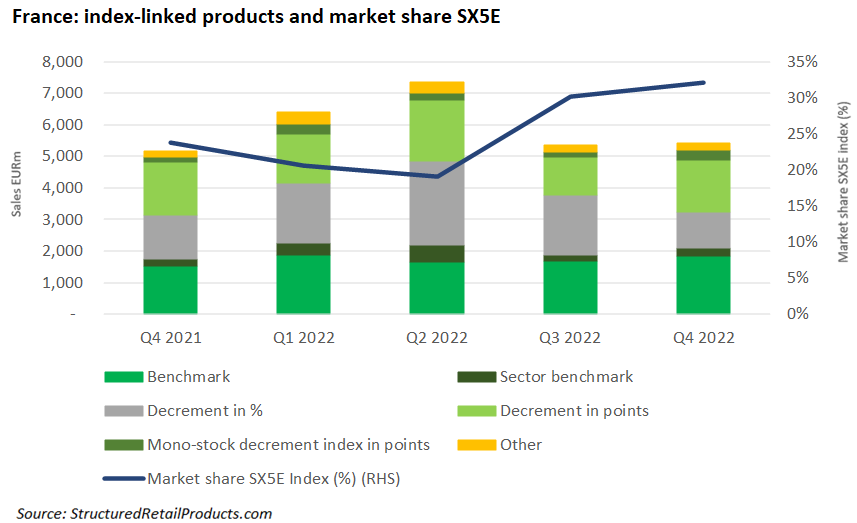

The Eurostoxx 50 increased its market share as higher interest rates lessened the appetite for decrement indices.

In the fourth quarter of 2022, some 32% of index-linked sales in the French market was tied in products on the Eurostoxx 50 (SX5E) – an increase of eight percentage points year-on-year (YoY) and up 13 points from the low seen in Q2 2022.

The rise was driven by the increase in interest rates in the second half of the year, allowing issuers to provide simple structures on the European benchmark once again.

During the quarter, an estimated €1.7 billion was invested in products tied to the SX5E (Q4 2021: €1.2 billion). Products issued by Morgan Stanley collected almost 30% of the volumes linked to the index, with Crédit Agricole (23%), Goldman Sachs and Société Générale (12% each) also frequently issuing products on the SX5E.

Sales for index-linked products totalled €5.4 billion in Q4, up 4.5% YoY. At 34%, the largest chunk of volumes was invested in structures on benchmark indices, which apart from the SX5E also included the S&P 500, Nasdaq 100, and the local Cac 40. A further 4.8% was invested in sector benchmarks.

Sales of products linked to decrement indices, at an estimated €3.1 billion, were significantly down from previous quarters, especially compared to Q2 when €4.8 billion was gathered.

However, with rates back to historically normal levels, option budgets are higher, and there is less need for decrement, which was clear in the French market during Q4. This especially applied to products linked to indices where the decrement is a percentage whose sales were down 57% compared to Q2.

Despite the lower sales, the latter category was still responsible for the best-selling index-linked product of the quarter, which came in the shape of Iris Impact, an eight-year green bond from Natixis that was distributed via the Caisse D’Epargne network. It offered access to the iEdge ESG Transatlantic SDG 50 EW Decrement 5% NTR Index and collected approximately €200m during its subscription period.