Local cooperative bank OP Yrityspankki Oyj kept the competition at bay as it remained Finland’s number one issuer for the sixth consecutive quarter.

Ninety publicly offered structured products collected an estimated €375m (US$407m) in the second quarter of 2023 – up 46% by sales volume year-on-year (YoY).

Average volumes, at €4.2m per product, also increased compared to Q2 2022 when products sold on average €2.5m.

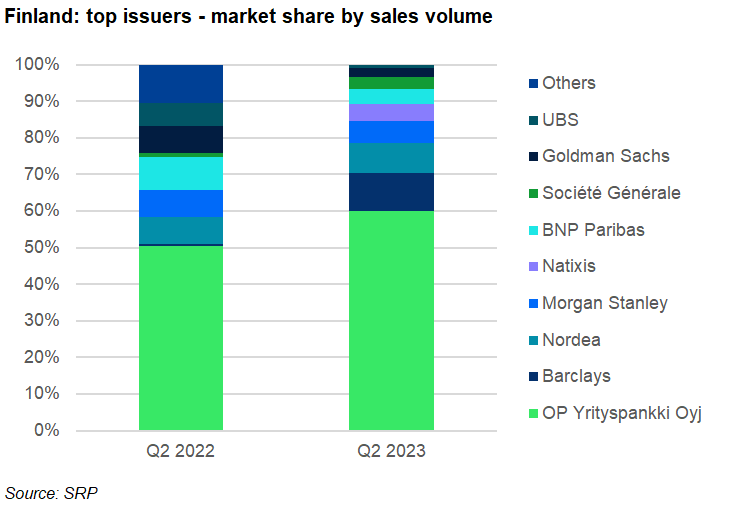

OP Yrityspankki Oyj (formerly known as Pohjola Pankki Oyj) was market leader for the sixth quarter in a row. The Finnish cooperative bank sold 27 products worth €225m – the equivalent of a 60% market share. It is an increase of almost €100m by sales volume compared to Q2 2022 when it gathered €130m, also from 27 products.

The bank’s offering included OP Säästöobligaatio Korkoputki 1 v XXVI/2023, a one-year, capital-protected note on the Euribor, which with sales of €50.6m was the best-selling Finnish product of the quarter.

Barclays, in second, increased its market share to 10.4% (Q2 2022: 0.5%). The UK bank was the manufacturer behind 15 products (€39m) that were mostly linked to equity baskets. They were distributed via Alexandria Markets (14) and Aktia (one).

Nordea and Morgan Stanley claimed 8.3% and 6.1% market share, respectively – fairly stable compared to last year – while Natixis captured 4.7%. The latter, which was active in Finland for the first time since December 2022, sold eight products worth €17.5m. All Natixis’ products were linked to its proprietary iEdge single stock decrement indices which are administered, calculated and published via SGX.

BNP Paribas saw its market share drop by five percentage points: from 9.1% in Q2 2022 to 4.1% this quarter. The bank’s 11 products (€15m) were available via four different distributors: Alexandria Markets, SIP Nordic Fondkommission, UB Omaisuudenhoito, and S-Pankki. The bulk of its volumes, at €10m, came from five credit-linked notes, including three linked to the Markit CDX North America High Yield Index S40 and two tied to the Markit iTraxx Europe Crossover S39.

Société Générale, Goldman Sachs, and UBS were also active in the quarter while Citi, Credit Suisse, Danske, and EFG were the main absentees.