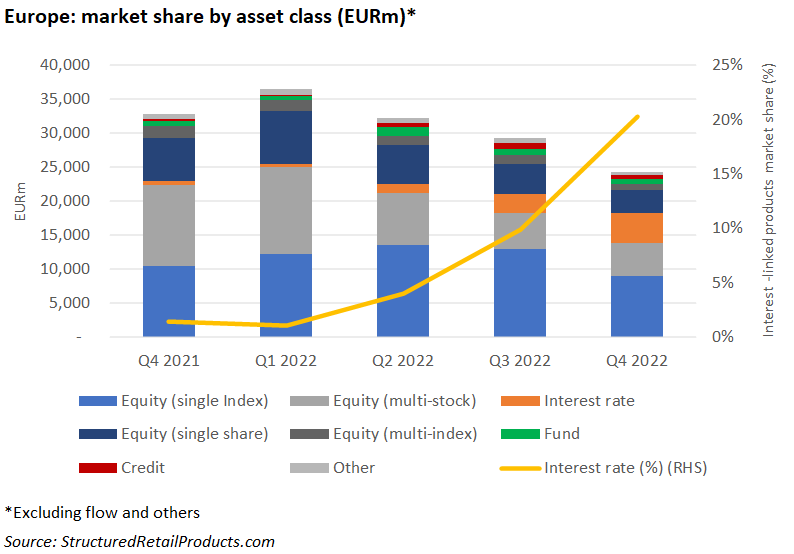

Interest-linked products are rapidly closing in on products tied to equities, increasing their market share in Q4 by almost 20 percentage points YoY.

Some €24 billion (US$25.8 billion) was collected from around 28,500 structured products in the fourth quarter of 2022 – down 27% by sales volume year-on-year (YoY).

Single equity indices remained the number one asset class, with 2,250 products linked to this category gathering sales of just under €9 billion – the equivalent of a 37% market share – compared to €10.5 billion in the prior year quarter (Q4 2021: 32% market share).

The Eurostoxx 50 was the most used index in the quarter, seen in 850 products, followed by MSCI World Climate Change ESG Select 4.5% Decrement EUR Index (234), S&P 500 (195) and FTSE 100 (153).

Products tied to multiple stocks came in second, slightly ahead of interest-linked products in third. The former category was the main asset class in Q4 2021, capturing 37% of the European market, however, it fared less well in 2022, ending the year with a 21% market share. Structures on multi-stocks were mostly utilised in Switzerland but were also popular in the Italian market.

Boosted by the rise in rates in the second half of 2022, the biggest YoY increase in market share was provided by interest-linked products: from one percent in Q4 2021 to 20% in Q4 2022. The rise in sales was particularly evident in final quarter, when 145 interest-linked products sold an estimated €4.5 billion, up 61% compared to Q3 (€2.7 billion from 156 products) and an eight fold increase compared to Q4 2021 (€486m from 19 products).

France was the main market for interest-linked products in Q4, with estimated sales of €1.6 billion from 81 products, followed by Belgium (€483m from 12 products) and Finland (€325m from 12 products). Whereas the Euribor was the preferred underlying for investors in France and Finland, in Belgium the market was dominated by steepeners paying a coupon equal to (often two times) the spread between the 30-year EUR constant maturity swap (CMS) rate and the five-year/two-year CMS rate.

Structures linked to single stocks and multiple indices saw their market share decrease by 5.4 and 1.9 percentage points YoY, respectively, while the share of fund-linked products increased by 1.4 percentage points.