The group’s wealth revenue fell 9% to US$1.9 billion in Q3 22 year-on-year (YoY) mainly due to adverse insurance market impacts of US$375m and lower investment distribution.

Wealth balances posted a 10% decline YoY, reaching US$1.47 trillion as of the end of Q3 22. On a quarterly basis, this was a 5.6% decrease, according to HSBC’s latest earnings presentation.

Within wealth and personal banking (WPB), revenue rose 25% to US$6.3 billion driven by personal banking from July to September, which was up 51% to US$4.3 billion YoY ‘primarily from interest rate rises and global balance sheet growth,’ stated the presentation.

We maintained our strong momentum in the third quarter and delivered a good set of results - Noel Quinn, chief executive

In the first nine months, WPB posted revenue of US$17.2 billion, up 7.4% compared with the prior-year period. Wealth contributed to US$6 billion, a 12% decline YoY, while personal banking revenues grew 26% to US$10.9 billion.

Specifically, global private banking increased 9.2% to US$1.5 billion from January to September YoY ‘due to the positive impact of rising interest rates on net interest income’. This increase was partly offset by a decline in brokerage and trading revenue, reflecting reduced client activity compared with a strong 9M 21, according to HSBC.

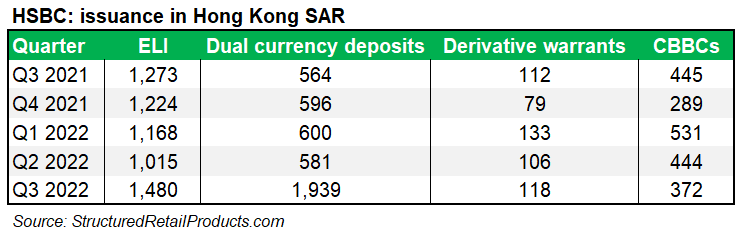

SRP database registers 1,480 equity-linked investments (ELIs) issued by HSBC Hong Kong from July to September, higher than 1,237 in the prior-year period.

There are an additional 1,939 dual currency deposits linked to seven FX pairs, up from 564 YoY. The EUR/USD pair was seen for the first time this year, and was linked to 68 products from August to September.

In Taiwan, HSBC issued 352 structured notes linked to unknown share baskets with a snowball payoff in Q3 22, a decrease from 532 in the prior-year period, SRP data shows. The majority was distributed in-house, and the products featured seven external distributors led by Cathay Securities Investment Trust.

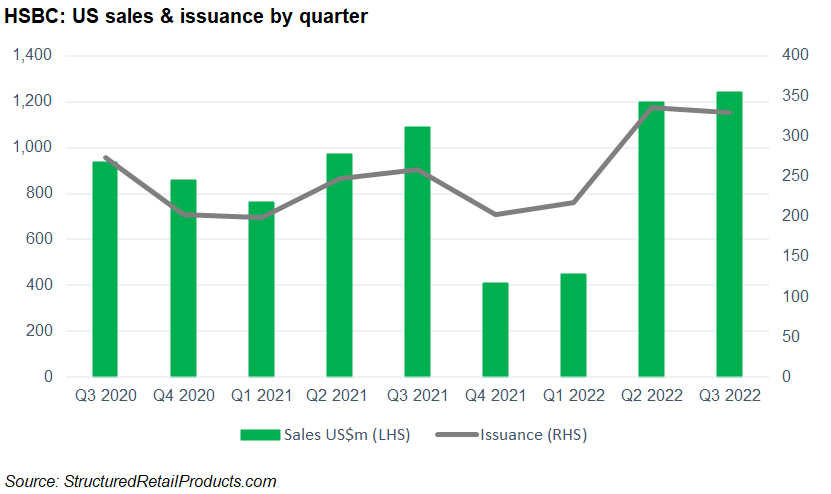

In the US, the sales of retail structured notes issued by HSBC reached a two-year high at US$1.24 billion through 330 products following a strong Q2 22. As of September, the UK bank was the 10th largest issuer with a 3.98% market share, or traded notional of US$2.9 billion, SRP data shows.

The global banking and markets (GBM) division posted a revenue increase of 16% to US$3.8 billion in Q3 22 YoY led by a 20% revenue growth of markets & securities services (MSS) ‘driven by global interest rate increases, partly offset by reduced fees from lower market levels’. The division’s nine-month revenue stands at US$11.8 billion, down US$600m YoY.

In the meantime, commercial banking (CMB) revenue climbed 40% to US$4.3 billion across all products with double digit growth in all regions notably in Asia and the UK in Q3 22 YoY, bringing the nine-month revenue to US$11.5 billion.

Group-wide, HSBC delivered reported revenue of US$14.3 billion in Q3 22, 28% higher YoY, and net profit of US$2.6 billion, 39.6% lower YoY or 55.6% lower quarter-on-quarter (QoQ).

Compared with H1 22, the first six months of 2022 saw a revenue decrease to US$25.2 billion 'primarily due to foreign currency translation impacts and H1 22 losses on planned business disposals'.

‘Our 3Q22 results included an impairment of US$2.4 billion following the reclassification of our retail banking operations in France to held for sale, as well as a net charge for expected credit losses and other credit impairment charges (‘ECL’), compared with a net release in 3Q 21’, stated HSBC.

Reported net profit dropped 7.1% to US$11.8 billion in the first nine months, which included a US$1.8bn deferred tax gain.

'We maintained our strong momentum in the third quarter and delivered a good set of results,' said Noel Quinn (pictured), group chief executive, commenting on the results.

Click here to view HSBC’s Q3 22 earnings presentation.