KBC was the number one provider in what proved to be an excellent quarter for the Belgian market.

Some €1.1 billion was collected from 20 publicly offered structured products in the second quarter of 2023 – up 293% by sales volume year-on-year (YoY), according to SRP data.

Average volumes, at €52.4m per product, were also significantly up from the prior year quarter when products sold on average €11.6m.

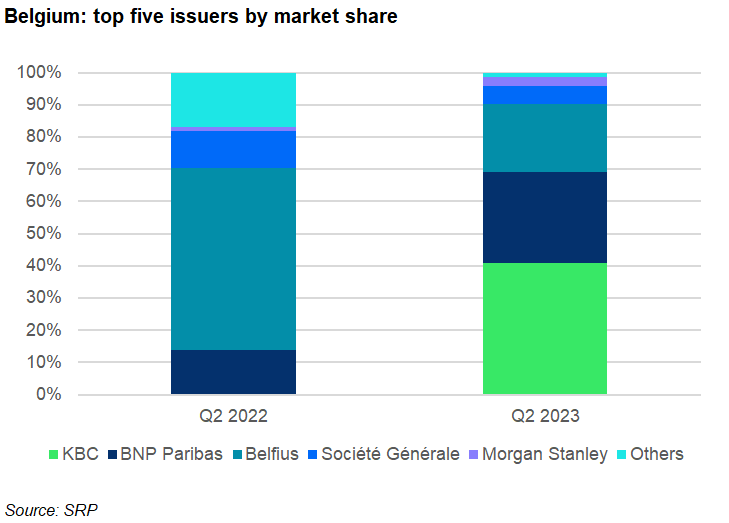

Seven issuers were active during the quarter (Q2 2022: eight).

KBC captured 41% of the Belgian market, making it the number one provider in the quarter. The bank insurer collected €429 with KBC-Life MI Global BestOf 100-1, an eight-year life wrapped structure that offers an overall minimum capital return of 116% at maturity. It was the only product sold by KBC in the period, although still one more than in Q2 2022 when it refrained from issuing products.

BNP Paribas, in second, claimed a 28.1% market share – up 14.3 percentage points YoY. It was the issuer behind eight products that sold a combined €295m. The bank’s best-selling product in the quarter was Fixed to Floating CMS Linked Coupon 2029, a six-year steepener issued on the paper of BNP Paribas Issuance BV. It sold €168m and was distributed via the branch networks of Crelan and AXA Belgium.

Despite seeing its market share drop by 35.5 percentage points – from 56.5% in Q2 2022 to 21% this quarter – Belfius increased its sales to €220m (from five products), up €70m YoY. The bank’s offering included Memory Coupon 06/2027 (€81m), a four-year, capital protected note that pays a fixed coupon of 1.15% per annum. Additionally, a memory coupon of 2.50% is paid, providing the underlying Eurostoxx 50 index closes at or above its initial level on the valuation date.

Société Générale held a 5.6% market share (Q2 2022: 11.3%) and just like KBC, it only sold one product in the quarter: Fixed to Floating CMS Linked Coupon Callable Note 2028. The five-year steepener was available via Bank Nagelmackers and achieved sales of €59m.

Morgan Stanley (2.9% market share) completed the top five. Its two products were distributed via Deutsche Bank Belgium and were worth a combined €31m.

The two other issuers active in the quarter were Deutsche Bank and Goldman Sachs.