Maturing products linked to the US multinational retail corporation delivered an average return of 20.56% pa and none returning a loss.

Walmart delivered strong top-line growth globally in the second quarter of 2022, partially driven by inflation. Total revenue was $152.9 billion, up 8.4% year-on-year (YoY). In the US, the company saw sales accelerate to 6.5% growth, reflecting strong grocery sales and higher average ticket size.

Despite these positive results, the company’s share price, which closed at $121.58 on 30 June, fell by 19.5% during the quarter.

With the help of SRP’s StructrPro tool, we analysed how structured products linked to the Walmart stock performed in the US market.

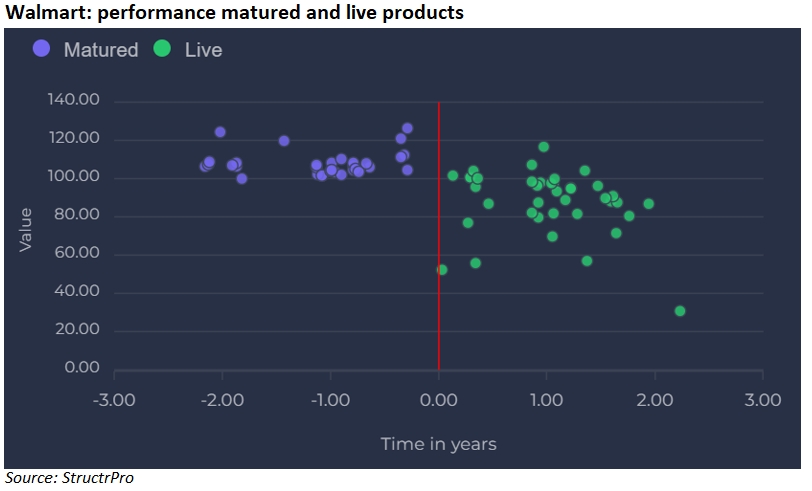

Our sample comprises 74 products, of which 39 are still live and 35 have matured. Sixteen of the reviewed products are tied to the Walmart share on its own, with the remaining structures linked to a worst-of basket.

Eight live products currently provide a gain. Of these, Incapital’s Trigger Autocallable Contingent Yield Notes (90276BKQ5) on a worst-of basket also comprising the common stocks of D.R Horton and Charles Schwab Corporation, is the best performer. If it expired today (18 August), the three-year registered note, which was issued on the paper of UBS and sold $2.8m at inception, would return 116.65% to investors.

Thirty-one of the live products are showing a mark to market loss because of the recent decline in the stock price (-6.44% on average). Credit Suisse’s Contingent Coupon Autocallable Yield Notes (22553P2C2), which collected $8.4m, is currently trading at 30.75%, well below its European barrier of 60%, although it has until 13 November 2024 to recover.

Another income autocall, this time a joint effort from CS and Citigroup Global Markets, is currently valued at 76.91%. Its underlying basket comprises Home Depot, Target and Walmart and the next coupon payment date is coming up on 19 August. Providing the worst performing share closes at or above 75% of its starting level, the product will pay a coupon of 2.0625%.

The maturing products, however, paint a different picture with none returning a loss. Thirty-four products provided a gain, with an average return of 20.56% pa. The remaining product, CIBC’s Fixed Interest Autocallable Note (136071BR7), which was linked to a worst-of basket also comprising the common stock of Verizon Communications, returned full capital.

The highest return came from UBS’ Return Optimisation Securities (90282D481) linked to the Walmart share on its own. It struck on 28 October 2020 at $140.04 and had increased by more than 11% by the time it reached its final observation date (3 May 2022). Since the product offered 500% participation in the rise of the share, this was more than enough to reach the maximum overall return of 126.37%.

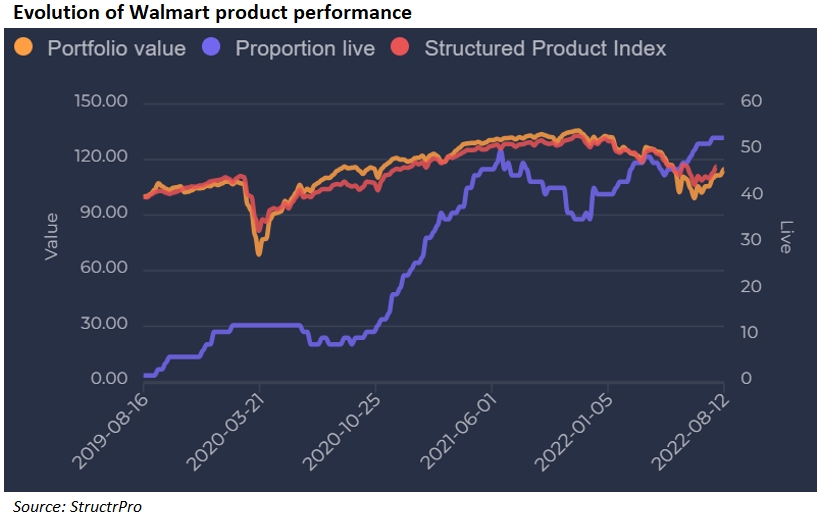

This chart, which uses StructrPro's innovative market index algorithms shows that the performance of Walmart's structured products is broadly in line with the overall structured product universe on the SRP database. Falls in 2020 have been followed by market growth except for the recent corrections. The purple line shows the increase in Walmart products as the stock becomes a more popular underlying.

The SRP US database lists 234 live products linked to Walmart of which 21 worth $26m had strike dates in 2022. For the benefit of this article we used a sample of 74 products from StructrPro.

Click the link to read the Walmart Q2 2022 earnings and presentation.