With sales volumes down almost 60% YoY, the market is eagerly awaiting the interest rates to rise.

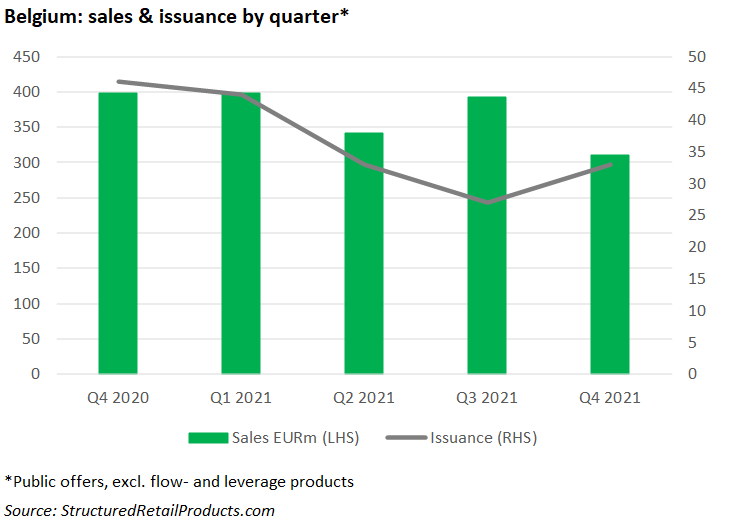

Structured products collected sales of €411m on the primary market in Belgium during the fourth quarter of 2021, according to the latest figures released by the Belgian Structured Investment Products Association (Belsipa).

Volumes decreased by 59% year-on-year (Q4 2020: €1 billion) but were up by six percent compared to the prior quarter (Q3 2021: €387m).

Capital protected products are slowly making their way back into customers' portfolios - Florence Devleeschauwer

The volume-adjusted share of capital-protected products as part of the primary market turnover fell by 18% YoY. Between quarters, however, the share of these products (of which the majority only offer partial protection) increased by 95%.

Turnover of structured products sold on the secondary market in Belgium amounted to €348m, which is a quarter-on-quarter decline of 22% and a decline of 23% when measured on an annual basis.

The market situation remains complicated for structured products because the expected interest rate hikes in the eurozone have not yet taken place, according to Florence Devleeschauwer (pictured), chair, Belsipa.

‘Capital protected products are slowly making their way back into customers' portfolios […] the situation may change in 2022 with the rise in interest rates that has started in recent weeks,’ said Devleeschauwer.

Filip Gils, vice chair Belsipa, added that offering more advanced financial products in the sector always entails the need to take into account complex legal requirements, many of which are at a European level. ‘We are therefore looking to bring more transparency to this investment category, also by offering interested investors this market report,’ Gils said.

SRP’s own database registered 33 structured products worth €310m (excluding flow and leverage) striking between 1 October and 31 December 2021 (Q4 2020: €400m from 46 products). Of these, 29 were wrapped as securities (€295m) and four were life insurance products (€15m).

Seven products put full capital at risk; 14 pay a minimum capital return of 100%; and 11 provide at least 90% capital protection. The remaining product, Goldman Sachs International (UK) Callable Global AI Minimum Redemption USD 2029, distributed by Crelan, offers a minimum capital return of 107%.

Seventy-five percent of the products issued during the quarter were linked to a single equity index and 21% was linked to the interest rate. The sole fund-linked product was Barclays Bank PLC (UK) Fund Opportunity USD 2028, which was distributed via Deutsche Bank. It had an eight-year tenor and offered access to the Acatis Gane Value Event Fund.

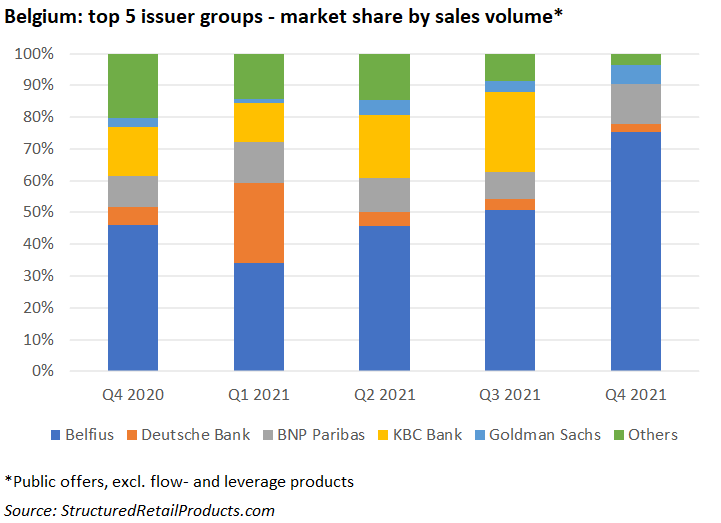

Belfius was the main issuer with a 75% share of the market in Q4 2021. Other issuers active during the quarter included BNP Paribas, Goldman Sachs, Deutsche Bank, Barclays, Société Générale and Credit Suisse.

As of 31 December 2021, there were 1,981 live structured products in the Belgian market. The outstanding volume for these products stood at €22.2 billion, which is a decrease of two percent compared to the invested volume at the end-September 2021. On an annual basis the invested volume shrank by 16%.

Belsipa was founded in 2013 and has Axa Bank Europe, Belfius, BNP Paribas Fortis, ING Belgium, Goldman Sachs, KBC, Société Générale, Crédit Suisse and Natixis as full members. Those banks aside, Crelan, Bank Nagelmackers, AG Insurance and Deutsche Bank also provided data to the report, which covers approximately 95% of the Belgian market.

Click the link to read the full Belsipa Q4 2021 market report on retail structured products.