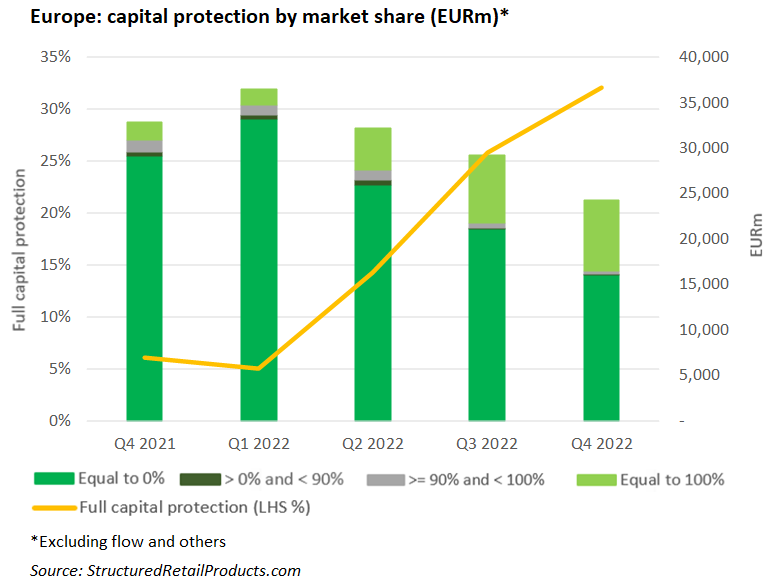

Products offering 100% capital protection increased their market share by 26 percentage points YoY in Q4 2022.

An estimated €24 billion (US$17.8 billion) was collected from approximately 28,500 structured products in the fourth quarter of 2022 – down 27% by sales volume compared to the same quarter last year (Q4 2021: €33m from 34,000 products).

Some 32% of the notional in Europe during Q4 2022 was invested in products offering 100% capital protection, against just six percent in the prior year quarter, according to SRP data.

The market share of fully capital protected products steadily progressed throughout 2022, starting at the beginning of the year when the two-year USD swap rate surged above two percent and volatility spiked across all markets which meant tenors could be reduced to two-years.

Hence, as early as Q2, some markets started to see activity in short maturity capital protected notes, including the reappearance of Shark notes denominated in US dollars. An example is the two-year 100% ProNote USD on the Swiss Market Index (SMI), which was issued by Credit Suisse in Switzerland.

By July, the market share for capital guaranteed products had increased to 14% after Eurozone rates moved from negative territory to +2.5%, allowing banks to focus on shorter-dated products and with fixed maturities, which carry less risk, while at the end of Q3 it had reached 26%.

The levels of 100% capital protected structures in the individual European markets varied in Q4. In the UK, their market share increased from 3.5% in Q4 2021 to 18% in Q4 2022; in Sweden it was up from 0.8% to 15%; in Germany it went from 2.6% to 15%; and in Belgium it increased by 51 percentage points: from 47% to 98%.

In markets familiar with autocalls, such as France, where the market share of capital guaranteed products increased to 34% (Q4 2021: 2.4%), we now see all the main issuers, including Société Générale, Morgan Stanley, Credit Suisse, BNP Paribas and Citi, offering autocalls with 100% capital protection.

In Q4, 41 such products were issued in the French market, including LCL Pro Capital 100, which is linked to the Euro iStoxx 50 GR Decrement 3.75% Index and BNP Paribas Asset Management’s Apollo Economie Circulaire II which offers access to the ECPI Circular Economy Leaders NTR 3.5% Decrement Index.

Another product that became increasingly popular towards the end of the year were the bonus fixed rate notes, which were seen in France, Ireland and the UK, among others. An example is Barclays’ two-year Bonus Fixed Income on the Eurostoxx 50, which pays a fixed annual coupon of 2.35%. At maturity, a bonus coupon of 0.1% is paid, providing the index closes at or above its initial level.