Mitsubishi UFJ retained first place in the first quarter of 2022, despite a 14% drop in market share.

Some JPY245 billion (US$2.1 billion) was collected from 177 structured products in Q1 2022 – a decrease of 57% in sales compared to the same quarter last year (Q1 2021: JPY546 billion from 197 products).

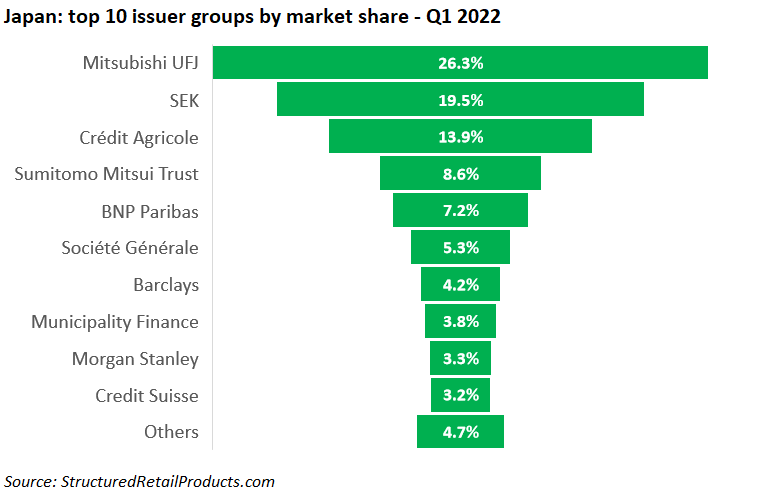

Fifteen issuer groups, a mix of local banks/securities houses, Scandinavian government funding agencies, and European/US investment banks, were active during the quarter.

Mitsubishi UFJ was the number one issuer in the quarter with a 26.3% share of the market – down from a 40.7% market share in Q1 2021.

Its products were issued through three different entities – MUFG Securities EMEA, Mitsubishi UFJ Securities International, and Mitsubishi UFJ Trust & Banking – that collected a combined JPY64.5 billion from 30 structures.

In second, the Swedish Export Credit Corporation (SEK), a state-owned company that provides medium- and long-term export credits, saw its market share increase to 19.5% (from 6.4% in Q1 2021) while Crédit Agricole captured 13.9% of the market in third – up 8.3% YoY.

Sumitomo Mitsui Trust Group, which was not active in Q1 last year, claimed 8.6% market share in Q1 2022. It sold 12 autocalls worth JPY21.1 billion that were all linked to a basket comprising the Nikkei 225 and either S&P 500 or Eurostoxx 50.

BNP Paribas completed the top five. The French bank, which had a 7.2% market share, sold its products via local securities firms including Daiwa, Gungin, and Daishi Hokuetsu Securities.

Société Générale, Barclays, Municipality Finance, Credit Suisse and Morgan Stanley also issued products during the quarter. The latter was the manufacturer behind the best-selling product of the quarter, which came in the shape of ノックイン動/KI M20260610.

The five-year registered note on the Nikkei 225 and S&P 500 achieved sales of JPY23.2 billion during the subscription period. It was available via Mitsubishi UFJ Morgan Stanley Securities, 105 Securities, and 77 Bank, with Bank of New York Mellon acting as the derivatives manufacturer.