The structure has earned Huatai Securities the ‘Deal of the Year’ accolade at the SPR China Awards 2022.

The structure generated an undisclosed traded notional of ‘several billions of Chinese yuan’ onshore at the Chinese securities house in 2022.

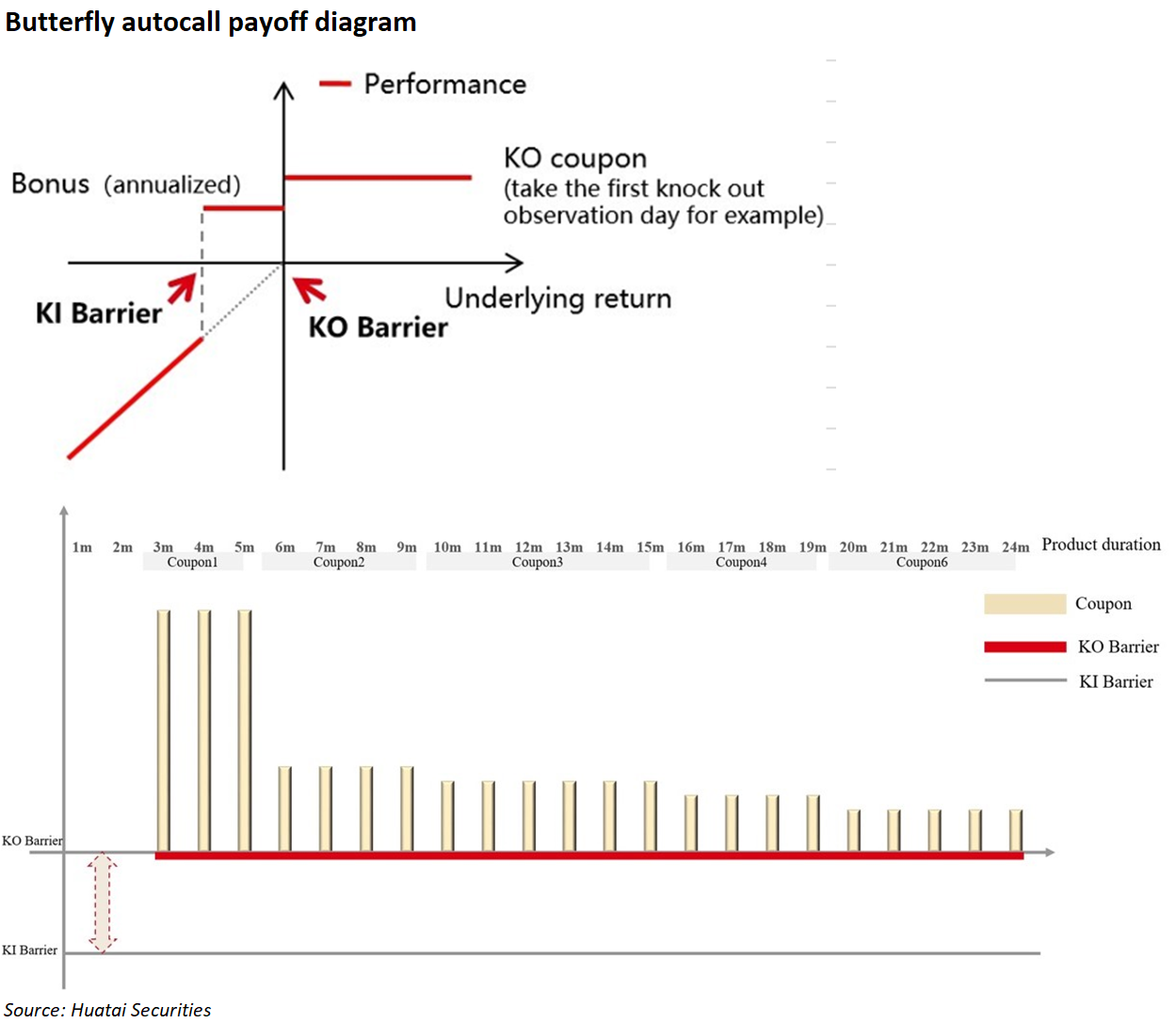

The Butterfly autocall (蝶变雪球) product offers a provision where its trigger-out coupon will decrease over the investment period compared with a classic autocall.

With the addition of a snowball payoff, the butterfly autocall features a greater trigger-out coupon in the early stage and a lesser trigger-out coupon in the later stage as well as a lesser ‘bonus coupon’, which is paid when neither knock-out (KO) nor knock-in (KI) event occurs.

We have been making efforts to innovate in underlying assets and barrier options for butterfly autocalls since the beginning of this year - Ding Ye

In 2022, the structure accounted for approximately 20% of the incremental autocall products by traded notional at Huatai Securities, which owned CNY 846.6 billion (US$123.8 billion) assets as at the end of 2022 as one of the three largest securities houses in China.

The derivative manufacturer estimates that over half of the live autocall products are butterfly autocall in the Chinese market.

“As the maturity date approaches, the KO level decreases, and the probability of the product being knocked out increases, making it easier for the clients to get back the principal instead of bearing losses,” Ding Ye (pictured), head of OTC institutional solutions, derivatives and product Innovation at Huatai Securities, told SRP.

Classic autocall products feature higher probability of early redemption in the “early stage” in the Chinese market, based on the back-testing results by Huatai Securities. In a way, the snowball payoff offsets the decreased trigger-out coupon in the later stage and bonus coupon for its one-off conditional coupon payment feature.

Butterfly autocall was launched by the securities house in 2022 in a response to low volatilities and tightened backwardation in the onshore index futures that's been seen since 2021.

“We have been making efforts to innovate in underlying assets and barrier options for butterfly autocalls since the beginning of this year,” Ye added.

Specifically, the firm’s underlyng pool has been expanded beyond the CSI 500 to include the CSI 1000, Hang Seng Tech and Heng Seng China Enterprises indices - Rainbow options, which features dual underliers, have also been made available.

“The [objective] is to increase the win rate of butterfly autocalls by changing the settings of KO or KI levels that are path dependent while reducing trigger-out coupons and bonus coupons as less as possible,” said Ye.

In 2022, Huatai posted several billions of Chinese yuan traded notional of butterfly autocalls with counterparties ranging from local commercial banks and their wealth management subsidiaries (理财子公司), subsidiaries of fund management companies (基金子公司), hedge funds and in-house high-net-worth individual (HNWI) clients.

The products were traded in the form of structured notes, known as ‘beneficiary certificates’ and over-the-counter (OTC) options.

Since June 2022, CMB Wealth Management, a fully-owned subsidiary of China Merchants Bank, has launched 60 butterfly autocall products under the series of Zhao Yue Zhen Xuan (招越臻选联动系列). With a tenor of three months to four years, these products offer a typical expected return of 3.5% to 10% pa.

Trailblazer

The demand for butterfly autocalls has been accelerated by the transformation of the wealth management industry in China, which was required to gradually adopt the net asset value (NAV) model since 2018, according to Ding.

Under the landmark rules, wealth management products shall be evaluated mark-to-market and must not guarantee a return in an explicit or implicit way.

“[Butterfly autocall] fills the gap of certain asset allocation for wealth management products following the NAV model reform,” said Ding. “Compared with index enhancement products, butterfly autocall stands out for its comprehensive consideration of time, volatility and valuation, instead of a unilateral bullish view on indices.”

The index enhancement payoff (指数增强), which is designed to outperform benchmark indices by reducing or closing positions of unfavourable constituent stocks and adding to positions of favourable constituent stocks, has been very popular in the Chinese structured product market, particularly before 2020.

There's has been an “explosive growth” of autocall products in China since the debut in 2019. In the first three years, investors were in the stage of grabbing a basic understanding of structure with a focus on classic and step-down autocalls, according to Ding.

“As the market evolves, more variations start to appear in the autocall market,” he said.

The product tenor now offers different options - six months, one to two years and even longer from the initial one year. In the meantime, underlying assets have been also expanded to cover stocks, offshore indices, sector indices, exchange-traded products and commodities.

However, it has been a challenging environment to deliver returns that match investors’ expectations due to lowered volatility and tightened basis since last year, according to Ding.

“In response, we shifted our focus to investment tenor and correlation,” he said. “Early this year, we became the first to launch butterfly autocalls with long tenor, which raises the KO probability and is able to offer a more attractive trigger-out coupon in the early stage.”

The use of Hong Kong-listed shares with moderate correlation as underliers is expected to gain traction in the autocall space in China, he added.

“In addition, the persistent high interest rates and risk events overseas have put further pressure on the global economic system while the recovery of China’s economics and financial sector has stepped up,’ said Ding. “This has made it more difficult for investors who have no investment views or those with limited research capabilities to invest.”

“Tactical option products are gradually favoured by Chinese wealth managers and asset managers in the current environment, which are combined with traditional fixed income investment products,” he concluded.