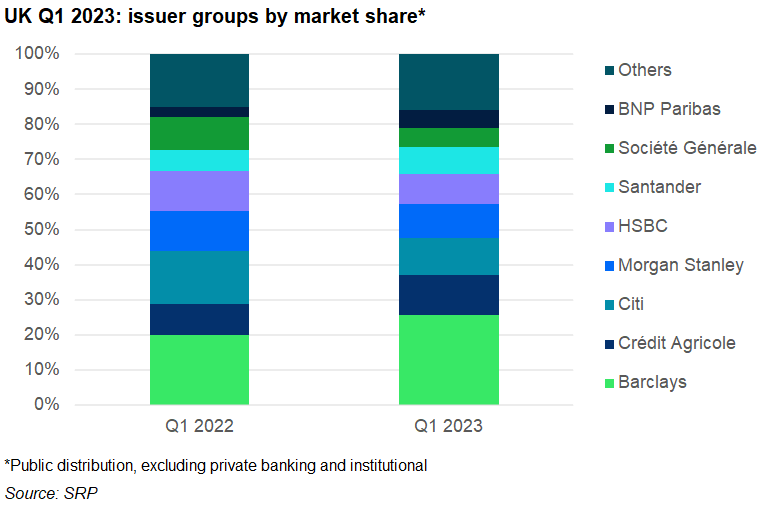

Barclays claimed a market share of more than 25% to retain its position as the top provider in the UK.

Eleven issuers were active in the UK structured retail products market during the first quarter of 2023. Combined they collected an estimated £350m (US$437m) from 237 products issued – an increase of 20% by sales volume year-on-year (YoY).

Barclays retained its position as the number one issuer. It claimed 25.5% of the UK market in the quarter from 35 products sold (Q1 2022: 19.6%). The bank’s offering included 20 capital guaranteed structured deposits, the majority of which were available via MB Structured Investments/Meteor Asset Management (16 products).

In second, Crédit Agricole (CA) increased its market share to 11.6% (Q1 2022: 8.4%). Unlike Barclays, which had a strong focus on capital protection, the French issuers’ products were kick-out plans with European barriers of between 35 and 40% that put full capital at risk.

Citi held 10.4% of the UK market in the quarter, down 4.5 percentage points YoY. Most of its products were autocalls, predominately on the FTSE 100, with similar barriers to those seen at CA.

Despite increasing its issuance to 33 products (Q1 2022: 19), Morgan Stanley registered a slight drop in market share: from 11.1% in Q1 2022 to 9.8% this time around. The same applied to HSBC which completed the top five. The UK bank sold 30 autocalls on the FTSE 100 compared to just 16 products in the prior year quarter.

Santander, which captured a 7.5% market share, was responsible for one of the highest selling products in the quarter. Issue nine of its Defensive Kick Out Plan was listed on the London Stock Exchange for an issued amount of £6.6m.

Other issuers active in the quarter included SmartETN (7.9% market share), Société Générale (5.5%), BNP Paribas (5.1%), RBC (4.6%) and Goldman Sachs (3.5%).