The wealth business has tumbled at the UK bank in the first quarter of 2022, leading to a 25% decline of net profit compared with a year ago.

Reported net profit at HSBC dropped 24.6% to US$3.4 billion in Q1 2022 year-on-year (YoY), which was attributed to lower revenue and ‘a net charge for expected credit losses and other credit impairment charges (ELC)’, according to the bank’s latest earnings report.

Reported revenue went down four percent to US$12.5 billion, primarily in wealth and personal banking (WPB), ‘reflecting unfavourable market impacts in life insurance manufacturing and lower investment distribution revenue in Hong Kong, as well as lower global debt markets and principal investments revenue in global banking and markets (GBM).

While Covid-19-related restrictions in Hong Kong SAR resulted in a comparatively muted Q1 22 for its wealth business, the UK bank expects a recovery when restrictions are lifted. ‘We continue to expect mid-single-digit percentage revenue growth in 2022,’ stated the earnings report.

The UK bank was forced to defend its strategy following media reports that Ping An, its larger stakeholder with an 8.2% stake, has recommended HSBC to spin off its Asia business, and list in Hong Kong.

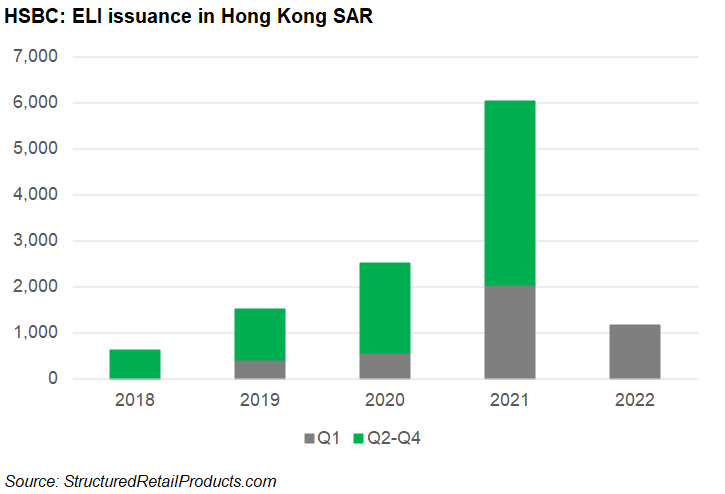

In Hong Kong SAR, where HSBC has its structured products hub, the UK bank issued and distributed 1,168 equity-linked investments (ELIs), mostly reverse convertible notes with a typical minimum order amount of HK$100,000 (US$12,700), SRP data shows. The issuance was almost halved compared with Q1 21.

In Russia where the bank primarily serves multinational corporates, new business or customers are being accepted due to the sanctions put in place by the UK government, which has led to a declining trend at HSBC Russia.

As the most profitable division, WPB posted a net operating income of US$5.2 billion from January to March, six percent lower from the prior-year period. The dip was reflected across the entire wealth business lines comprising investment distribution, life insurance manufacturing, global private banking and asset management.

Net operating income at GMB fell four percent to US$4 billion in Q1 22 YoY as the banking growth was offset by the slowdown of markets and securities services.

However, commercial banking delivered a nine percent increase of net operating income, reaching US$3.5 billion YoY driven by credit and lending.

The bank’s corporate centre booked a loss of US$227m in the quarter, translating to a further slide for central treasury and legacy portfolios compared with a year ago.

Asia pivot

The bank led by CEO Noel Quinn (pictured), has been enhancing its wealth capabilities in Asia while shrinking its market share in the US and parts of Europe.

In Q1 22, the UK bank completed the acquisition of AXA Singapore and exited from mass market retail banking in US.

Additionally, HSBC has announced the planned sale of its branch operations in Greece as well as its retail operations in France. The latter will result in a pre-tax loss of approximately US$2.7 billion in the second half of 2022.

By region, Asia accounted for 67.3% of the reported pre-tax profit, or US$2,8 billion in Q1 22, which represented a 39.5% increase quarter-on-quarter, but a 25.4% decrease YoY. Next in line were North America (US$553m), Middle East and North Africa (US$385m), Europe (US$253m) and Latin America (US$171m).

Compared with Q1 21, a moderate growth was seen in North America as well as Middle East and North Africa in terms of the pre-tax profit.

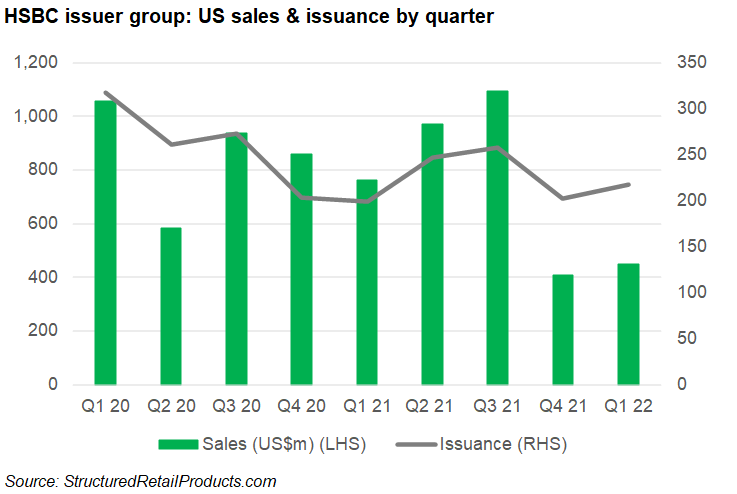

In the US, HSBC has issued 217 structured notes with a total trading notional of US$350m, which rose 9.1% QoQ but fell 40.9% YoY, according to SRP data.

The new issuances are linked to 81 different reference assets driven by headline indices and ETFs. For single stocks, Advanced Micro Devices, Bank of America and PayPal are the top picks.

Worst-of, protected tracker and knock out structures were the most favoured payoffs during the quarter while there were 10 products with a digital option tracking seven underlying assets led by the S&P 500.

In addition, the UK bank launched 97 structured deposits for retail in China in Q1 22, which track a group of 29 reference assets featuring ChinaAMC CSI 300 Index ETF (HKD), Tencent Holdings and Tracker Fund of Hong Kong, SRP data shows.