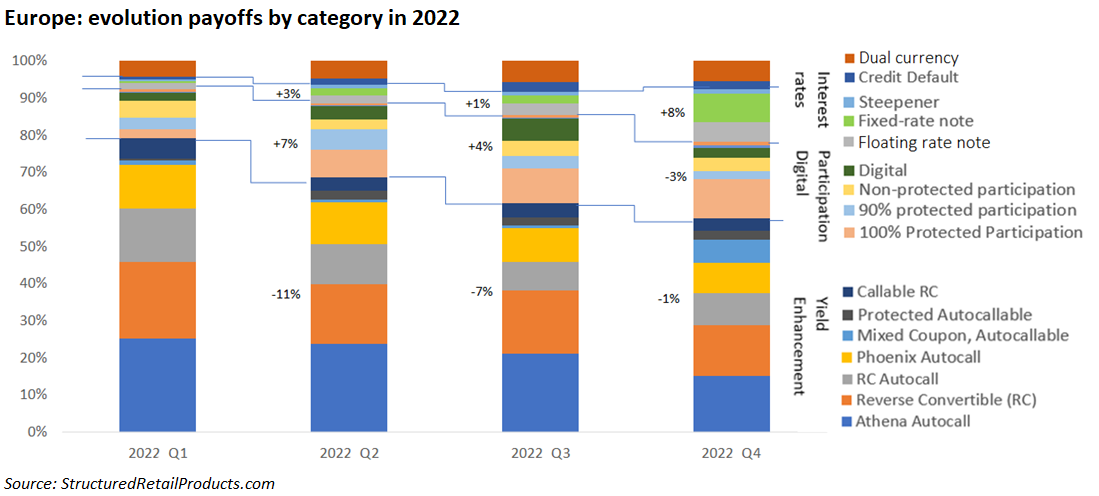

There was less focus on complex payoffs in 2022, with the positive rates environment leading to an influx of fixed-coupon structures in Q4.

Yield enhancement products remained the largest category, despite seeing their market share decrease continuously throughout the year. In the first quarter of 2022, they represented 79% of the notional sold, however, by the end of Q4 their market share had shrunk to 59%

Within the yield enhancement category, Athena autocalls and reverse convertibles are the main payoffs, capturing 15% and 14%, respectively, of the European market at the end of the year.

The second group are the participation products, whose market share steadily increased during the first three quarters (from 13% in Q1 to 24% in Q3) before slightly dropping in the final quarter (21%).

Here we notice the steady growth of fully protected equity-linked notes, which claimed 11% market share in Q4, up nine percentage points compared to the first quarter.

Overall, there was little focus on adding too much complexity to the payoffs, which were mostly familiar structures. In terms of innovation, providers remained consistent with the uncertain and volatile environment for both stocks and bonds.

As the year unfolded, we saw the five-year swap in euro evolving around three percent in October, leading to an environment favourable for fixed-coupon structures that were able to offer between three and five percent per annum, depending on the issuers funding.

Interest-linked notes captured 15% of the market in Q4, up from just two percent in the first quarter. In some markets, fixed-rate notes sold large volumes in Q4, while sales for (fixed to) floating-rate notes and steepeners were also on the up.

In Belgium for example, Crelan collected €150m with Fixed to Floating CMS Linked Coupon Note 2028, which was issued on the paper of Société Générale and also distributed via the Axa Belgium network, while in Finland Pohjola Pankki gathered sales of €125m with OP Säästöobligaatio Korkoputki 1 v XXV/2022, a one-year MTN on the Euribor.