Société Générale (SG) has won the Most Innovative Index, Best Proprietary Index Provider and Best ESG Solution at the SRP Apac Awards 2023.

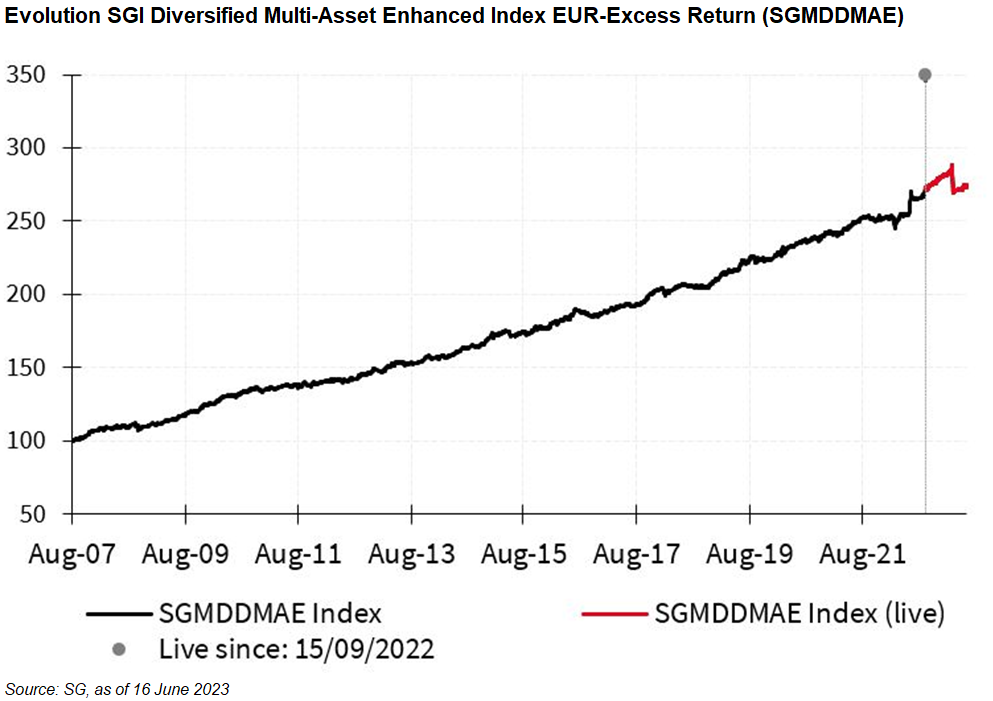

Developed by SG Index (SGI), the SGI Diversified Multi-Asset Enhanced Index (EUR-Excess Return) has been recognised as the Most Innovative Index at this year’s SRP Apac conference for its performance in the structured product market during a challenging environment in the region.

[Going] into late May we started to see a recovery of client interest as the market has stabilised with the strategy performing again - Eric Huang, SGI

With a 4% volatility target mechanism, the multi-asset index aims to capture both alpha and beta via a basket of 4 best-in-class SGI systematic strategies, which offer diversified exposure across equities, commodities, foreign exchange (FX) and rates.

Launched on 15 September 2022, the index was targeted at investors seeking decorrelated and diversified sources of income.

In Apac, the index has been traded through structured products in Singapore, Japan, South Korea and Australia, and has been deployed as a replacement for traditional 60/40 portfolio and momentum multi-asset strategies which have suffered in an environment of positive equity/bond correlation amidst inflationary and rate hiking cycle.

“We had quite strong demand in January and February from regional clients. The SVB shock in early March has put a pause in investors’ demand,” Eric Huang (pictured), director, head of SGI, Apac, told SRP, referring to both the SGI Diversified Multi-Asset Enhanced Index (EUR-Excess Return) and the SGI Diversified Multi Asset Enhanced 2 Index (USD-Excess Return).

“[Going] into late May we started to see a recovery of client interest as the market has stabilised with the strategy performing again,” said Huang.

Momentum, risk parity, trend, carry and value are the factors used for the index.

Specifically, the SGI Diversified Multi-Asset Enhanced Index is long only equity, bond and commodity assets with an objective to capture the trends during bullish periods while limit market drawdowns - it harvests momentum premium by filtering best performers and balances risk diversification to limit downside.

The index also takes long and short positions on short-term rates futures while capturing trends across interest rate markets. It features a defensive risk profile during market downturns alongside upside potential in bullish markets.

Beta hedged commodity dynamic carry is achieved through systematic long-short CTY futures and alpha generation by maximising roll yields.

Huang noted that beta-hedging can better decorrelate the index from spot movements and that the systematic long-short FX strategy was designed to capture value premium by buying cheap currencies and selling expensive ones.

“The value of the currencies is determined as the ratio of the spot FX and the purchase price parity on any given day.”

Since its inception in 2005, SGI has raised ‘dozens of billions’ in assets under management (AuM), nearly half of which comes from bespoke solutions. There are 1,800 live indices and more than 130 markets and execution venues available globally.

The SGI Platform has acted as an essential tool supporting multiple businesses across a number of SG divisions, including access to a wide range of market access, risk premia and delta-one strategies, in an open architecture and transparent environment through rules-based Index format.

The asset classes available in the SGI platform include equities, interest rates, credit, commodities, FX and alternative assets while the products are generally investable via certificates, notes, swaps and funds.

During 2022, the French bank has traded trend overlays on equity benchmarks with regional banks in Japan, CTY dynamic carry indices with private banks and family offices in Singapore as well as thematic indices with wealth managers in Singapore.

Another offering highlighted by the bank was a volatility target versions of SGI’s best-in-class flagship commodity smart beta and carry indices as part of its quantitative investment strategies (QIS).

The dynamic smart beta indices seek to enhance the performance of the benchmark indices by minimising the cost associated with rolling futures, while keeping a low tracking error to these. To achieve this, the indices adapt their exposure to the curve regime of each commodity market.

In the meantime, dynamic carry indices are long smart commodity beta index and short a benchmark with an aim to harvest the negative convexity normally associated with commodity future curves.

On the thematics side, the bank highlighted several recent developments focused on global nuclear baskets, clean hydrogen value chain, greenflation and Asia nuclear.

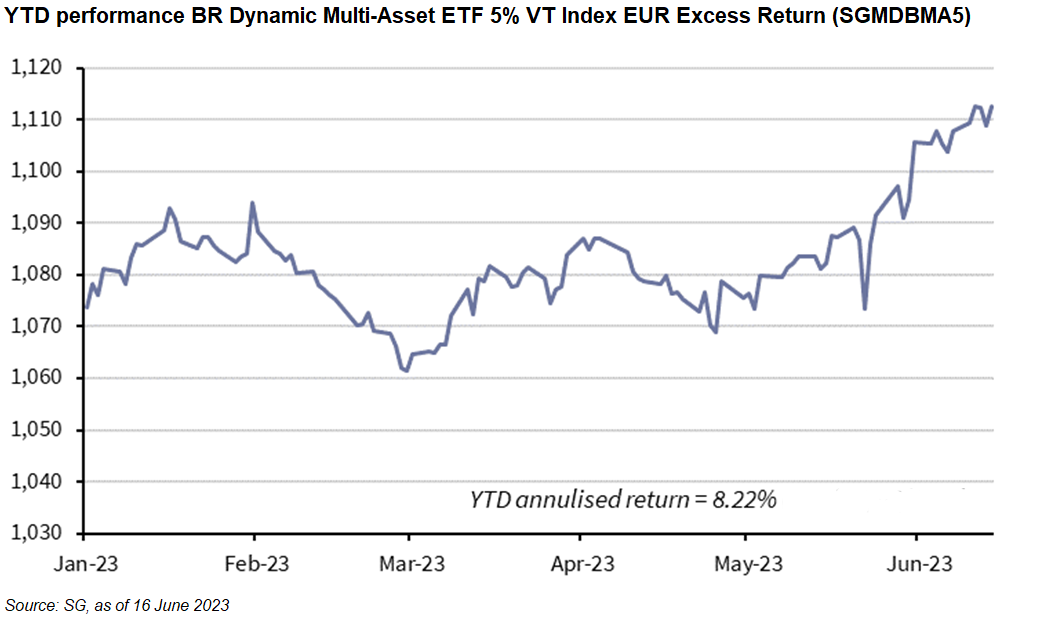

The bank’s BR Dynamic Multi-Asset ETF 5% VT Index (EUR - Excess Return) pocketed the Best ESG Solution accolade, which was offered via a structured note which included a yearly issuer call.

The index which went live on 25 August 2022 is a bespoke systematic long-only multi-asset index combining the performances of the iShares MSCI World SRI ETF and the iShares Green Bond Fund, with a volatility target mechanism to limit the magnitude of price fluctuations of the index.

The product caters to a large regional bank in Malaysia that was looking for alternative and diversified exposure to its clients and was interested in exploring “sustainable and positive solutions”.

Leveraging on this momentum, SG introduced the index to the clients who were very interested and finally traded it end of last year.

In the ESG space, SG also highlighted the Solactive Just Transition Select AR 5%, SGI Green Transition Indices and Solactive Transat Biodiversity Screened as two of its new additions to its index range developed in-house or created in partnership with external index providers.

Funding and contribution are the two ways to embed ESG considerations into a structured note at SG.

The bank commits to finance or refinance, in part or in full, positive impact finance projects for an amount equivalent to the value invested in the ‘positive impact notes’. And a fraction of the collected amount of the notes will contribute to a project through the payment of an external partner or provider.