New asymmetric strategies and capital protected structures linked to digital assets in focus; ETC Group launches first crypto ETP linked to MSCI play; DeFi protocol gains further support; and more.

Hong Kong hybrid fintech platform bridging traditional financial assets and digital assets Arta TechFin has partnered with digital asset structured derivative solutions provider Enhanced Digital Group UK Limited (EDG UK), to distribute digital asset structured products in Hong Kong on an exclusive basis.

This partnership with EDG UK, which is led by Chris Bae (pictured), will allow Arta clients to access digital markets in traditional USD structured note formats – the fintech platform is seeking to offer investors a variety of return scenarios, including asymmetric strategies and capital protected structures.

EDG UK and other partners bring in global liquidity and cutting-edge product choices to meet our client demands for tailor-made digital asset solutions in traditional USD formats - Eddie Lau, Arta TechFin

In addition to the existing offering in Singapore and Zurich Arta’s partnership with EDG UK will enable the Hong Kong fintech to offer a one-stop global solution in over-the-counter structured products and exchange-traded derivative products listed in Chicago and Hong Kong.

Eddie Lau, chief executive officer of Arta TechFin, said the partnership is part of the company’s plan to develop and be part of a global digital asset financial ecosystem.

‘EDG UK and other partners bring in global liquidity and cutting-edge product choices to meet our client demands for tailor-made digital asset solutions in traditional USD formats,’ he said.

The HK fintech also announced that is looking to set up an Asean headquarter in Singapore to strengthen its distribution channel and client coverage and obtain Capital Market Services (CMS) licenses in Singapore.

Earlier this year, Arta announced a strategic partnership with the digital asset business division of BC Technology Group to create an end-to-end virtual asset financial service ecosystem, including origination of asset-backed security tokens, secondary trading of physically-settled and cash-settled DA spot and derivatives, and custody of OTC and exchange-traded DA.

The HK fintech also partnered with Leonteq in late-March as a strategic distribution partner in Hong Kong and in the rest of Asia Pacific region via its partnership network of family offices and asset managers.

First ETP linked to MSCI crypto index launched

ETC Group has listed the ETC Group MSCI Digital Assets Select 20 ETP (ISIN DE000A3G3ZL3) on Deutsche Börse Xetra.

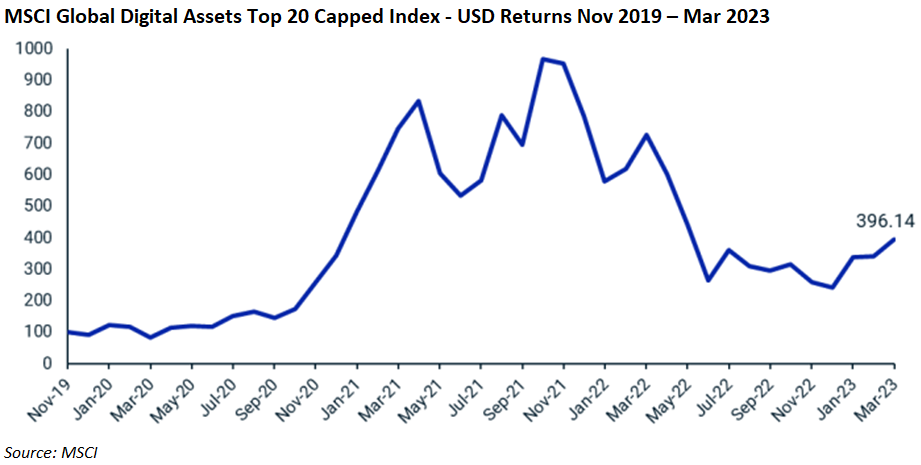

The new exchange-traded product tracks the performance of the MSCI Global Digital Assets Top 20 Capped Index and is tradable in EUR and US dollars on Xetra.

Issued in Germany, this is the first time the ETP provider led by Bradley Duke (right) offers a product linked to a broad crypto market index tracking the top 20 investable digital assets comprising approximately 85% of the crypto market - the three largest positions within the index are currently Bitcoin (ETC), Ethereum (ETH) and Ripple (XRP).

The index is managed and calculated by MSCI and rebalanced quarterly. At rebalance, the weight of individual components is limited to 30 percent in order to improve diversification. Stablecoins, privacy coins as well as ecosystem tokens, and so-called meme coins are not included in the index.

The index methodology is publicly available at MSCI Global Digital Assets Select Top20 Capped 20230301

Investors can trade the new ETP like shares or ETFs via their regular securities account at online brokers and banks that offer trading on Xetra and trading in crypto ETPs. Like all ETC Group products,

The ETC Group MSCI Digital Assets Select 20 is fully backed by the underlying digital assets and issuer default risk is minimised via an independent trustee - the digital assets backing the ETP are kept in cold storage by a regulated custodian and all transactions are additionally monitored independently by a dedicated administrator.

ETC Group’s range of ETPs linked to digital assets include the world's first centrally cleared Bitcoin ETP on Deutsche Börse Xetra, as well as Europe's first Metaverse ETF launched together with HANetf.

IPC and Kaiko partner to offer crypto trading market data

US provider of voice communication systems for financial companies IPC Systems has partnered with cryptocurrency market data provider Kaiko to offer enterprise-grade data to IPC’s Connexus Crypto ecosystem.

Launched last year, Connexus Crypto is IPC’s flagship solution for cryptocurrency trading and has been engineered to support complex trading strategies including arbitrage aimed at placing market participants ahead of the competition by enabling them to buy and sell a cryptocurrency simultaneously in different markets.

The solution also provides users with low latency connectivity and instant access to the liquidity of several global crypto exchanges. It is underpinned by the Connexus Cloud platform, a multi-cloud trading ecosystem connecting more than 7,000 global market participants.

Under the agreement, Kaiko will build custom data plans designed to serve those using the IPC’s flagship Connexus Crypto trading environment and deliver real-time stream data, including spot, and derivative.

In addition to real-time prices, Kaiko will offer other products such as aggregated quotes and rates enabling users to implement highly efficient arbitrage and algorithmic trading strategies, perform effective risk management, investing, monitoring, and regulatory compliance activities.

‘The fusion of Kaiko and IPC’s capabilities (…) will support IPC’s extensive global customer base to enhance their trading activities, while also growing our mission to be the leading source of real-time information to market participants,’ said Ambre Soubiran (above-right), CEO, Kaiko.

DeFi protocol lands US$17m for expansion, new partnerships

Decentralized-finance platform Thetanuts Finance has closed a US$17 million funding round led by Polychain Capital, Hyperchain Capital and Magnus Capital.

The funding will help the company create new partnerships with layer 1 and layer 2 networks, liquidity providers, blockchain foundations, market makers and exchanges.

The funding round comes as the industry continues to slowly climb out of the crypto winter deep freeze that nearly stalled the investment landscape. Providers of blockchain infrastructure have proven to be the most resilient firms during the downturn, and DeFi projects are being favoured over centralized products after the collapse of centralized exchange FTX last year.

Thetanuts Finance offers crypto structured products that cater to option traders, decentralized autonomous organizations, market makers and other liquidity providers - users can earn yield on major cryptocurrencies and popular altcoins, provide liquidity, and execute short and long options strategies.

Thetanuts Finance will soon launch a buy-side altcoin options market powered by decentralized options vaults, which the firm says will make options strategies available to more investors.

‘We are dedicated to leading the way in building a thriving altcoin options market for both budding and established ecosystems across different chains, including non-EVMs. We look forward to driving the DOV model to new heights,’ said Thetanuts Finance adviser Sherwin Lee.

Thetanuts Finance raised US$18 million in March 2022 in a round that was led by crypto options exchange Deribit, QCP Capital, Jump Crypto and crypto hedge fund Three Arrows Capital which collapsed in the Summer of 2022, largely because of its exposure to Terra, a crypto network that fell apart in May 2022 wiping out almost half a trillion USD from the cryptocurrency markets.

LSE to launch bitcoin futures and options trading

London Stock Exchange Group (LSE) is planning to offer Bitcoin index futures and options derivatives trading and clearing services this year.

The UK exchange said it has partnered with a digital trading platform with Global Futures and Options (GFO-X) to launch UK’s first regulated Bitcoin futures and options trading, according to media reports.

London Stock Exchange Group Paris-based LCH SA clearing arm will introduce DigitalAssetClear, a clearing service for cash-settled dollar-denominated digital assets traded on GFO-X.

LCH SA will offer clearing of Bitcoin index futures and options contracts traded on GFO-X, subject to regulatory approval. This will be made available through a new segregated clearing service, LCH DigitalAssetClear.

The new Bitcoin index futures and options contracts will be cash-settled through LCH DigitalAssetClear and will be based on the GFO-X/Coin Metrics Bitcoin Reference Rate (GCBRR), a BMR-compliant reference rate of the U.S. dollar price of Bitcoin. Firms will be able to trade futures and options on the Bitcoin reference index directly.

‘Bitcoin index futures and options are a rapidly growing asset class, with increasing interest among institutional market participants looking for access within a regulated environment they are familiar with,’ said Frank Soussan, head of LCH DigitalAssetClear.

CEO and co-founder of GFO-X Arnab Sen (above right) added: ‘Recent market events in the trading of digital assets have highlighted the need for a safe, regulated venue where large financial institutions can trade at scale, while keeping their clients’ assets protected’.

LCH DigitalAssetClear will operate a fully segregated clearing service – including a segregated default fund – for market participants clearing these instruments. The service is expected to go live in Q4 2023.