How to make cheaper hedges without lowering the strike.

Investors are always reluctant to buy puts to protect their portfolio. Indeed, the market “usually goes up” and spending premium to buy protection is seen as a waste of money and a source of performance impairment. Worth noting that they usually buy and hold the hedge until maturity.

They go for cheap hedges. Considering vanilla solutions, for three-month maturity, the 95% strike is very often a favourite. A 95% put is cheaper than the ATM put (by around 1.70%) but at the same time 95% does not seem too far out: in other words if the market goes down it will go there, so it looks like an efficient hedge.

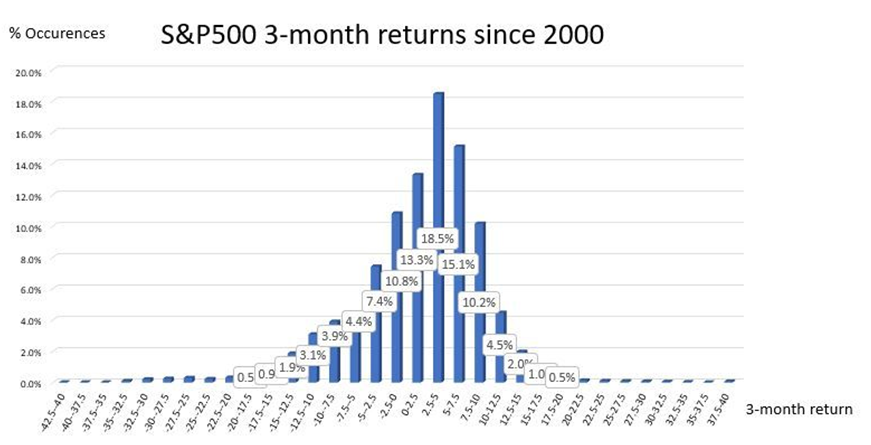

In practice the scenarios where the SPX is down between -5% and 0% make up for 18% of the occurrences, it is a lot. Scenarios where the SPX is down more than -5% make only 16.20% of occurrences, and to breakeven you need a move down of around -8%.

The wise investor (in terms of timing) who bought a 95% Put on SPX three months ago would have paid more than 3.00% for it and got only 3.50% back… a very poor reward for a very good view.

There are much better ways of cheapening hedges and history shows that lowering the strike is not the right way.

Volatility Knockout Puts

Only pay for the way the market is (not) moving

Investors choose the three-month 95% put on SPX, that rarely pays out, because it is cheaper than the ATM put but it rarely pays out unless you manage it actively. Another way of cheapening the put has been developed recently and makes the most of the elevated skew of SPX.

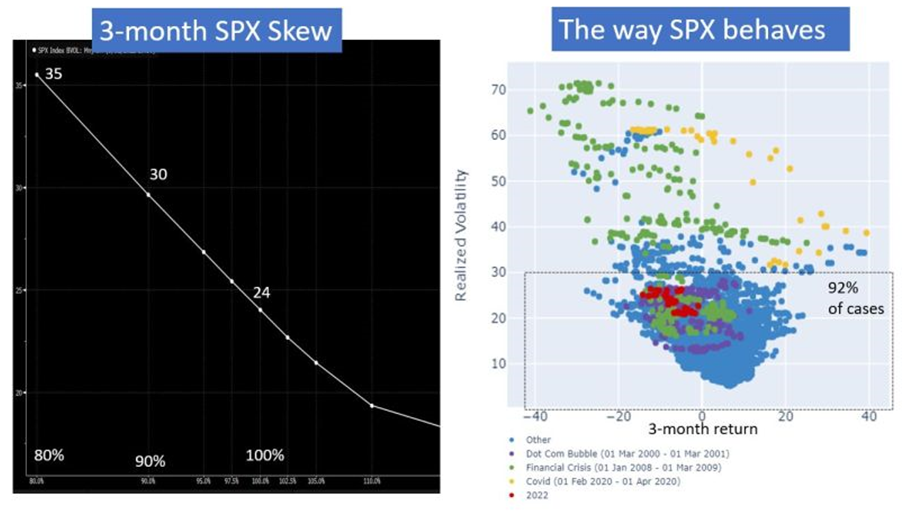

It consists in a regular put option that knocks out if the realised volatility observed across the life of the option is above a certain level. Ex: ATM Put on the SPX with 30 volatility knockout will have the same payout of an ATM if the realised vol of SPX observed at maturity is below 30.

Setting the volatility knockout at 30% cheapens the option by circa 40%. That is an extreme cheapening thanks to the steepness of the skew!

Indeed, current SPX three-month skew suggests that the SPX should realise 30 if it goes down 10% and 35% if it goes down 20%. History shows that those levels are rarely reached. Since 2000, the three-month realised volatility is below 30 in 92% of cases. Exceptions being the financial crisis and Covid. (see graph below).

2022 is depicted as a volatile year but looking at figures for the SPX, we are in the 92% bulk (see red points below) with max vol of only 26.40. In other words, the ATM put with volatility knockout is a very efficient way of buying a cheap hedge that performs well historically for “buy and hold hedgers”

That product is highly (and beautifully!) exotic and we will dive into it soon.

Image: m.mphoto/AdobeStock

Disclaimer: the views, information or opinions expressed herein are those of Eric Barthe, and do not necessarily reflect the views of SRP.

Eric Barthe, Partner, Head of Financial Engineering, Anova Partners - www.structuredproducts.net

Eric is partner at Anova Partners, where he heads the structuring team and drives the firm's financial engineering efforts. He started his career as an exotic trader at Goldman Sachs in London. He was there for 8 years, trading on the index and single stocks exotic book. After a short interval with the Boston Consulting Group, Eric joined Leonteq as global head of structuring and head of financial engineering. He was also previously a professor of financial engineering for the MSc International Finance at HEC Paris. He is a graduate of the Ecole Centrale Paris, HEC and the London School of Economics.