Hana Financial and Meritz Securities stood out from the competition in a quarter that saw sales increase by 11% YoY.

Some KRW16.4 trillion (US$12.5 billion) was collected from 5,221 structured products (excluding flow- and leverage) in the second quarter of 2023 – an increase of 11% by sales year-on-year (YoY).

Average volumes, at KRW3.1m per product, were level from the prior year quarter.

Approximately 84% of total sales was invested in 3,904 products targeted at retail investors with the remaining volumes coming from private placements.

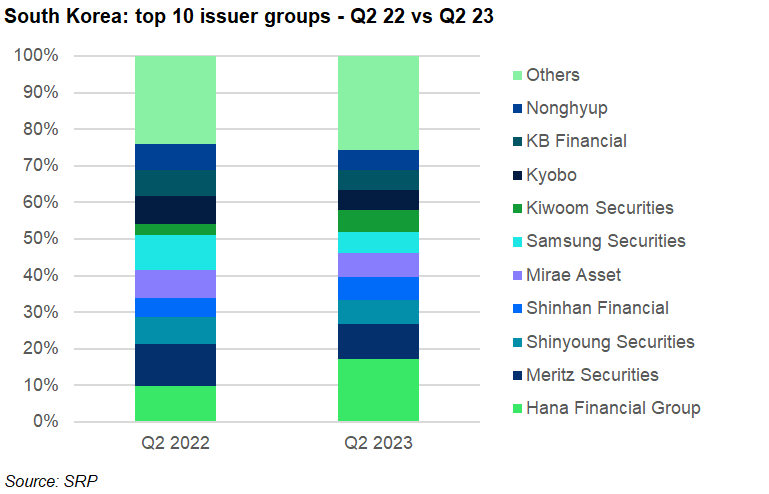

Twenty-two issuer groups – mainly local securities houses – were active during the quarter, the same number as in Q2 2022.

Hana Financial was the number one issuer in the quarter. The company claimed 17.2% of the Korean market, up 7.2 percentage points YoY – the biggest increase of any issuer group in Q2.

Hana issued 452 products worth KRW2.8 trillion, with almost 50% of its sales coming from products linked to an equity index basket and a further 35% tied in products on the interest rates.

In second place, Meritz Securities captured 9.6% of the Korean market in Q2 2023 – down from 11.4% in Q2 2022. The firm achieved sales of KRW1.6 trillion from 298 products that again mostly focused on baskets of equity indices (62% of all sales) often including the S&P 500, Eurostoxx 50, and Nikkei 225 or Kospi 200.

Margins were tight in Korea, with the next eight issuers that completed the top 10 separated by only 1.1 percentage points.

There was certainly not much between Shinyoung Securities and Shinhan Financial – in third place and fourth place – which held a market share of 6.5% and 6.4%, respectively. The former gathered sales of KRW1.1 trillion from 302 products while Shinhan sold 402 products worth just under KRW1.1 trillion.

Just behind those two, Mirae Asset completed the top five with a 6.3% market share (Q2 2022: 7.6%) that was achieved from selling 449 products worth KRW1.1 trillion.

Kiwoom (5.9% market share) was responsible for the best-selling product of the quarter, collecting KRW219.6 billion with Dream ELB 365. The one-year digital offers 104.4887% at maturity, providing the underlying share of Samsung Electronics closes at or above its initial level on 26 June 2024.

The company was also behind the best performance of the quarter, which was achieved by Kiwoom New Global 100tr Club ELS 589, a two-year autocall that knocked out at the first time of asking, returning 109.25% (40.48% pa).