The French bank's global markets division saw continued ‘strong client demand’ for fixed income, currencies and commodities (FICC) derivatives due to reallocation and hedging needs in Q3 22.

Revenues at the division was up 14.7% to €1.99 billion in Q3 22 year-on-year (YoY), representing a 11.6% rise at constant scope and exchange rates, according to the quarterly earnings report from BNP Paribas (BNPP).

The growth is reflected in both FICC and equity and prime services segments, which posted respective revenues of €1.12 billion and €863m. That translated to an increase of 25.5% and 3.3% YoY, respectively.

Equity markets delivered ‘sustained level of activity business in derivatives this quarter - a good level of activity on the whole in prime services, but a less active primary market,’ stated the bank.

FICC recorded ‘very good performance in commodity derivatives, rates, foreign exchange and emerging markets’ whereas the context in the primary and credit markets was ‘less favourable’.

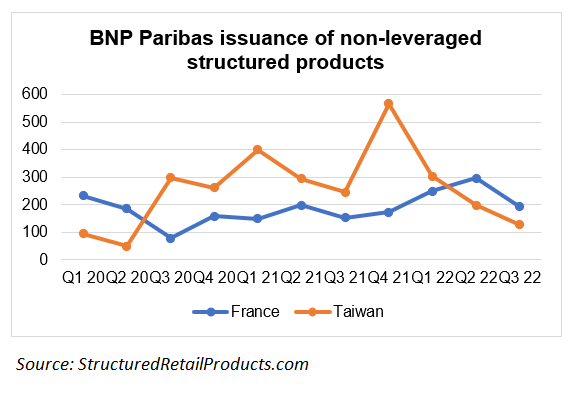

The bank headed by CEO Jean-Laurent Bonnafé (pictured), issued 561 non-flow structured products across 16 markets from July to September, according to SRP data.

In France, BNP Paribas has marketed 193 structured products featuring 118 certificates and 73 medium term notes were launched, which were deployed with a total of 10 payoffs. The majority of the products were linked to single index, single share or share basket while credit and interest rates were used in six products each.

There was one structured green bond with a 10-year tenor, tracking the performance of the S&P Transatlantic 100 ESG Select Equal Weight 5% Decrement Index.

SRP has also registered 40 structured products issued by BNP Paribas in Italy in Q3 22, which were sold US$296.4m-equivalent, down 42.9% from a quarter ago. There were two products launched in Belgium, tied to the 30-year EUR constant maturity swap (CMS) rate and five-year EUR CMS rate.

BNPP Fortis is offering its first equity-linked note – callable note Eurozone 2030 - in Belgium in 15 months by returning to the market in November, as SRP reported.

Outside of Europe, the bank was active in Taiwan, Japan and Hong Kong SAR. It issued 193 structured notes in Taiwan, compared to 153 in the prior-year period, with 14 local banks or securities houses acting as distributors led by CTBC Bank.

In Q3 22, BNPP collected US$167.9m-equivalent from 22 structured bonds in Japan.

The bank is also one of the 15 issuers in Hong Kong’s listed structured products market, having launched 31 derivative warrants (DWs) and 377 callable bull bear contracts (CBBCs) during the last three months.

Franchises

The bank has reported digitalisation is on track as it continues to consolidate leadership positions in multi-dealer electronic platforms – BNP Paribas has signed an agreement to acquire the fintech Kantox, a platform for automation of currency risk management for corporates.

Global banking and securities services recorded revenues of €1.18 billion and €632m in Q3 22, respectively, representing 31.1% and 16.6% of the entire revenues at the corporate & institutional banking (CIB) pillar.

Within CIB, revenues grew by 5.9% to €3.80 billion YoY with operating expenses increasing by 4.5% to €2.34 billion.

Revenues at the bank’s commercial, personal banking & services (CPBS) climbed by 9.6% to €7.1 billion. Investment & protection services (IPS) saw revenues increasing 8.9% to €1.63 billion saw ‘strong rise in a very unfavourable market context, driven mainly by the increase in insurance (+7.2%) and wealth management (+9.1%)’.

Group-wide, revenues climbed 8.0% to €12.31 billion YoY, leading to net income of €2.76 billion, which represented a10.3% rise.

Click in the link to read BNP Paribas’ Q3 22 earnings presentation.