The Swiss structured products specialist posted record revenues and profits for 2021, driven by high levels of client activity across its range of investment solutions.

Leonteq has reported its group net profit more than tripled to CHF155.7m (US$168.3m) in full-year 2021 (FY2020: CHF39.9m).

Total operating income was CHF417.8m, up 78% year-on-year, reflecting strong fee income of CHF306.7m and a positive net trading result of CHF112.4m.

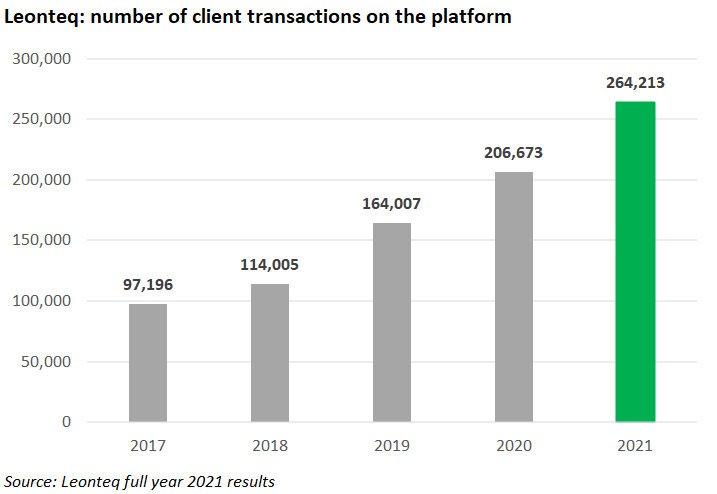

Client transactions increased by 28% to a total of 264,213 and the number of issued products grew by 29% to 41,663 in 2021.

In terms of own issued products, Leonteq saw volumes and revenues reach record levels. The company significantly expanded its fund derivative business, which saw revenues increase to CHF28.1m (2020: CHF4.2m).

Revenues from products with crypto assets as underlyings grew to CHF17.4m in 2021, a sixfold increase compared to the previous year; while revenues in asset management-like business, including actively managed certificates (AMCs) and tracker certificates, rose by 59% to CHF57.7m.

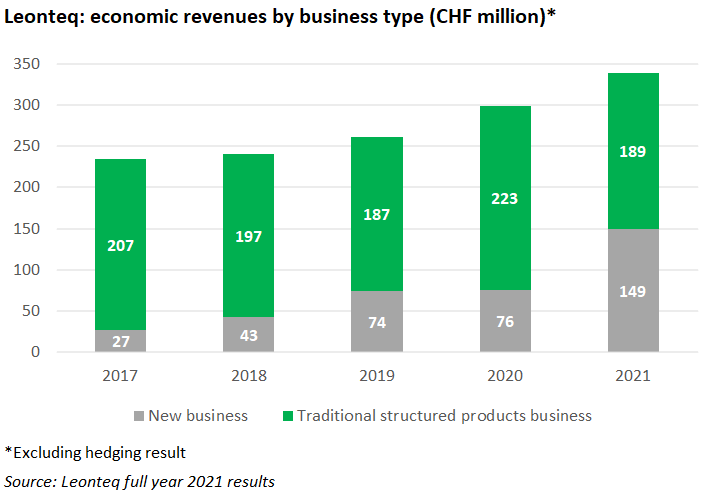

Economic revenues for its traditional structured products business – eg barrier reverse convertibles and autocallables, predominately on shares or equity indices – decreased by 15% to CHF189m in 2021.

However, revenues for new business were up by 96% to CHF149m (FY2020: CHF76m). The latter included revenues for growth initiatives and activities with lower balance sheet intensity, including asset management-like business, crypto assets, fund derivatives, balance sheet-light business, treasury income and pension savings.

Leonteq issued 3,263 publicly offered structured products on its own paper in full-year 2021, according to SRP data (FY2020: 3,545 products).

The company’s products were available across nine different jurisdictions of which its domestic market Switzerland, with 2,465 products, saw the brunt of the activity.

All but three of the products available in the Swiss market were reverse convertible certificates, often with a callable feature and linked to a worst-of basket of shares.

Stocks from the pharmaceuticals & biotechnology sector, such as Roche, Novartis and Nestle were the most popular underlyings, followed by shares from the technology sector (Apple, Logitech International, AMS), and automobiles & parts sector (Tesla, Volkswagen, Daimler).

Together with its platform partners, Leonteq is the leading issuer of Six Exchange-listed yield enhancement products with a market share of 26%, and it ranks as the number three issuer of total Six-listed structured products with a market share of 12%.

The company also expanded its range of digitally tradable investment products in Switzerland by listing products on BX Swiss in Q1 2021. Net fee income in Switzerland was CHF117.2m in 2021, down nine percent compared to the previous year

Other European markets where the company was active included Italy (478 products), Germany (235 products), and to a lesser extend Sweden, where its 32 products were distributed via Sirius Asset Management (23), Sip Nordic Fondkommission (seven) and Strivo (formerly known as Strukturinvest)( two).

Operations in Europe generated net fee income of CHF146.3m (-15%), the second-highest result in Leonteq's history after the very strong performance in the previous year. The Swiss firm made particularly good progress in Italy, where it ranks among the top four issuers on Sedex and Cert-x for structured investment products, with a market share of eight percent. In Portugal, Leonteq finished setting up its service centre in Lisbon, where it currently has 38 employees.

In Asia and the Middle East, Leonteq increased the range of products issued by Standard Chartered and improving its AMC offering for Asian clients. It also expanded its regional footprint by opening a new office in Dubai. As a result, the Asia region (including the Middle East) saw a 31% increase in net fee income YoY to CHF43.2m in 2021.

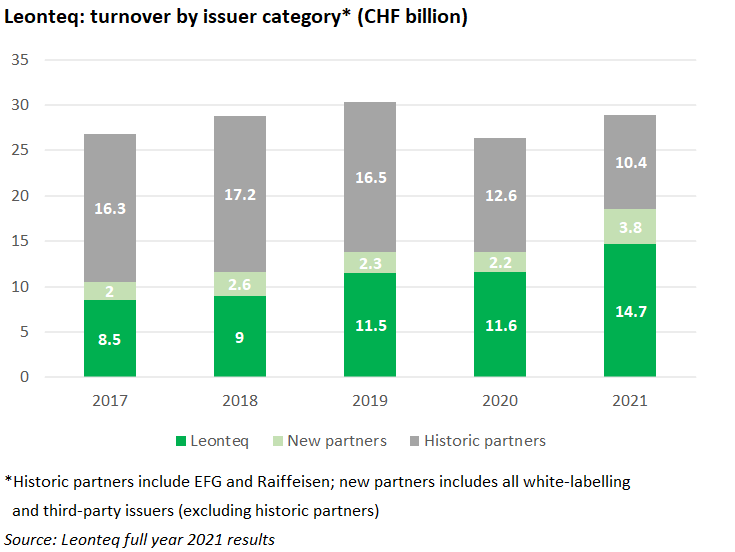

Across Europe, Leonteq increased its number of white-labelling partners to 14 following the onboarding of Basler Kantonalbank and Banque Internationale à Luxembourg onto its multi-issuer platform and recorded more than CHF1.2 billion in turnover from these two new partners. In addition, it signed in January 2022 new cooperation agreements with VP Bank and Swissquote and recently extended its cooperation with Raiffeisen Switzerland until 2030.

2022 marks the beginning of a new five-year ‘Growth Strategy 2026’ cycle, which it will execute through four dimensions: offering, platform, regions and sustainability.

Against this background, Leonteq expects to launch new initiatives, including an automated flow platform designed to offer clients a large range of securitised leverage products (including warrants), and a new innovative white-labelling onboarding concept.

At the same time, it plans to take ‘targeted measures’ to strengthen its brand in Europe, Asia and the Middle East.

The company led by Lukas Ruflin (pictured), has also published its inaugural sustainability report as it is integrating ESG factors into its range of products and services with the ambition of becoming a leading ESG provider for structured products.

Click the link to view the Leonteq 2021 results, presentation, full year report (Leonteq AG), full year report (Leonteq Securities), and sustainability report.