In this week’s wrap, we look at a selection of structured products with strike dates between 26 June and 2 July 2022.

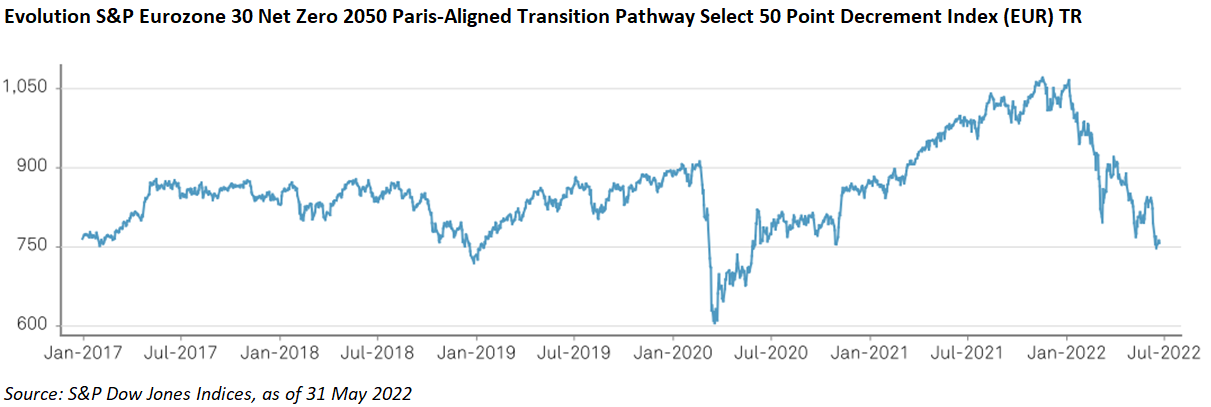

DS Investment Solutions distributed DS Selection ADP Juin 2022 in France. The 12-year product is eligible via a life insurance or capitalisation contract and provides access to the S&P Eurozone 30 Net Zero 2050 Paris-Aligned Transition Pathway Select 50 Point Decrement Index (EUR) TR. The index is designed to measure the equal-weight performance of 30 equity securities drawn from the S&P Eurozone LargeCap, which are selected from the companies most closely aligned with a 1.5ºC climate scenario transition pathway budget to be collectively compatible with a 1.5ºC global warming climate scenario at the index level.

The first eight semesters of investment, the product offers a fixed coupon of two percent, regardless of the performance of the index. Additionally, if on any of the semi-annual observation dates, the index is at or above its initial level, the product redeems early for a capital return of 100%, plus a coupon of 2.05% for each semester that has passed. At maturity the barrier for capital protection is 50%. The product is listed on the Luxembourg Stock Exchange and issued on the paper of BNP Paribas Issuance BV. BNP Paribas acts as the guarantor.

Priips Summary Risk Indicator (SRI): four out of seven.

Pohjola Pankki launched OP Säästöobligaatio Pohjoismaiset Pankit IX/2022 in Finland. This 100% capital-protected medium-term note (MTN) offers 115% participation in the performance of an equally weighted basket comprising five Nordic banks: Nordea, SEB, Swedbank, DNB, Handelsbanken, and Danske Bank. The return is capped at 15%. There is a structuring cost of maximum three percent. The product is not listed.

Priips SRI: two out of seven.

Meteor marketed the FTSE 150 EWDR Defensive Kick Out Plan in the UK. The eight-year product is linked to preference shares issued by Citigroup Global Markets Funding Luxembourg, which are in turn linked to the performance of the FTSE Custom 150 Equally Weighted Discounted Return Index. The plan has a step-down autocall barrier, which starts at 105%. Capital is preserved if the index closes at or above 65% of its starting price. BNP Paribas Securities Services is the custodian. Meteor will receive a distribution fee of up to 1.95%. The product is listed on the London Stock Exchange.

Priips SRI: five out of seven.

Dekabank issued Express-Zertifikat VarioZins Spezial 09/2027 on the MSCI Germany Climate Change ESG Select 4% Decrement Index in Germany. Every year, the performance of the index is measured. If at no time during the valuation period, the index has traded below 364.30 points – which is 41.50% of the initial price – the product offers a coupon equal to 0.30% of the closing price of the index (one index point corresponds to €1). The product has a step-down autocall barrier, which starts at 100% and subsequently decreases by five percent per year. At maturity, if at no time during the investment the index has traded below the barrier, or if the final index level is at or above the initial level, the product offers 100% capital return. Otherwise, the investor participates 1:1 in the fall. The product is not listed.

Priips SRI: four out of seven.

Raiffeisen Centrobank introduced Oil & Gas Index Express 6 in Austria. The five-year certificate is linked to the Stoxx Europe 600 Oil & Gas Price EUR index. It offers potential annual yield of 9.5%, providing the index closes at or above its starting level on the validation date. The barrier, which is set at 60% of the starting level, is only active at the end of term. The product is listed in Vienna and can also be traded on the exchanges of Frankfurt and Stuttgart.

Priips SRI: six out of seven.

NORTH AMERICA

Citigroup Global Markets collected US$155,000 with five-year barrier securities linked to the Eurostoxx 50 and iShares MSCI EAFE ETF in the US. At maturity, if neither underlying has fallen below 70% of its starting price, the product offers minimum 100% capital return, plus 200% participation in the rise of the worst performing underlying. Otherwise, the investor participates 1:1 in the fall of the worst performing underlying. There is an underwriting fee of 4.13%. The estimated value of the securities on the pricing date was US$913.20.

Also in the US, Morgan Stanley achieved sales of US$5.1m with its Trigger Absolute Return Step Securities on a weighted basket comprising Eurostoxx 50 (40%), Nikkei 225 (25%), FTSE 100 (17.5%), Swiss Market Index (10%), and S&P/ASX 200 Index (7.5%). At maturity, if the final basket level is at or above its initial level, the product offers 100% capital return, plus the greater of 54% and 100% of the rise in the basket over the investment period. If the basket has fallen, but not below the downside threshold of 75%, the capital return is 100% plus 100% of the absolute value of the fall. UBS Financial Services, acting as dealer, will receive a fixed sales commission of US$0.35 for each security it sells. The estimated value on the trade date US$9.367 per security.

ASIA PACIFIC

Chugin Securities distributed 固定利付コーラブル債 M20290628 in Japan. The seven-year registered note is linked to the Japanese interest rate and offers a fixed coupon of 0.70% pa. The product can be called at the discretion of Société Générale (the issuer). Daishi Hokuetsu Securities and Gungin Securities act as third-party providers.

HSBC Bank issued 股票掛鈎投資2022/Basket DCDC ELI DFBAS2201872 in Hong Kong SAR. The six-month product is denominated in Australian dollars and offers access to Tracker Fund of Hong Kong and CSOP FTSE China A50 ETF (HKD). If both underlyings are above 10% of their initial level at any coupon observation date, a fixed coupon of 13.44% pa is paid. The product is subject to daily early redemption, from 27 July 2022 onwards.

Korea Investment & Securities targeted True ELB 1713 at retail investors in South Korea. The three-year bond is linked to a basket of three indices: Kospi 200, S&P 500, and Eurostoxx 50. It has a knockout feature that is triggered if the worst performing index closes at or above 101% of its initial level on the semi-annual validation date. At maturity, the product offers 100% capital return plus a fixed coupon of 16.8% if the worst performing index closes at or above 101%. Otherwise, the product offers 100% of capital return.