Our performance analysis of the French structured retail products market in 2021 shows a positive period for the industry and end investors in a market that continues to grow in size and choice.

Despite the challenges posed by the pandemic lockdowns, the dividend crisis and the autocallable woes caused by the market correction of 2020 which resulted in hedging issues and missing potential maturities, the French market bounced back in 2021 delivering value to investors and proving once again that structured products are an efficient way to deliver risk-adjusted returns.

For last year’s analysis we reviewed over 3,000 products with maturity or potential early redemption dates between October 2020 and October 2021, of which 1,887 products matured or expired early. Of these, seven percent reached their organic maturity date and 93% triggered early maturity.

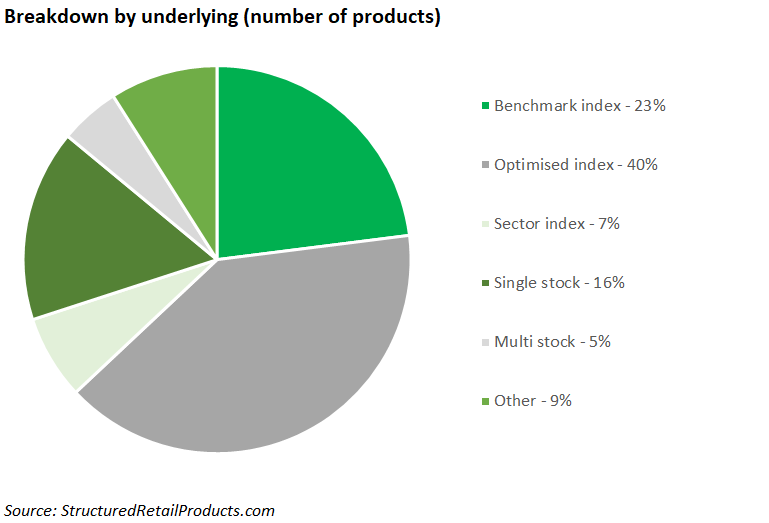

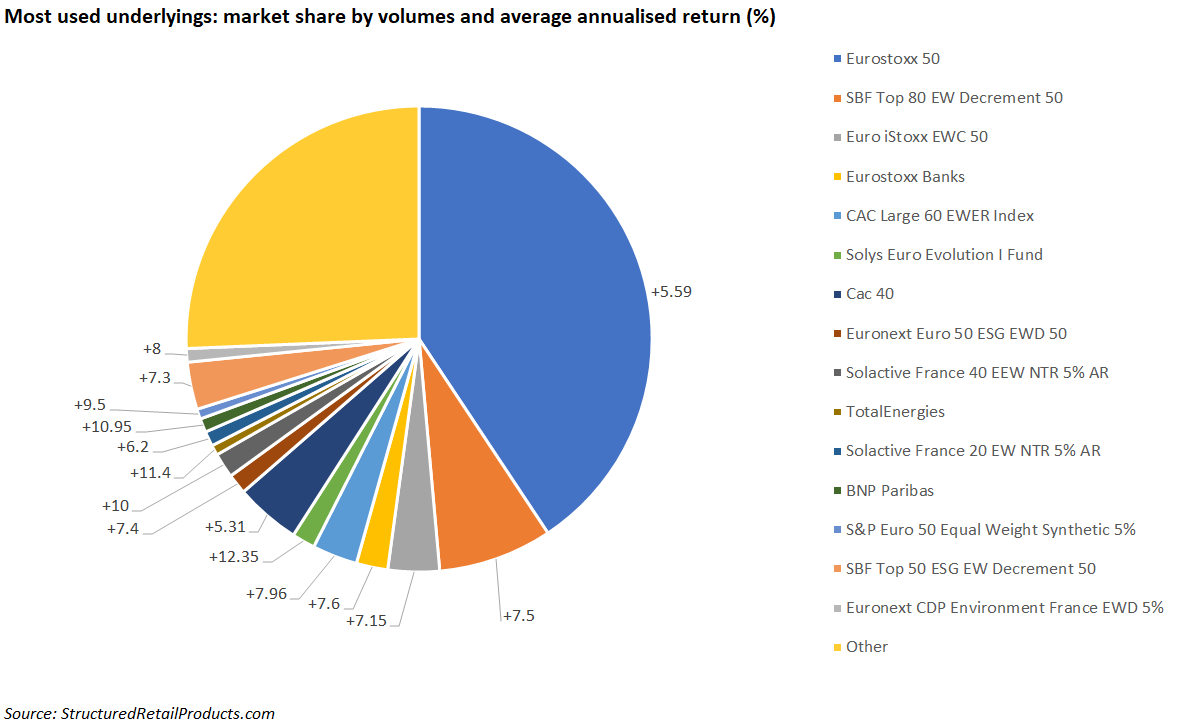

A break-down of the sample by underlying shows that index-linked products accounted for 70% of the maturities - most of these products were linked to optimised and bespoke indices such as decrement strategies. Products linked to stocks represented 20% of the total maturities.

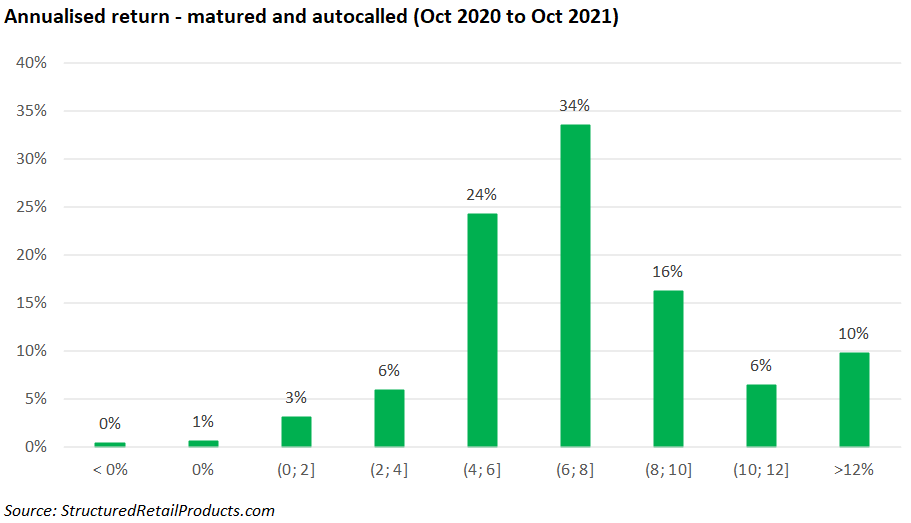

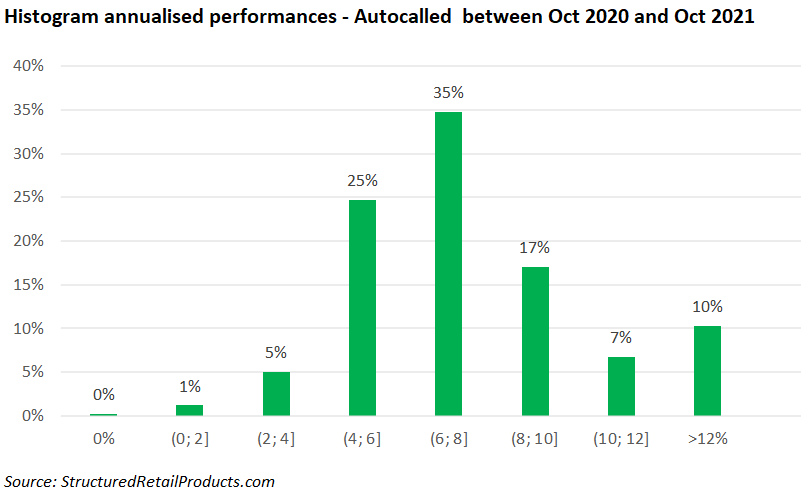

Looking at the histogram of returns, structured products benefited from the market uplift and delivered higher gains than they would have done the previous 12 months.

“It will be fair to say that this performance has been realised in the context of an impressive equity markets rally over the period,” said Nikolay Nikolov, product manager at Euromoney Derivatives.

Ninety nine percent of all products matured delivered a positive performance with annualised returns of between 0.6% and 65%.

The average annualised return of all products maturing in 2021 stood 7.8%, or 2.5% more than the annualised performance we reported for the previous 12-month period. Of the products matured, 34% paid between six and eight percent.

Overall, 85% of the products matured delivered a performance of ≥ 5%, and only five products delivered a loss to investors upon maturity. Negative maturities ranged from -0.85% pa. and -27.5% pa.

The five products incurring in losses in 2021 were launched in 2015, 2017 and 2018 - these loss-making structures were linked single stock underlyings from the banking and the commercial real estate sector.

The successful performance of structured products in 2021 was largely supported by the massive wave of autocalling products, especially since March 2021 - Nikolay Nikolov

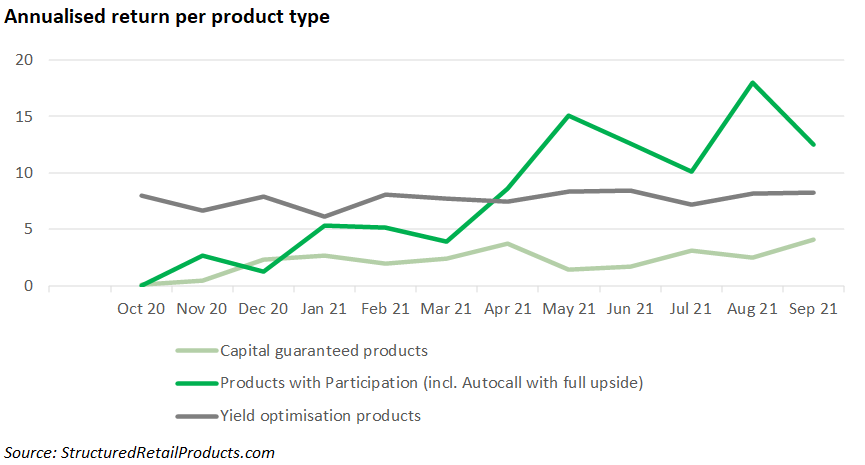

The analysis also found that a number of products with positive returns outperformed the average. A breakdown by product type shows that products with some form of participation significantly outperformed the other two sub-groups since April 2021.

This is because upside calls allowed to fully benefit from the equities market rally.

“In the period after the market crash in 2020, there was an increase for in demand bullish structures as investors seeking a higher potential gain were willing to place a bet on markets rebounding,” said Nikolov.

Bullish autocalls with full upside exposure triggered their early expiration features when markets rallied paying out high yields, including two-digit returns. These maturities peaked in April, May and throughout the summer, which coincided with the first anniversary of their strike.

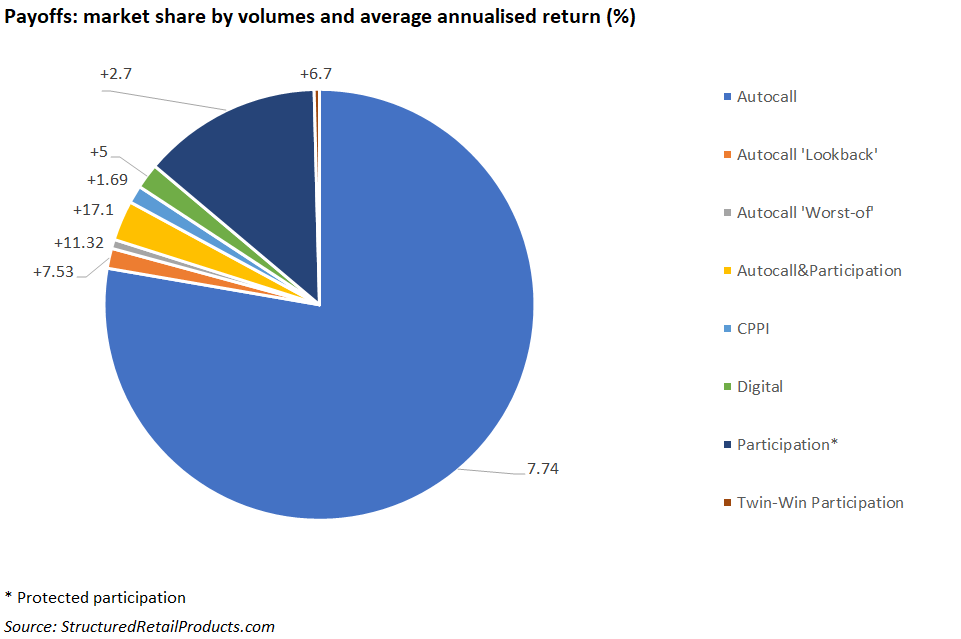

Traditional autocallable structures (Athena) represent the vast majority of the structured products market in France and can be seen in the Yield Optimisation group which represents around 80% of the matured volumes.

Yield optimisation products consistently delivered around eight percent over the period which is in line with the objective of these structure: to deliver regular and visible return to investors, while ensuring a protection against market dips and any potential exogenous shocks as we witnessed during the market crash.

Capital guaranteed products have been extremely scarce over the last five years as the low interest rate environment continued to hinder the ability to provide meaningful upside with full protection.

The majority (3/4) of capital guaranteed products maturing in 2021 were launched in 2013, and before – structure of these products is very different from what we are currently seeing in the market.

On average this group returned an annualised yield of between 0 and 4%. A typical product in the capital guaranteed sub-set would be an eight-year structure linked to the EuroStoxx 50 which participates in the index with averaging throughout the investment term. This explains the underperformance.

This group also includes some Portfolio Insurance products which failed to deliver strong returns as older CPPi structures usually monetise after a market correction and could not participate in the market rebound. However, it is important to note that a number of new CPPi structures on SRP’s database don’t present monetisation risk and will not suffer from sudden market downturns.

Asset class, payoffs

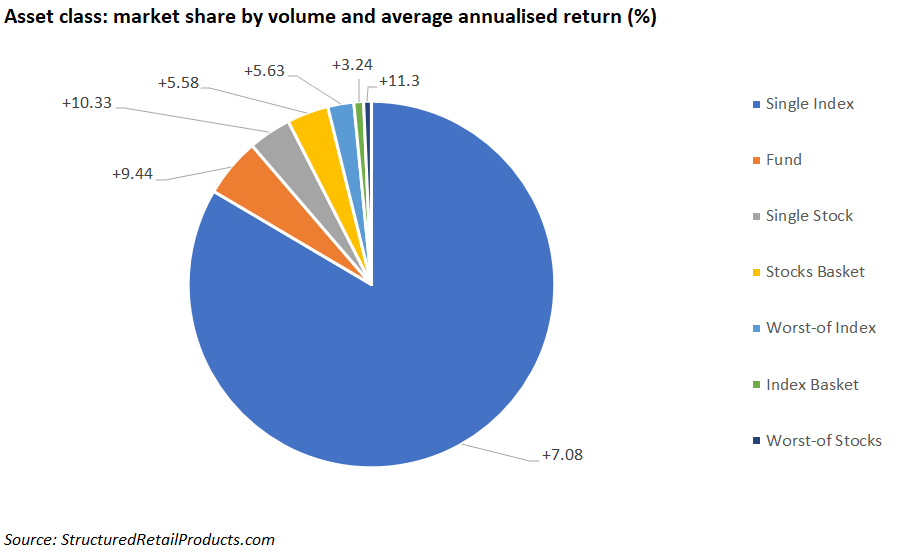

Looking at maturities by asset class, the analysis shows that single index-linked structures which represent over 85% of all maturities in 2021 delivered seven percent (annualised).

Products linked to single and baskets of stocks paid out the highest average returns - slightly above 10% and 11%, respectively.

Seventy-five of all maturities in 2021 were linked to 12 underlyings (see chart above). The Eurostoxx 50 Index was featured across 40% of all the products matured which delivered an average annualised return of 5.59%.

The highest average annualised returns were paid out by products linked to the Solys Euro Evolution I Fund (12.3%), followed by Total Energies (11.35%) and the share of BNP Paribas (10.95%).

By payoff type, the autocallable structure dominated last year’s maturities accounting for 83% of all matured products and an annualised return of 8%. Plain autocalls paid an average annualised of return of 7.5%; autocalls on 'Worst-of’ stock baskets returned 11.32%; and bullish autocalls returned 17.1%.

Protected participation products largely linked to the Eurostoxx 50, Cac 40 and equally weighted baskets of shares, returned 2.7% annualised.

Autocalls

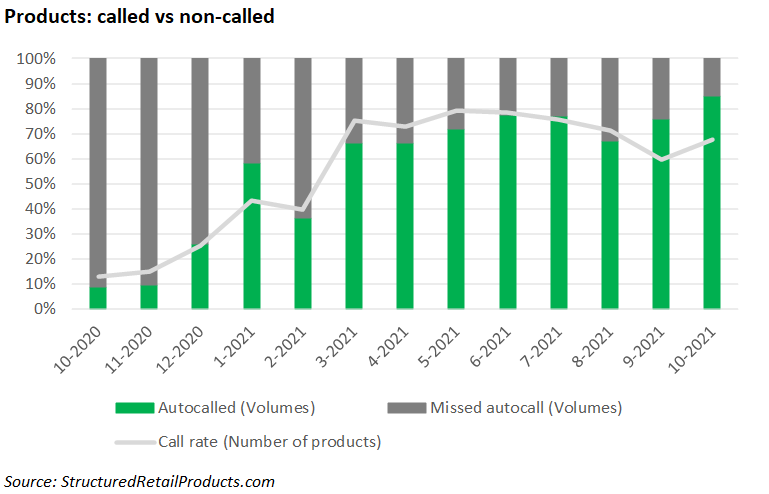

Autocall structures represented 95% of the products matured in the past 12 months and delivered an average annualised return above eight percent, higher than the returns recorded during the previous 12 months.

The analysis shows that 70% of the autocall structures have paid out a coupon above six percent. The average investment period of the early redeemed autocalls was one year and eight months versus the seven and a half year average holding period for products without that feature.

Among the best performers in this category are bullish structures designed to offer the greater between a coupon and the actual performance of the underlyings. Autocallables with full upside exposure capitalised on the market rebound and triggered bonus coupons as long as the underlying increased in value.

The best performer in this category was a life insurance product linked to Euronext Eurozone 40 EW Decrement 5% Index which paid a bonus coupon of 41% when the index increased by 10% from its initial level - the product returned 44% in just one year after the index met this condition in the summer of 2021.

Autocalls linked to stocks at 10% also returned above market average. In 2020, stock-linked products struggled to perform as they breached their knock-in barriers during the market crash. In 2021, however, many of these products paid out double-digit returns.

“The successful performance of structured products in 2021 was largely supported by the massive wave of autocalling products, especially since March 2021,” said Nikolov.

The number of autocall products maturing at the first opportunity increased after March 2021 and the high call rate was sustained in the months after.

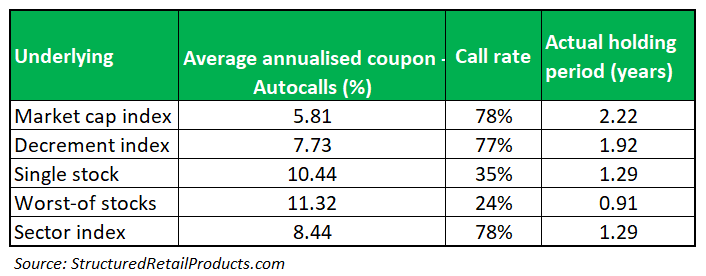

From an underlying perspective, we looked at maturing autocall products into five categories including products linked to market cap indices, optimised indices, single shares, worst-off baskets and sector indices.

Worst-off (11.3%) and single stock (10.4%) autocalls delivered the highest average annualised returns but had the lowest call rate at 24% and 35%, respectively. Sector (8.4%) and decrement indices 7.7%) also delivered good returns and had a high call rate at 78% and 77%, respectively. Market cap indices has the longest investment terms and delivered the lowest returns but had one of the highest call rates at 78%.

Click the link to access the France Structured Products Performance report 2020-2021.

SRP is the leading source of data intelligence on structured products globally, enabling you to plan for the future, gain market insights and compete strategically. Contact us to try a free a demo.

Image: Anthony Choren/Unsplash.