Structured products expiring during Jan-May 2023 returned average annualised coupons of 8.50%.

In a recent study, SRP analysed more than 1,100 structured products that matured or were redeemed early in France during the first five months of 2023.

The products under review collected an estimated €8.2 billion (US$9 billion) during their initial subscription. Their average annualised return was 8.50%, according to SRP data.

Approximately €5.3 billion was invested in 974 products that delivered average annualised returns of between seven and 10.8%. A further €2.7 billion was tied in 180 products which returned average annualised coupons of between 4.4 and seven percent.

For comparison, a similar study conducted by SRP for more than 1,000 products (€12.6 billion) maturing or expiring early in 2022 found that these delivered an average annualised return of 6.9%.

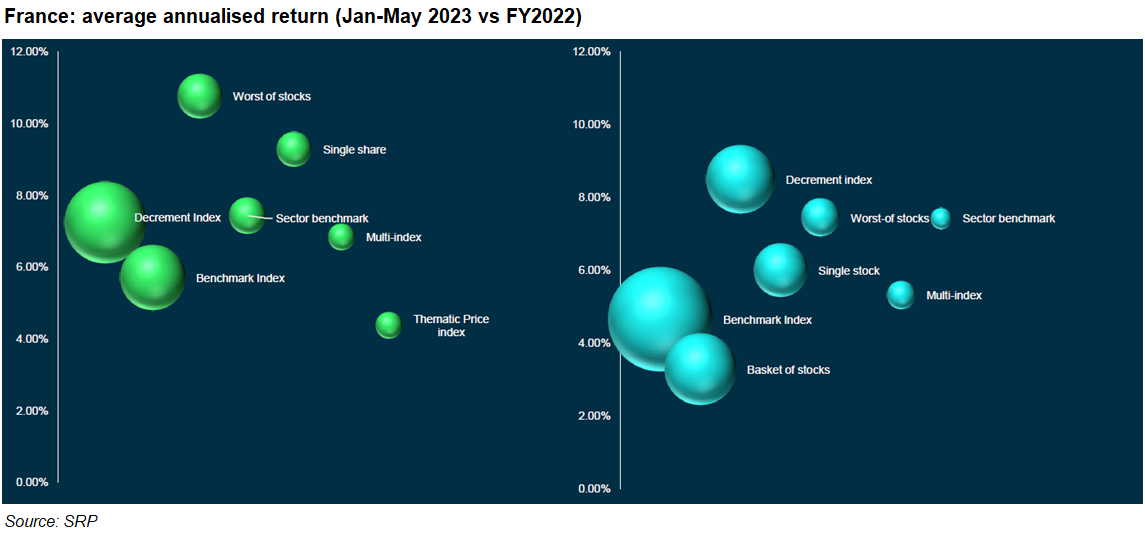

The 400 products linked to a decrement index, which sold an estimated €3.1 billion at inception, provided an average annualised return of 7.24% between Jan-May 2023 – a slight drop compared to 2022 when a sample of 322 products tied to a decrement index (€2.2 billion) returned on average 8.5% pa.

The Euro iStoxx Equal Weight Constant 50 was the decrement index that frequented in the highest number of expired products: 70 in total with an average annualised return of 6.3% pa (2022: 6.9%/22 products).

Some 150 maturing structures linked to a benchmark index, which collected around €2 billion (2022: €5 billion from 105 products), provided an average annualised return of 5.70% (2022:4.70%) while the 250 products linked to worst of stocks, although relatively small by sales volume (€950m), paid on average a coupon of 10.8% pa – up 7.5 percentage points compared to 2022.

The latter included SGP Actions, a five-year autocall linked to a basket comprising the shares of Crédit Agricole, Engie, and Stellantis, which redeemed early after one year, returning 52.4% pa.

Sector benchmarks, which were seen in 90 of the expiring products (€620m), paid an average coupon of 7.4% pa – similar to 2022.

The average coupon for the 220 products tied to a single share (€580m) stood at 9.3% pa (2022: 6%). Of these, Athéna Mensuel Action Janvier 2022 returned 42% pa – 15 months into a five-year tenor – after the underlying share of Orange had increased by more than 15% on its quarterly valuation date.

Expiring products linked to multi-indices and thematic price indices, which, at 17 and 11 products, respectively, were low in number, paid coupons of 6.8% and 4.4% pa.

Disclaimer: returns are based on the coupon shown in the formula and do not take into account management fees, custody fees, levies and taxes.