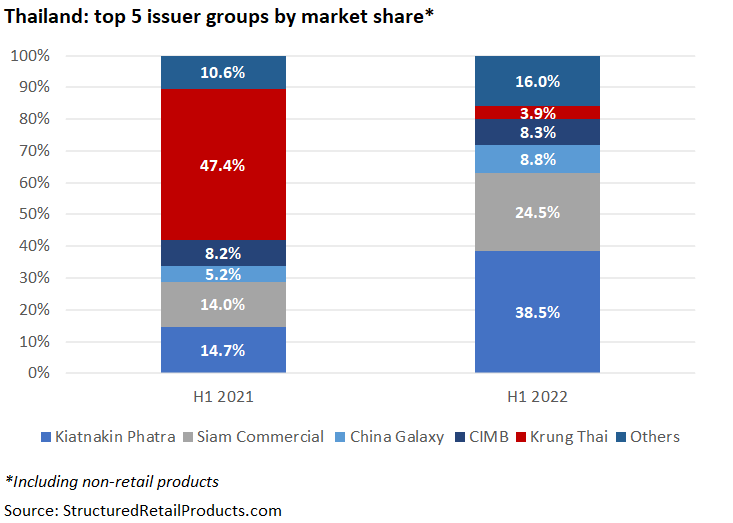

Kiatnakin Phatra Securities gained almost 24% in market share to become the top issuer in Thailand.

Krung Thai Bank, last year’s number one, headed in the opposite direction as it saw its market share shrink to just 3.9%.

Some THB58.7 billion (US$1.6 billion) was collected from 14,279 structured products in the first half of 2022.

Sales volumes were up 9.2% compared to the prior year period while there was a 140% increase in issuance (H1 2021: THB53.7 billion from 6,044 products).

Average volumes stood at THB4.1m per product, a decrease from H1 2021 when products sold on average THB5.9m.

Sixteen different issuer groups were active in the semester – up one from H1 2021. They were a mixture of mainly local and regional banks and securities houses.

Kiatnakin Phatra Securities was the number one issuer with a market share of 38.5%, up from 14.7% in H1 2021. The company achieved sales of THB22.6 billion from 2,997 reverse convertibles that were exclusively linked to a equities.

In second, Siam Commercial Bank claimed 24.5% of the Thai market – an increase of more than 10% year-on-year (YoY). It sold THB14.4 billion from 6,189 products, the vast majority of which were sold via its SCB Securities subsidiary. Again, equities – share baskets in particular – were the dominant asset class.

China Galaxy Financial Holding Company captured 8.8% market share from 3,652 products sold via CGS-CIMB Securities. Structures were mostly linked to a single share, of which Banpu (502 products), KCE Electronics (367) and Kasikornbank (326) were the most frequently used.

Malaysian universal bank CIMB’s market share remained stable (+0.1% YoY). It collected THB4.9 billion from just 50 products, including 26 that were tied to FX rates.

Krung Thai Bank completed the top five. The state-owned bank, which was the dominant issuer last year, saw its market share decrease from 47.4% in H1 2021 to just 3.9% this semester.

More than halve of its volumes (THB1.3 billion) were tied in a structured note linked to the Solactive Global Artificial Intelligence ESG EUR 5% AR Index, which was the best-selling Thai product of the semester.

Other active issuers included Bangkok Bank, Kasikorn Bank, Standard Chartered and DBS.

The products sampled include non-retail.