustainable the desired product should be. Supply and demand are matched accordingly. That sounds wonderful, but it will be a big challenge in terms of communication,” he said.

Wulf was critical of the EU Commission’s new proposals for the capital markets union, which aim to make relevant market and trading information available to all market participants in real time, if possible.

“There is already such a system in the USA. However, the EU lacks a structural business environment and a system based on the US model cannot simply be replicated here,” he said.

Positive outlook

According to Fritz Mostböck (right), head of group research at Erste Group Bank, a moderately positive equity market performance is expected in 2022, albeit with increased volatility due to geopolitical conflicts and ongoing supply chain issues.

“In view of the interest rate environment and the economic catch-up potential, there is no alternative to investing in shares in 2022,” he said, adding that particular attention should be paid to the markets of Central and Eastern Europe (CEE).

“From an economic point of view, the Central and Eastern Europe region is an essential backbone for listed companies from Austria, which see CEE as their extended home market. Calculated by market capitalization, they make up around 71% of the ATX,” said Mostböck.

As of 2 February 2022, there are 11,195 live structured products (excluding flow and leverage products) listed on the SRP Austria database. Of these, some 9,386 products worth an estimated €3.7 billion put full capital at risk while 738 products (€1.4 billion) are partially protected. Structures with full capital protection, despite lower in issuance (1,071 outstanding), achieved the highest sales, at an estimated €7 billion.

The ZFA was founded in 2006 by the leading Austrian certificate issuers to promote and develop the certificate market in Austria. The association provides information about certificates, creates transparency and training, and represents the regulatory interests of the certificate industry.

Click the link to read the ZFA 2022 presentation (German), outlook economy & financial markets (German), and update on selected market and policy trends (English).