The Swiss investment company has delivered a record result for 2021, and reported a 58% increase in trading income on its balance sheet from new issuance, hedging, and market making.

Vontobel has posted a profit after tax of CHF384m (US$415m) for 2021, an increase of 48% (2020: CHF259m).

Operating income increased by 21% to CHF1.54 billion from CHF1.27 million in the previous year.

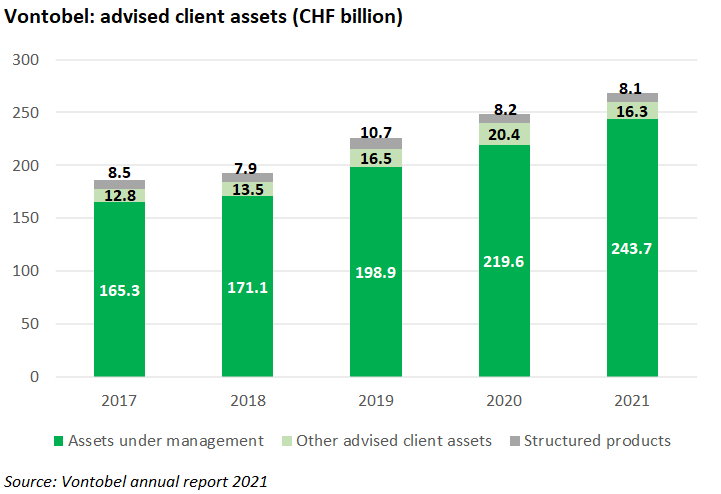

Advised client assets, which include structured products, grew by eight percent to CHF268.1 billion (2020: CHF248.2 billion), driven by the generally ‘very positive market developments’ and the performance of Vontobel investment solutions.

As of 31 December 2021, the outstanding volume of structured products issued was CHF11.3 billion, of which CHF3.2 billion came from actively managed certificates (AMCs).

Growth has been delivered across all client units, according to Zeno Staub (pictured), chief executive officer at Vontobel.

“Eighty percent of our revenues do come from asset management and wealth management, highlighting the robust repeatable business model we have filled as a global investment firm,” said Staub, speaking during the results press conference on 9 February.

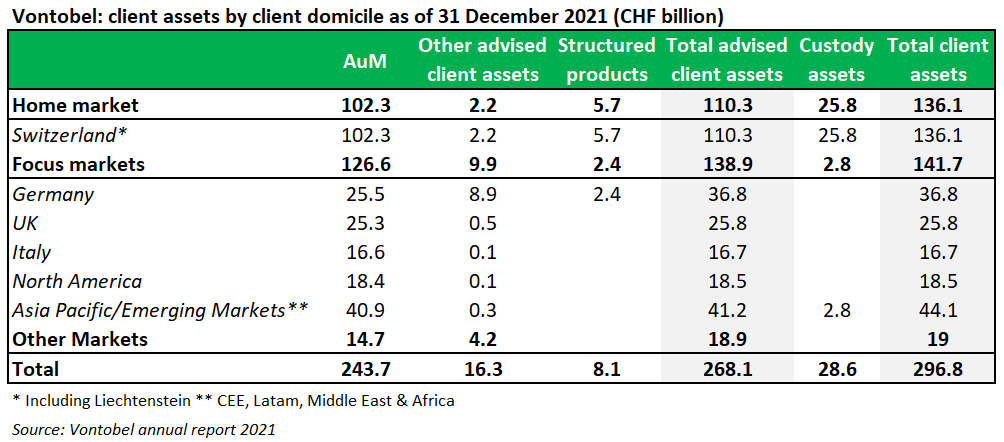

The SRP database registered 5,721 publicly offered structured products issued by Vontobel in 2021 (excluding leverage products). Of these, 2,914 products were targeted at investors in Switzerland, where the outstanding volume at the end of 2021 stood at CHF5.7 billion.

Ninety-nine percent of the Swiss products were reverse convertibles, often linked to a worst-of basket. The remaining 18 structures featured the dual currency payoff. The shares of Roche (215 products), Nestle (194), and Novartis (182) were the most frequently used underlyings, followed by the S&P 500 (125) and the local Swiss Market Index (117).

In Germany (outstanding volume end-2021 CHF2.4 billion), the company launched 2,472 products during 2021 – again almost exclusively reverse convertibles. The Eurostoxx 50 was the most featured underlying (261 products), while the Dax (109), Infeneon (95), and Volkswagen (91) were also in demand.

Another growth market was Italy, where the Swiss bank expanded its business in 2021. Some 335 products were issued during the year, including a number of cash collect certificates that offer investors the option to invest in an ESG-related theme via structured products.

During the year, Vontobel was able to significantly expand its market position for investment products as well as leverage products in key markets such as Switzerland and Hong Kong SAR.

In the digital investing client unit, operating income increased by 72% to CHF315.9m. This growth was driven primarily by the strong demand for structured products. In addition to the established end-client business with structured products that has been around for decades, this segment also manages platforms such as cosmofunding and Volt.

Clients assets

Vontobel recorded a strong increase in advised client assets of wealth management clients. Including the assets of financial intermediaries, AuM increased by 17% to CHF95.8 billion (2020: CHF81.6 billion). In asset management, advised client assets grew by six percent to CHF142.9 billion (2020: CHF 134.6 billion), having more than trebled over the last decade.

Other advised client assets are held primarily in asset management and consist of client assets for which Vontobel does not make investment decisions or have any responsibility for distribution. This includes advisory services in the area of asset allocation and the business with private label funds.

Today, 60% of advised client assets comprise the assets of clients domiciled outside Vontobel’s Swiss home market – primarily in target markets comprising Germany, the UK, Italy and North America, as well as the Asia Pacific region and Emerging Markets. However, the company is still well established in its home market, with clients domiciled in Switzerland accounting for CHF110.3 billion of advised client assets.

New money

Following strong growth in 2020, clients entrusted Vontobel with net new money totalling CHF8.1 billion in 2021 (2020: CHF 14.8 billion). In asset management, the termination of two low-margin mandates led to outflows of several billion francs - in the future, Vontobel will continue to focus on high margin mandates in the business with institutional clients.

These factors resulted in CHF1.9 billion of net new money in asset management, corresponding to growth of 1.4% while in the business with wealth management clients Vontobel achieved growth in all markets – with a particularly increase in demand in Switzerland, Germany and Italy. At 6.9%, the growth in net new money reached a very good level. In total, wealth management clients entrusted CHF5.6 billion of net new money to Vontobel.

Trading income

Trading income on the company’s balance sheet increased by 58% to CHF 493.3m, far exceeding the previous year (2020: CHF311.7m). This income position mainly comprises income from the issuing, hedging and market making of structured products and warrants. Stronger client demand was also reflected by income from forex and precious metals trading, which rose significantly compared to the previous year.

The company’s total net fee and commission income for 2021 stood at CHF974.8m, which can be broken down into asset management (CHF592.6m), wealth management (CHF432.1m), digital investing (-CHF11.5m), and centers of excellence/reconciliation (-CHF38.4m).

As of end-December 2021, Vontobel held 7,460 treasury shares to secure options and structured products (2020: 4,449).

Click the link to read the Vontobel 2021 results, presentation, and annual report.