Investing in equity markets via structured products has allowed French investors to avoid some of the recent market falls.

In the second part of our analysis, we compare the performance of structured products matured in France since 2015 with other popular passive index-based strategies held over the same period.

The analysis shows that structured products have delivered an enhanced regular return compared to fixed income strategies, while at the same time allowing a controlled and low risk exposure to equities.

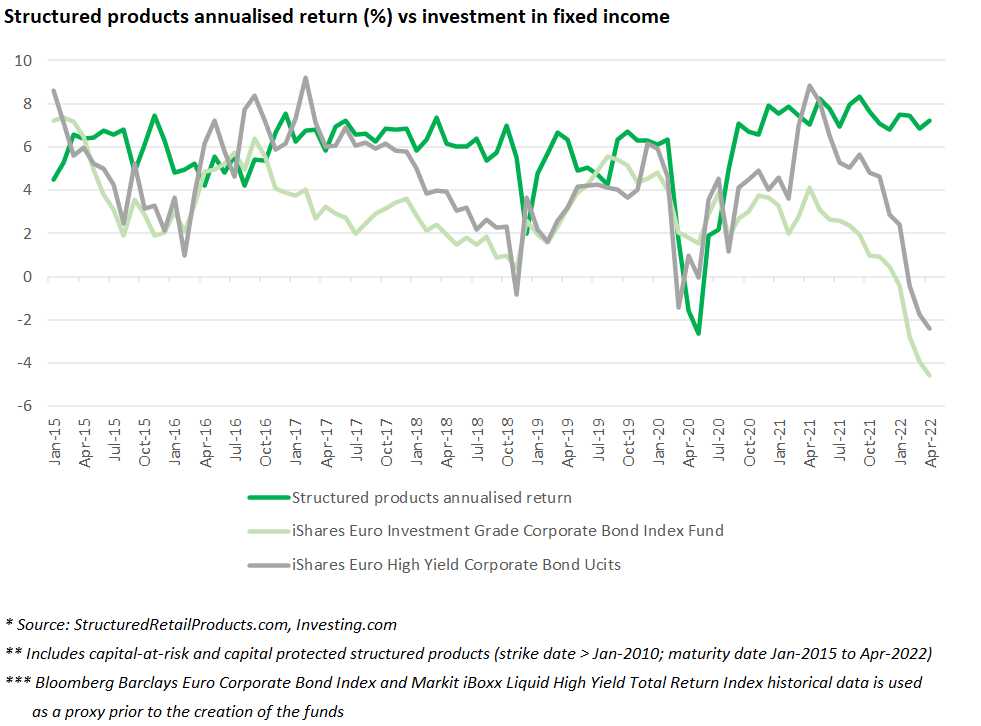

Structured products versus bond strategies

To measure structured products’ performance against the fixed-income alternatives we have compared it over a period of seven-years to two high yield and investment grade corporate bond exchange-traded funds (ETFs) with reinvested dividends: iShares Euro Investment Grade Corporate Bond Index Fund and iShares Euro High Yield Corporate Bond ETF.

Since the beginning of 2022, bonds prices have been falling under the effect of higher interest rates

We calculate the performance of the two ETFs (based on their price) and for a duration similar to that of each matured structured product. Prior to the creation of the ETFs, we used as a proxy the historical data of their respective benchmark indices: Bloomberg Barclays Euro Corporate Bond Index and Markit iBoxx Liquid High Yield Total Return Index.

Our analysis shows that during the last five years structured products have delivered more stable and broadly higher returns compared to an investment in a fixed-income ETF with the same duration.

In fact, since 2015, an investment in the bond ETFs would have outperformed structured products only in 2016, as well as between April and June 2020, when several riskier structures weighed on the average return.

In the first case, oil exposed high-yield utility ETFs tended to outperform in 2016 after slowing Chinese economy and falling crude oil prices in the second half of 2015.

In March 2020, the market crash triggered by the Covid-19 pandemic slashed returns across all asset classes while corporate bond valuations soared from their lows due to purchases by the European central bank especially high yield bonds. Notably, as a result of the massive monetary stimulus yields plummeted, pushing up bond prices.

The environment has changed since and the inflationary pressures have pushed interest rates up.

Since the beginning of 2022, bonds prices have been falling under the effect of higher interest rates. By contrast, yields on structured products have remained stable since the third quarter of 2020.

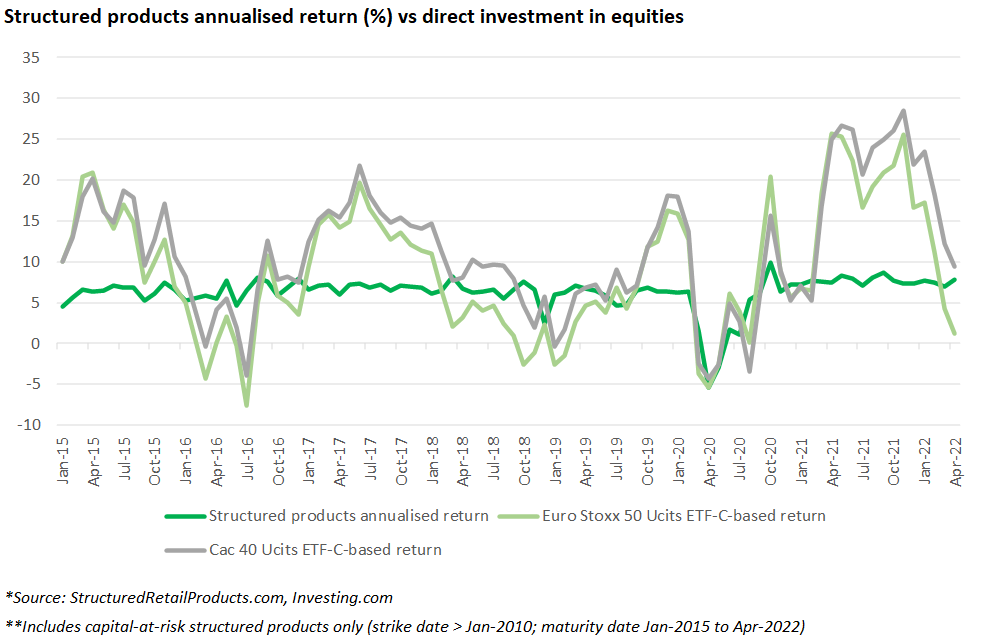

Structured products versus direct equity holdings

In the below chart we have compared the performance of capital-at-risk structured products to ETFs replicating the performance of the Cac 40 and the Eurostoxx 50, with reinvested dividends, over the last seven years.

As with the previous comparison, we calculate the performance of each of the two ETFs over the investment term of each matured structured product.

Once again, we can observe a stable performance of structured products compared to a direct investment in the equity markets.

Even with the performance mishap resulting from the Covid-19-triggered crash, it remains clear that over the last seven years structured products have effectively allowed a controlled exposure to equities’ fluctuations. Therefore, investing in the markets via structured products allowed investors to avoid some of the corrections that we had in 2016 following the crash of the Asian markets and in 2018.

Typically, since the Covid-induced crash of March 2020, performances of structured products in France have stabilised, delivering a return of between six and eight percent.

However, there have also been products underperforming - four percent of the products maturing in 2020 suffered a capital loss. Underperforming products, just as in 2021, were typically riskier structures linked to individual stocks or to worst-of baskets of stocks (featuring Renault, Carrefour, Saint Gobain, and stocks in the banking sector).

Equity index-linked products did not lose capital during the Covid-related market crash in 2020, as they have not breached the protection barriers (generally absorbing a -40% to -50% fall), according to SRP data.

This indicates that investing in equity markets via structured products has allowed French investors to avoid some of the market falls, thanks to the protection barriers that almost all structured products offer today.

Image: Ondrej Bucek/Adobe Stock Free