The UK bank is expected to close Q1 22 with a slower momentum in its wealth management activities after booking a strong recovery in 2021 compared with a year ago.

Net profit at HSBC increased 150% to US$14.7 billion in 2021 year-on-year (YoY) driven by ‘a net release of expected credit losses and other credit impairment charges and a higher share of profit from [its] associates’.

We carry good business momentum into 2022 in most areas and expect mid-single-digit lending growth over the year

Revenue dropped two percent to US$49.6 billion primarily reflecting the impact of lower global interest rates and a decrease in revenue in markets and securities services.

Asia has kept a safe lead as the top profit centre for the UK bank, led by CEO Noel Quinn (pictured), since it first announced the relocation of its structured product manufacturing hub to Hong Kong SAR in early 2020.

‘We carry good business momentum into 2022 in most areas and expect mid-single-digit lending growth over the year. However, we expect a weaker Wealth performance in Asia in the first quarter of 2022,’ stated HSBC in its 2021 annual report.

Uncertainty remains given recent developments in China’s commercial real estate sector, while inflationary pressures persist in many of our markets, according to the bank.

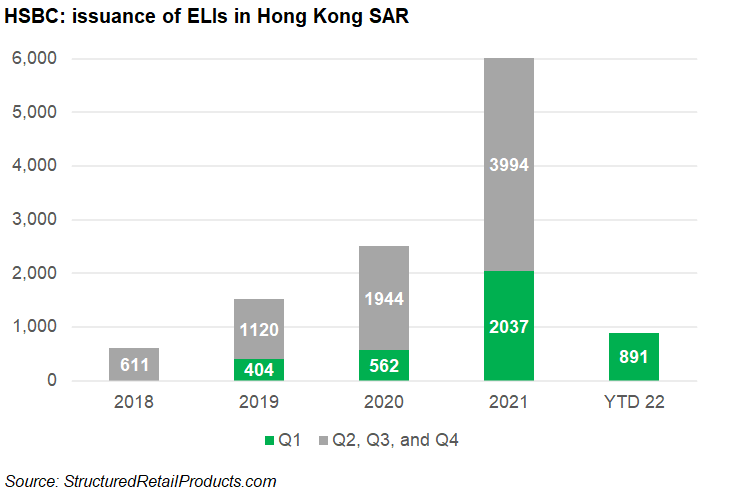

SRP database shows a total of 6,031 equity-linked investments (ELIs) issued by HSBC in Hong Kong SAR in 2021, representing a continuous growth from 2,506 in 2020 or 1,524 in 2019, SRP data shows.

However, the first quarter of 2021 year-to-date appears to slow down amid the high market volatility, particularly for in Hong Kong SAR and China. The UK bank has launched 891 ELIs, a plunge from the 2,037 in Q1 21.

In China, HSBC has issued and distributed 77 structured deposits from January to 15 March, which was higher from the 56 in Q1 21 but at a distance from the average quarterly issuance of 109 in 2021.

The UK bank has introduced several new underlying names during the past year, including the Hang Seng China Enterprises Index ESG Index, which was first made available in October 2021 through a two-year sharkfin payoff.

Back in August, HSBC also rolled out its first structured deposit linked to an MSCI index in China – the MSCI World ESG Screened 5% Risk Control Index. As of today, 14 products have been issued tracking the index through a shark fin payoff.

In Taiwan, 252 structured notes featuring snowball payoff were launched by HSBC from January to 10 March, lower than the 421 in Q1 21. With majority sold in-house, the products were distributed by UBS (16), BNP Paribas (10), Cathay Securities Investment Trust (three) and Far Eastern International Securities (one).

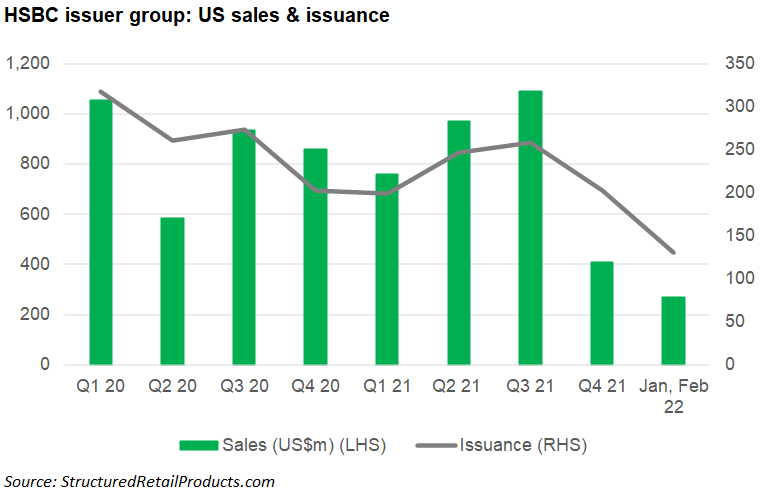

The shift is more noticeable in the US where HSBC issued 131 structured notes sold at US$269m from January to February, which formed 35.3% of the volume registered in Q1 21.

Earnings

In wealth and personal banking (WPB), HSBC said it continued to make progress in the execution of its wealth, asset management and insurance strategy, notably in Asia as the net new invested assets rose 17.2% to US$64 billion with US$36 billion coming from the region.

The segment posted pre-tax adjusted profit of US$7 billion, accounting for 32% of the total at HSBC. It also represented a 71% climb YoY. By geography, Asia and Europe generated 63.4% and 26.1% of the wealth adjusted revenue in WPB at US$9.1 billion followed by North America, which contributed US$530m.

In the meantime, the commercial banking division registered the most significant rebound as its pre-tax adjusted profit climbed to US$6.7 billion from US$1.8 billion YoY despite falling behind the US$7.4 billion seen in 2019.

Pre-tax adjusted profit at global banking and markets (GBM) also increased 10.2% to US$5.3 billion in 2021 YoY, which made up 24% of the total and translated to a stable level from 2019. The Asia and the Middle East markets delivered the strongest growth momentum.