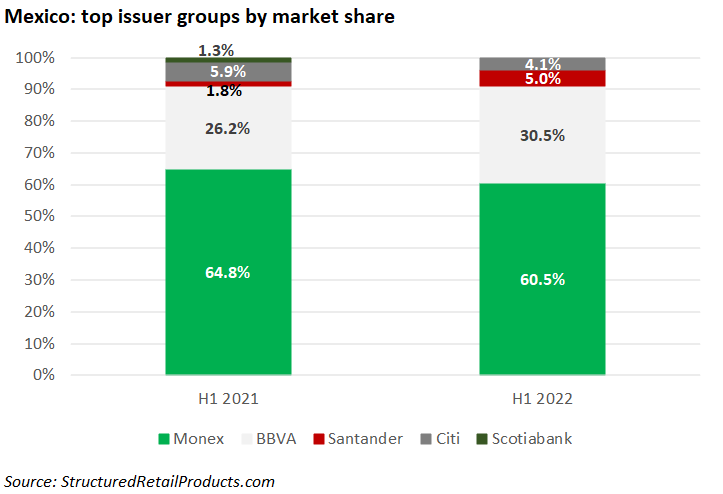

Monex remained the number one issuer group in a semester which saw both BBVA and Santander increase their market share.

The 2,073 structured products issued in the first half of 2022 achieved combined sales of MXN121 billion (US$6 billion) – the lowest volume in an opening semester since H1 2018 and a decrease of 22.4% compared to the prior year period (H1 2021: MXN156 billion from 2,897 products).

Average volumes, however, at MXN58.2m per product, were 8.2% higher than those in H1 2021 when products sold on average MXN53.8m.

Four issuer groups were active during the semester (H1 2021: five).

Monex dominated the market. The Mexican financial group collected MXN70 billion from 1,503 products between 1 January and 30 June 2022 – the equivalent of a 60.5% share of the market, slightly down on last year (H1 2021: 64.8% market share).

The company’s products were exclusively linked to the appreciation of the US dollar relative to the Mexican peso and featured predominately range, digital and dual currency payoffs.

BBVA Mexico, in second, saw its market share increase to 30.5%, up more than four percent year-on-year (YoY). It accumulated sales of MXN36.8 billion from 371 issued products.

Apart from the USD/MXN currency pair, which it used in 278 products, BBVA implemented 34 other underlyings, including the interbank equilibrium interest rate (TIIE 28), S&P/TSX 60 Index and eight different exchange-traded funds (ETFs). Fifty-nine of its products were linked to single stocks, of which the share of Meta was the most frequently used.

Santander claimed five percent of the market – up 3.2% from H1 2021. It accumulated sales of MXN6 billion from 76 products that were either dual currency notes or range/accruals on the USD/MXN.

The bank was also responsible for the best-selling product of the quarter, which came in the shape of a 12% pa dual currency note that sold MXN1.6 billion.

Banamex, a 100% subsidiary of Citi, sold 123 products worth MXN4.9 billion (4.1% market share, a decrease of 1.8% YoY). Once again, the bulk of the issuance was tied to the USD/MXN (121 products), with the two remaining products linked to iShares Silver Trust ETF and TIIE 28, respectively.

Scotiabank, which had a 1.3% market share in H1 2021, was no longer active this semester.