The new risk control proprietary indices add to a growing range of underlyings seen in the US indexed annuities market which continues to break sales records.

Ibexis Life & Annuity Insurance Company has introduced a new proprietary index developed by Bank of America (BofA) via a new fixed indexed annuity (FIA).

The Ibexis FIA Plus fixed indexed annuity which will be available via an independent marketing organisation (IMO) sales channel.

Clients have the flexibility to annually allocate their money into a traditional 0% floor strategy for a competitive participation rate - Ryan Lex, Ibexis

The BofA U.S. Strength Fast Convergence Index applies Bank of America’s Fast Convergence (FC) Technology to the Nasdaq 1000 Index with the goal of reducing risk and improving performance. By monitoring market moves and rebalancing throughout the trading day, FC technology aims to control the realised volatility of the index more efficiently, with the goal of added consumer value.

The index also includes a 4% monthly cap rebalanced daily with the goal of higher participation rates in index-linked products and a 12.5% volatility target to mitigate losses by allocating to non-interest bearing cash. When realised volatility decreases below the target, the index applies up to 175.0% leverage with the goal of capturing returns.

The FIA Plus also offers crediting options linked to the HSBC AI Global Tactical Index (HSBC AIGT), as well as the S&P500 and a fixed account. The new annuity is an accumulation focused FIA but also offers additional floor options that provide higher accumulation potential.

Ryan Lex (pictured), chief distribution officer at Ibexis, said: ‘With the FIA Plus, a client has the ability to control their level of risk. Clients have the flexibility to annually allocate their money into a traditional 0% floor strategy for a competitive participation rate or expose prior gains to more risk in exchange for increased upside potential.’

NAC adds risk control strategies from Barclays to FIA range

North American Company for Life and Health Insurance, a member company of Sammons Financial Group, has deployed the Barclays Transitions 12 VC Index and Barclays Transitions 6 VC Index as index-linked crediting options offered by its new NAC Control. X FIA.

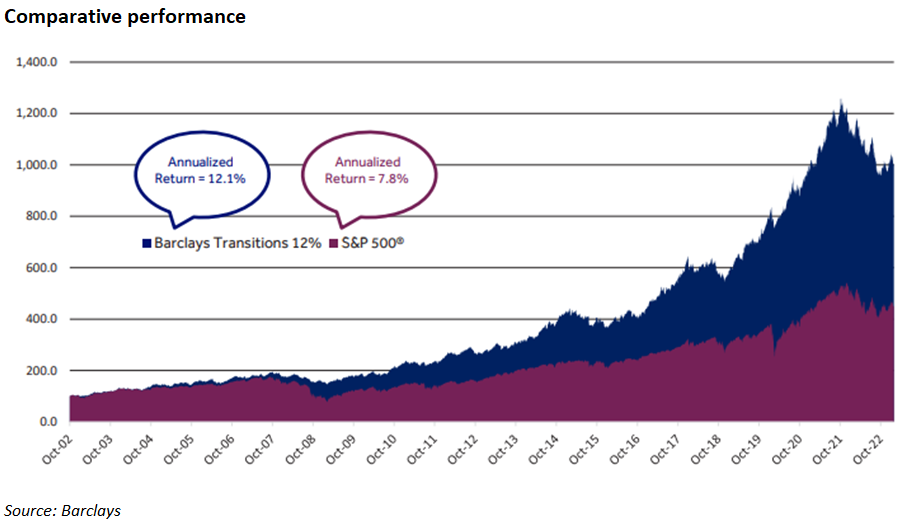

Both indices seek to provide investors with consistent broad-based exposure to US equities while seeking to stabilise performance throughout each economic cycle by incorporating commodities and longer duration US treasuries. The index transitions between allocation trend scenes based on market conditions using dynamic trend rotation.

To further control risk, both indices aim to limit their annual volatility to a six and 12% target using Barclays’ proprietary intraday volatility forecasting technology.

The new exclusive Barclays Transitions Indices are designed to follow the equity markets and capture as much upside as possible while managing risk during changing market conditions, said Bryce Biklen, North American’s chief distribution officer.

New FIA deploys J.P. Morgan factor play

National Western Life Insurance Company has launched the NWL Capital Solutions, a 10-year FIA that offers exclusive access to the J.P. Morgan Factor Focus index, and seven different index strategy options, including the Dow Jones Industrial Average and S&P multi-asset risk control (MARC) 5% Index.

The J.P. Morgan Factor Focus index was introduced in the US annuities market in the summer of 2022 via the insurers’ newest FIA - the NWL New Frontiers. The J.P. Morgan Factor Focus index is calculated on an excess return basis and provides a dynamic rules-based allocation to an equity constituent - the J.P. Morgan U.S. Minimum Volatility ETF and a bond component - the J.P. Morgan Core Bond Index, offering dynamic allocation to the U.S. dollar fixed income market, with a volatility target level of five percent.

The S&P MARC 5% index which debuted in the US annuities market at the end of 2017 was designed to track the performance of a risk-weighted portfolio consisting of three asset classes - equities, commodities and fixed income - represented by three component indices: the S&P 500 Excess Return Index, the S&P GSCI Gold Excess Return Index and the S&P 10-Year US Treasury Note Futures Excess Return Index. S&P Marc 5% is dynamically rebalanced between the three indices and the cash component to target a five percent level of volatility.

Record-breaking quarter for US annuity sales

Following record-high sales in 2022, total first quarter annuity sales stand at US$92.9 billion, a 47% increase from the prior year. This is the highest quarterly sales level ever recorded, according to LIMRA’s U.S. Individual Annuity Sales Survey.

Fixed-indexed annuity sales had a record-breaking quarter at US$23.1 billion, up 42% from first quarter 2022 results and four percent higher than the record set in the fourth quarter of 2022.

‘Economic conditions remain favorable for FIA products, and this is forecasted to continue throughout the year,’ said Todd Giesing, assistant vice president, LIMRA Annuity Research, adding that FIA sales are expected to grow as much as 10% in 2023, ‘as investors continue to seek out solutions with a balance of protection and growth’.

Registered index-linked annuity (RILA) sales amounted to US$10.4 billion in the first quarter of 2023, up eight percent from the prior year. LIMRA is predicting RILA sales to have another record-breaking year in 2023, likely growing at least 10% as RILA’s value proposition will continue to attract investors seeking a greater return on investment in exchange of some of the downside risks.

According to LIMRA, traditional variable annuity (VA) sales continued to slide posting sales of US$12.9 billion in the first quarter, down 30% from first quarter 2022 results - with market volatility expected to remain high, LIMRA is forecasting sales growth in this category to be flat in 2023.

Financial advisor is lead plaintiff in FIA sales lawsuit

A former Lincoln Financial agent is the lead plaintiff in a Texas lawsuit alleging that the insurer misrepresented the potential returns with its OptiBlend fixed indexed annuity, according to a report from InsuranceNewsNet.

Former agent Henry Morgan and eight other plaintiffs, all Morgan's clients, signed FIA contracts in February 2020 alleging Lincoln led them to expect the consistent six percent gains the product back-testing illustrations showed.

The plaintiffs are seeking class-action status and are suing both Lincoln and Fidelity Product Services, which supplied the index underlying the Lincoln OptiBlend FIA - both Lincoln and Fidelity filed motions to dismiss this week, according to the report.

The motions argue that the lawsuit should be dismissed because plaintiffs do not state a claim. The alleged misrepresentations took place in 2019 and 2020. Initially filed in Dallas County court in February, the defendants successfully petitioned a month later to move the lawsuit to the US District Court for the Northern District of Texas.

The National Association of Insurance Commissioners is considering a full-scale revamp of the overall life insurance illustration model to address problems with back-testing illustrations of proprietary indexes used in life insurance and annuity products.