Monex captured more than two thirds of the Mexican market in a quarter which saw underlyings limited to FX and interest rates.

Some MXN72.4 billion was collected from 1,389 structured products in the third quarter of 2022 – a 21% drop in sales volume compared to the prior year quarter (Q3 2021: MXN91.8 billion from 1,741 products).

Average volumes, at MXN52.1m per product, were also lower than those in Q3 2021 when products sold on average MXN52.8m.

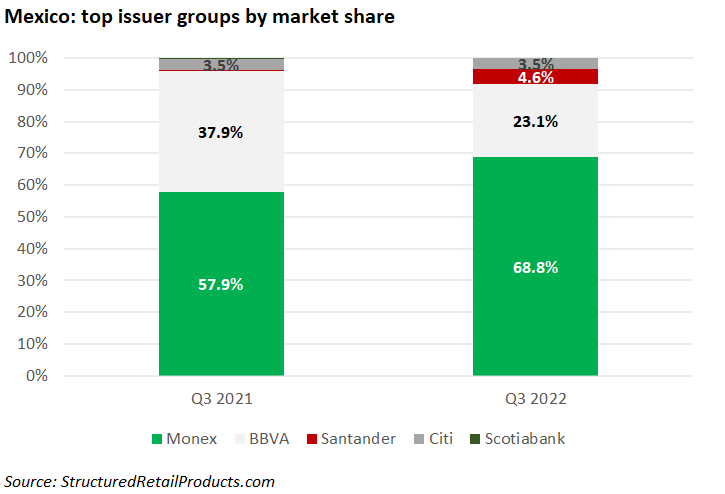

Four issuer groups were active during the semester (Q3 2021: five).

Monex was once again the dominating force, capturing 68.8% of the market – an increase of 10.9% year-on-year (YoY). The Mexican financial group collected MXN49.8 billion from 949 products that were exclusively linked to the appreciation of the US dollar relative to the Mexican peso and featured predominately range, digital and dual currency payoffs.

BBVA Mexico, in second, saw its market share decrease to 23.1%, down almost 15% YoY. It gathered sales of MXN16.7 billion from 333 issued products.

Unlike the prior year quarter, when the bank launched products on a variety of underlyings, including ETFs, single indices and stocks, issuance this time around was limited to the USD/MXN currency pair, which it used in 303 products, and the interbank equilibrium interest rate (TIIE 28).

Santander claimed 4.6% of the market – up 4.2% from Q3 2021. It achieved sales of MXN3.4 billion from 43 products that were either dual currency notes or range/accruals. The USD/MXN was the sole underlying used by the bank, which was also responsible for the best-selling product of the quarter: a 10.5% pa dual currency note that sold MXN1.2 billion.

Banamex held 3.5% of the market, level on the same quarter last year. The 100% subsidiary of Citi sold 64 products worth MXN2.5 billion with the bulk of the issuance again tied to the USD/MXN (60 products). The four remaining products were linked to TIIE 28.

Scotiabank, which had a 1.3% market share in Q3 2021, was not active this quarter.