Indices linked to European stocks remained the preferred underlying for autocalls, despite losing 14% market share.

An estimated US$31.6 billion was collected from 7,850 autocall structured products linked to a single index in 2022 – an increase of 6.8% by sales volume year-on-year (YoY).

The products were sold across 17 different jurisdictions, of which France, with estimated sales of US$21.5 billion (from 2,000 products), was the biggest autocall market for single index-linked structures.

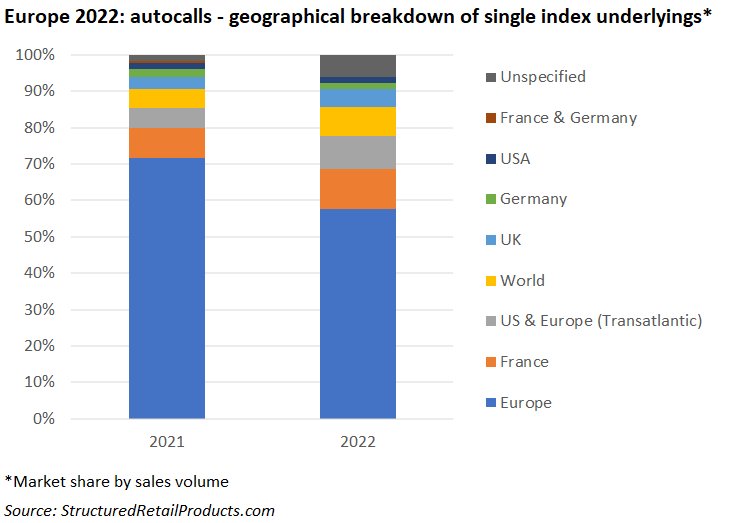

Looking at their geographical breakdown, indices linked to the European stocks remained the most attractive proposition with a 57.5% market share, despite losing 14% YoY. In this segment, the Eurostoxx 50 was the dominant index, claiming 29% of all volumes for Eurozone-linked indices, followed at quite some distance by the Eurostoxx Banks (3.6%) and Euro iStoxx 50 GR Decrement 3.75% Index (1.80%).

The latter was exclusively used in France by Amundi, including in LCL’s Premio AV (Avril 2022), which sold €146m during its subscription period.

Indices linked to France and Transatlantic indices linked to US & European stocks both increased their market share. The former, which includes the SBF Top 50 ESG EW Decrement 50 Points and MSCI France Select ESG 30 5% Decrement Net Index, among others, captured 11% market share – up 2.7% YoY – while US & Europe (Transatlantic indices), which included Natixis’ iEdge ESG Transatlantic Water EW 50 Decrement 5% NTR Index, claimed 9.3% of the market (+3.8% YoY).

Another category that performed well were global equities indices, which saw their market share increase to 7.9% (+2.5% YoY). In this segment, the MSCI World Climate Change ESG Select 4.5% Decrement EUR Index was used as the underlying for 857 products issued in Germany by Dekabank.

UK themed indices also fared well (+1.7% YoY), mainly due to structures linked to the FTSE 100, which claimed over four percent of all index-linked sales.