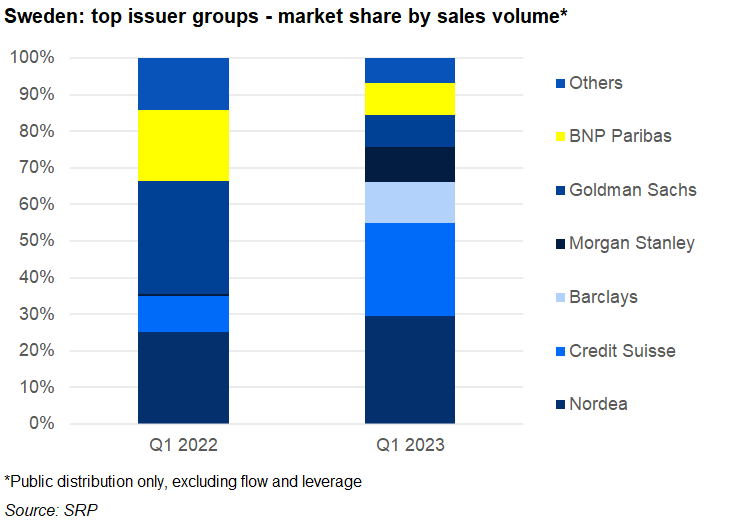

Nordea claimed top spot in a quarter which saw both Goldman and BNP lose significant market share.

An estimated SEK1.6 billion (US$155m) was invested in 112 publicly offered structured products during the first quarter of 2023 – down nine percent by sales volume compared to the prior year period (Q1 2022: SEK1.8 billion from 107 products).

Ten different issuer groups were active in Q1 2023 – they were a mixture of Nordic financial institutions and European and US investment banks (Q1 2022: nine).

Nordea was the number one issuer with a 29% share of the market – an increase of four percentage points year-on-year (YoY).

The Helsinki headquartered bank collected SEK480m from 28 products, which, apart from its own channels, were distributed via Garantum (15) and Strivo (seven). Nordea’s offering included 12 credit-linked notes (CLN), including five that were relying on the solvency of Stena, a Swedish shipping line company and ferry operator.

Credit Suisse, in second, increased its market share to 26% – up 16 percentage points YoY. The bank accumulated an estimated SEK415m from 28 products, which like Nordea, were available via Garantum (21) and Strivo (seven). Most of its products were linked to equity indices – including Aktieindexobligation Sverige Trygghet nr 4664, a 5.5-year note on the OMX Stockholm 30 that sold SEK31m.

Barclays claimed 11% of the Swedish market in Q1, on the back of 12 products distributed via Garantum that sold approximately SEK185m. The UK bank was not active in the retail segment during the prior year quarter.

Morgan Stanley, another bank with limited visibility in Q1 2022, held a 9.3% share this time around (SEK150m from 13 products) while Goldman Sachs, which was the main provider in Q1 last year when it claimed 31%, saw its market share drop to 8.9% (SEK145m from 12 products).

Another issuer that lost significant market share (from 21% to 8.6%) was BNP Paribas. The French bank issued just 10 products worth an estimated SEK140m (Q1 2022: SEK350m from 11 products).

UBS, Deutsche Bank, Citi, and Société Générale were also active during the quarter.