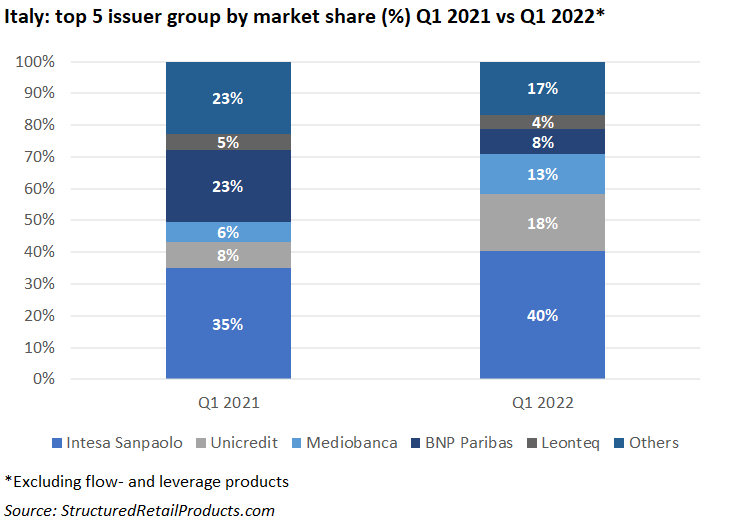

The top three issuers all increased their market share in the first quarter of 2022.

Some 474 publicly offered structured products (excluding flow- and leverage certificates) collected a combined €2.3 billion in Q1 2022 in Italy – a 17% decrease in sales volumes compared to the prior year quarter (Q1 2021: €2.8 billion from 601 products).

Despite a drop in sales, average volumes, at €4.9m, were slightly higher than those in Q1 2021 when products sold on average €4.7m.

Thirteen issuer groups – mainly Italian, French and Swiss banks – were active in the quarter (Q1 2021: 20).

Intesa Sanpaolo was once again the main issuer group with a 40% share of the Italian market – up five percent from Q1 2021. It achieved sales of €945m from 28 products, which included the best-selling Standard Long Barrier Plus Certificates on the Eurostoxx Banks that sold €107m.

More than halve of the bank’s sales in the quarter came from products linked to a single index, of which the Eurostoxx Select Dividend (three products) was the most frequently used.

Unicredit, whose main focus was on share baskets, claimed an 18% market share, up 10% from the same quarter last year. Figures for Mediobanca, which captured 13% of the market, were also positive (+7%).

BNP Paribas’s market share dropped significantly, from 23% in Q1 2021 to just eight percent this year, while Leonteq completed the top five with a 4.4% share of the market. However, the Swiss structured products specialist was the number one provider by issuance with 145 products, including 121 with a knockout feature.

Other issuers included, Vontobel, Banca Akros, EFG, Société Générale and Banco BPM.

The latter grabbed 4.3% of the market, thanks to sales of more than €100m for Equity Protection, a five-year digital on a worst-of basket comprising three indices: Eurostoxx Insurance, Eurostoxx Oil & Gas, and Eurostoxx Health Care. It was the bank’s sole product in the quarter.