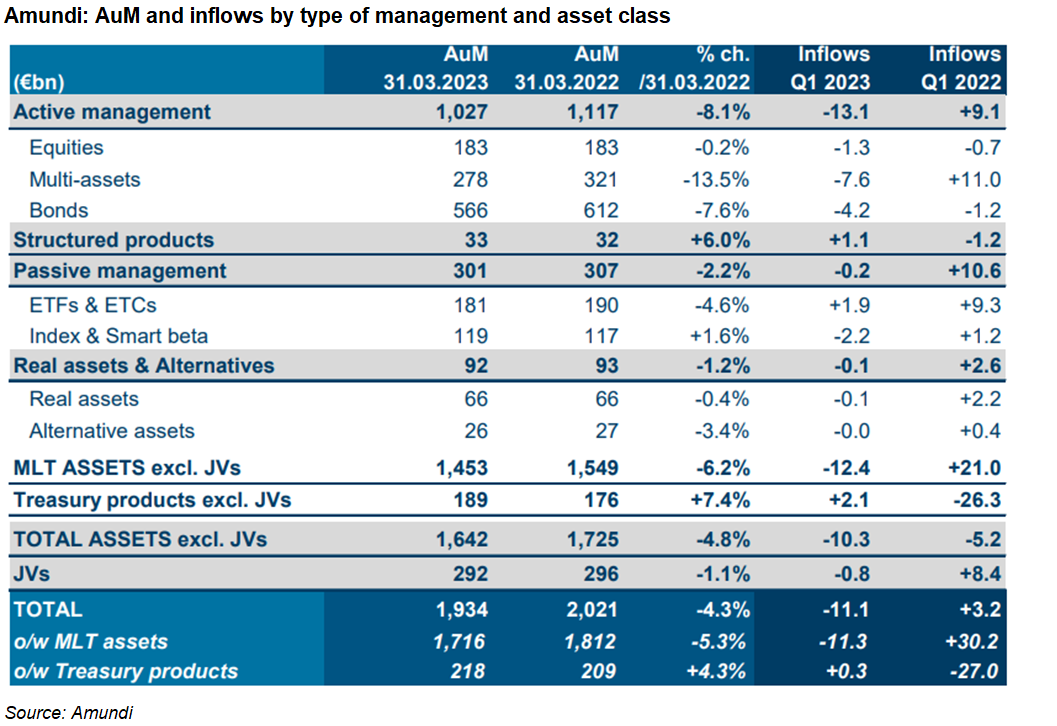

The asset manager reported €33 billion in AuM for structured products at the end of the first quarter of 2023.

Amundi reported adjusted net income reached €300m (US$327m) in Q1 2023, essentially stable compared to Q4 2022, and down -7.5% from Q1 2022.

The French networks posted positive net inflows of €2.7 billion, of which €0.8 billion in medium/long term (MLT) assets and €1.9 billion in treasury products. MLT inflows were mainly driven by structured products, at €1.5 billion.

We are the European leader [in structured products] and have operated in this segment for around 30 years - Domenico Aiello, CFO

Inflows from the international networks reached €1.2 billion, entirely in MLT assets, with healthy activity for bond funds (Buy & Watch) in Italy and structured products in Spain. International inflows were driven by partner distributors such as Unicredit (Italy and Czech Republic), Société Générale (Czech Republic) and Sabadell (Spain).

As of 31 March 2023, assets under management (AuM) for structured products stood at €33 billion, up six percent year-on-year (YoY).

‘We are the European leader [in structured products] and have operated in this segment for around 30 years,’ said Domenico Aiello (pictured), chief financial officer, speaking during the presentation of the results on 28 April.

Amundi’s structured products are available in the form of funds or in the form of European medium-term notes (EMTNs), with the latter issued by the company’s own issuance vehicles and consolidated on Amundi’s balance sheet.

‘Retail net flows in this quarter were around €1.6 billion and they were mainly in the latter type of products, so the EMTNs,’ said Aiello, who is expecting this trend to continue in the coming quarters.

‘The strong connection with our partner networks gives us the possibility to design and customise these products in terms of the most appropriate structures or formulas based on the objectives, either of the clients – for example whether they prefer more capital protection or yield or inflation protection – or of the distributors themselves,’ said Aiello, adding that Amundi’s banking status allows the company to issue and guarantee EMTNs and formula-based funds.

‘On the other hand, we work with leading banks and intermediaries to hedge the risk so that it is not kept on our balance sheet,’ he said.

According to Aiello, there is an opportunity for structured products via third-party distribution in the future. ‘So far, these have been products that have mainly centered on our networks with which we have longer term distribution agreements, but in theory these are strategies that, with some adaptations, can also be sold in other networks.’

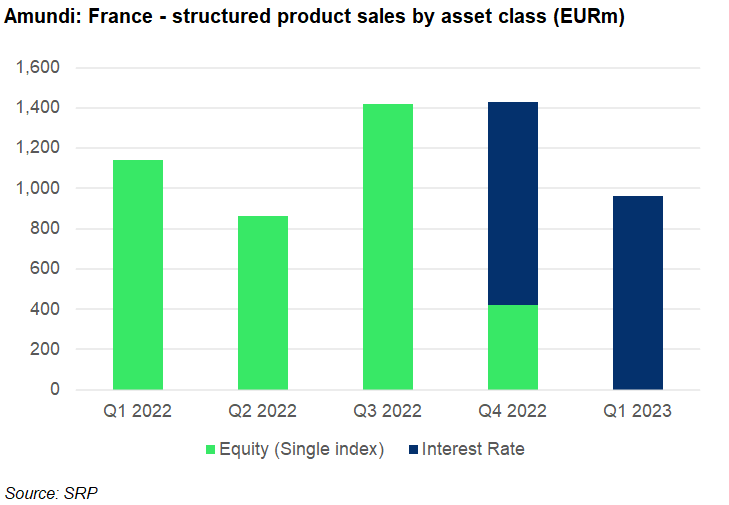

Amundi issued two structured products in France during Q1 2023, according to SRP data.

Both Obligation LCL (Janv 2023) and Obligation LCL Select AV (Janv 2023) are linked to the interest rates. The former is a plain vanilla bond with a six-year maturity that pays a fixed annual coupon of 3.3% while Obligation LCL Select AV (Janv 2023) adds a callable feature to a 10-year maturity and 4.75% pa coupon. SRP estimates these products collected combined sales of approximately €965m during their subscription period.

In the first three quarters of 2022, Amundi’s structured products offering was exclusively linked to single equity indices including the Eurostoxx 50, Euronext France Social Decrement 3.75% Index, Euro iStoxx 50 Carbon Adaptation GR Decrement 5% Index and the Euronext CDP Environment France EW Decrement 5% Index. However, since Q4 2022 the company has increasingly focused on rates-linked products, a strategy it continued in the first quarter of 2023.

The assets managed by Amundi as of 31 March 2023, at €1.9 trillion, were down 4.3% YoY, but up 1.6% compared to end-2022

Inflows for active management in Q1 2023 were negative, at -€13.1 billion, while passive management, which comprises exchange-traded funds (ETFs), exchange-traded commodities (ETCs), index funds and smart beta strategies, posted inflows of -€0.2 billion.

Click the link to read the full Amundi Q1 2023 results and presentation.