The Connecticut-headquartered advisor has launched a third-party investment platform to provide with access to the same strategies that the RIA uses with its own clients.

NewEdge Wealth has recruited seven advisors and opened three offices in the first half of the year, growing to nine offices nationwide, and is pitching its flagship SNAP strategy among financial professionals and institutions.

The NewEdge Structured Note Strategies team is focused on delivering true SMA offerings to platforms, advisors and clients - Michaelangelo Dooley

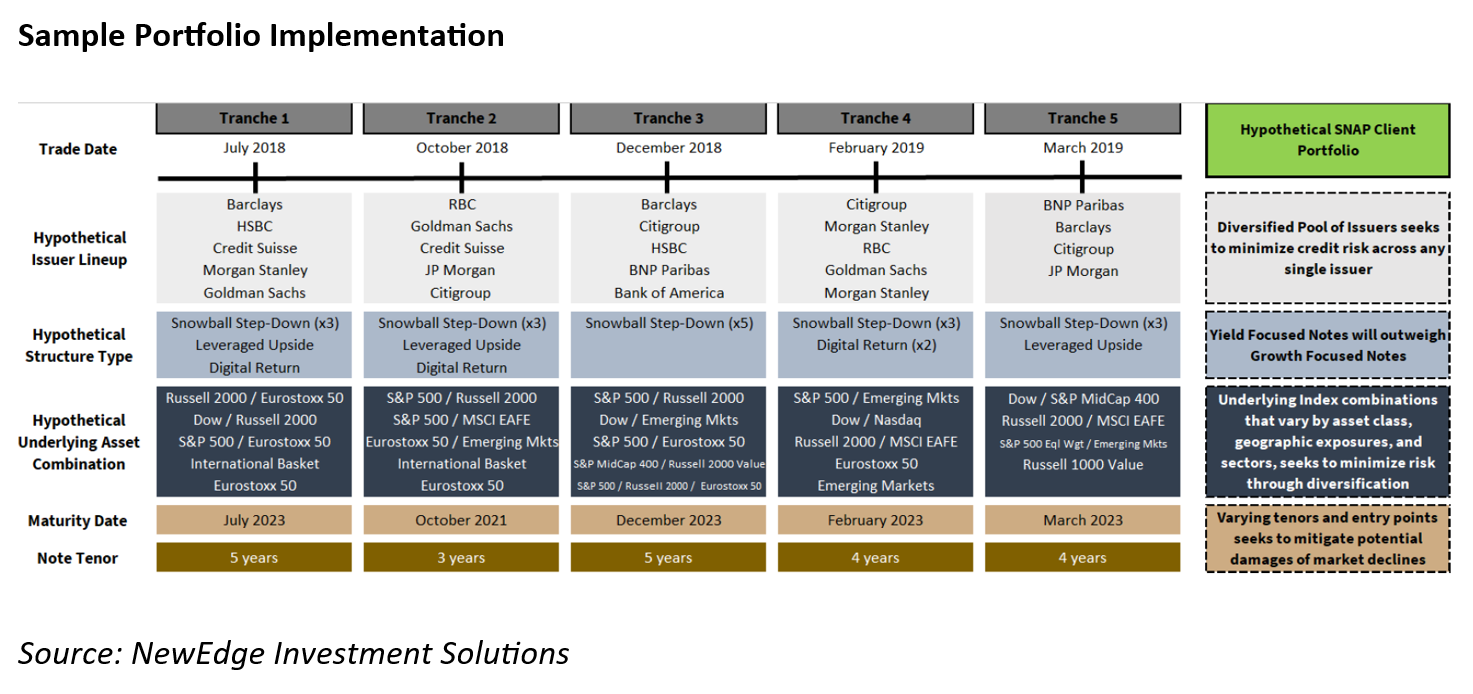

The registered investment advisor (RIA) believes its NewEdge Structured Note Advisory Portfolio (SNAP), provides a new approach to prove that structured notes can achieve diversified and differentiated return streams for investors when used in a separately managed account set up.

“We spent a lot of time creating all of the guardrails for a strategy that can basically fit within that a portfolio allocation structure and provide better execution; as well as giving advisors easier access to structured notes,” said Michaelangelo Dooley (pictured), principal, portfolio manager at NewEdge Wealth.

Up to this point, many of the structured note separately managed accounts (SMAs) that I have reviewed outside of our own have all been simplistic and routine in their implementation, focusing on consistency of implementation, types of notes purchased etc.”

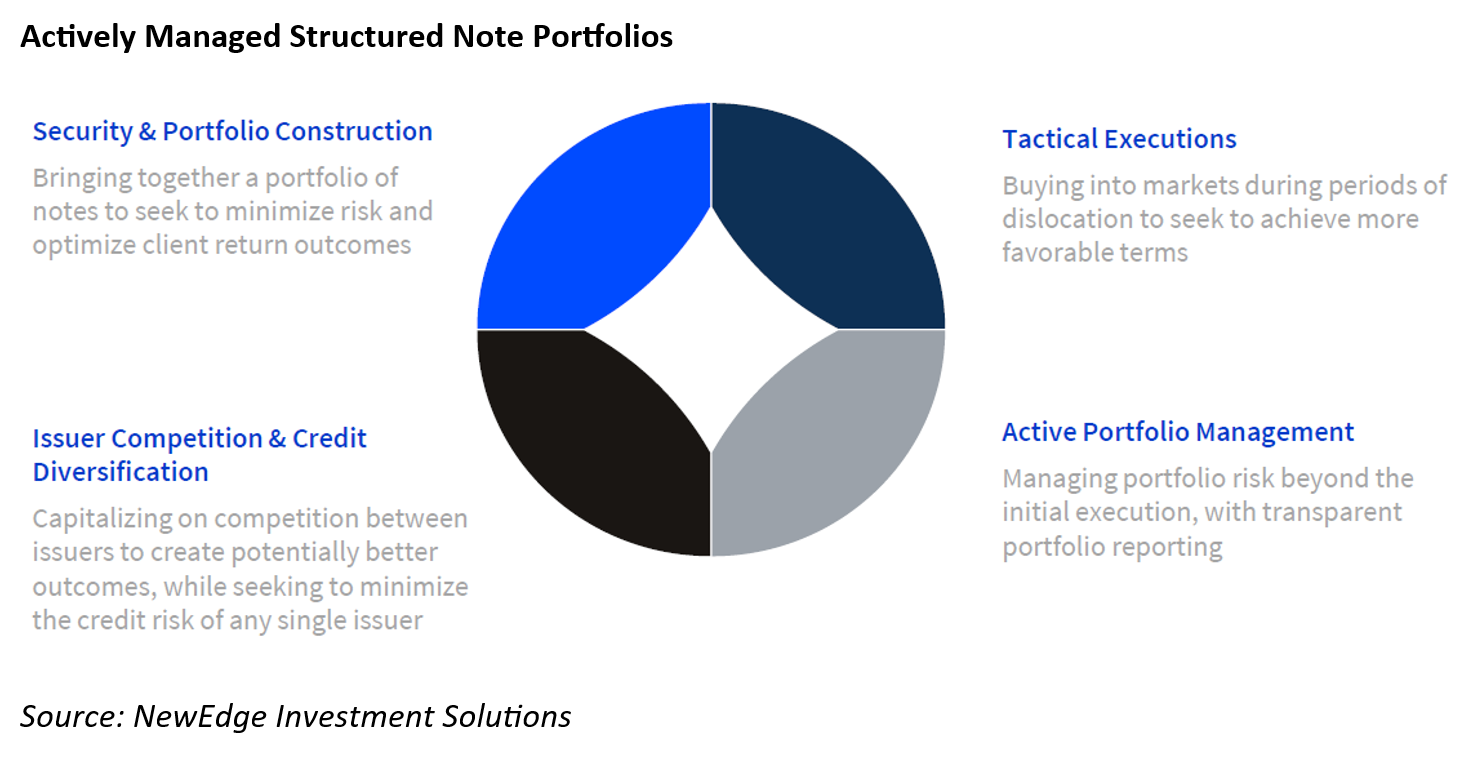

Dooley notes that while this is an important trait to maintain a consistent structure across many accounts, the appeal of the SNAP strategy is that “it maintains some of that flexibility that makes structured notes so special, while still managing towards set strategy objectives”.

“This gave us flexibility as we can access any types of structure notes while focusing on consistency of returns and tax efficiency,” he said.

The SNAP strategy only deals with long-term cap game-focused notes in the US, but it can also access both fixed return notes - yield notes that accrue income and have increased their visibility in the market over the last two years - and growth notes when applicable.

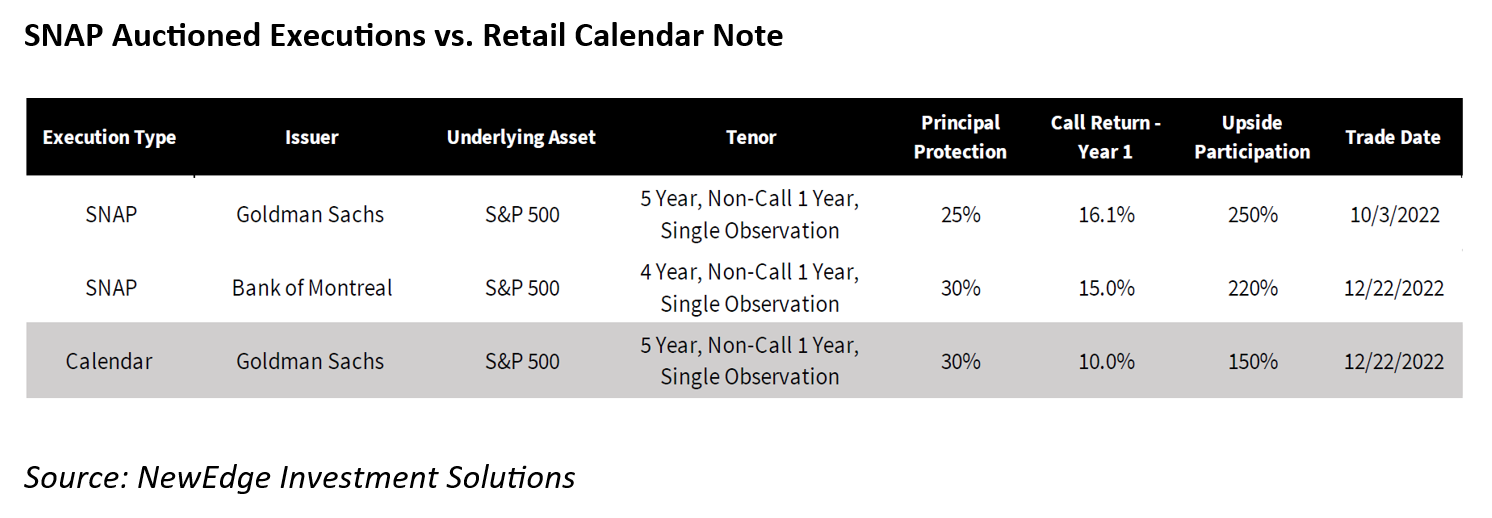

“When it makes sense for us, we can execute tactically,” said Dooley. “We don't need to execute every single month, we execute when volatility picks up.”

Do you think the SMA route has a wider application and go beyond the commission set up?

Dooley: All these things add a little bit of value, so you end up with a much better product than you're seeing sold on many platforms today. We have partnered with other advisors that were clients of us back at UBS and started a sub business of structured note management within UBS.

As we were doing this for years, I saw the opportunity to take it to a broader population and hopefully reshape how advisors and clients in the US access and think about the role that structured notes play within a portfolio.

Most financial advisors that we would speak with about structured notes faced similar challenges around client implementation and the time requirements to properly implement structured notes for their clients, our strategy provided them a solution for both. For clients, managing notes through an advisory strategy rather than one off brokerage transactions made them a far more transparent vehicle and more aligned with how their advisors already charged them (manager fees + advisory fees).

All of this led to our departure to NewEdge Wealth and the recent launch of our Structured Note Strategies group within NewEdge Investment Solutions creating a more institutional platform and separating from the strategy’s history as a financial advisor led one. The NewEdge Structured Note Strategies team is focused on delivering true SMA offerings to platforms, advisors and clients and will seek to lower the barriers to entry and improve investment outcomes for these groups.

Can you provide a breakdown of NewEdge’s SMA portfolio offering?

Dooley: Right now, I'm managing two separate distinct strategies. The SNAP strategy that goes back to 2018 can access all parts of the structured note market but the primary objectives are consistency of returns, high single / low double digits, downside protection and tax efficiency. Within that strategy we only use broad-based indices, no single stocks or custom strategies. It's meant to be almost like a hedge fund replicant. We want just consistency of returns. And we want transparency on why we're buying what we're buying.

The other strategy is a yield-distributing strategy. Even if after-tax returns take a hit for those taxable clients, we hear frequent feedback around investor’s desire for yield. This strategy is a 100% yield-distributing play, similar in the way that executes during volatility, and uses only broad-based ETFs as underliers but differs in that it cannot utilise growth-based notes.

What is the composition of the SNAP portfolio and what kind of exposures it offers?

Dooley: Most SNAP is snowball step down structures that accrue the rolling coupons – it can be called annually if we are at par or better, and if it goes to maturity the step-down portion is really the key because what we're doing is extending the duration of our average note four to five years.

As an example, based on historical index performance data, we know that the S&P 500 and the Russell Index are statistically unlikely to be down more than 30% or 35% over a four- or five-year period. As long as we don't see a market event where the S&P's down more than these 30-35% protection levels, the SNAP strategy is likely to achieve a per annum accrued coupon return times the number of years that the note's been outstanding, even if the markets (the underlying indices) are down. Those per annum accrued coupons have been executing in the 11-13% range (gross of fees) over the past year.

That is the cornerstone of what we do. That's probably 75 to 80% of the SNAP strategy's executions. Outside of that, when we see more appealing growth notes, ie a digital note linked to EuroStoxx 50 where I can extend my duration, increase my per annum expected return from 11% up to 15%, then that growth note may make sense.

We will use a variety of growth notes, leveraged upside notes, digital return notes, and more recently ‘catapult notes’ which offer a fixed call return if the underlying index is positive by any amount from the starting index level one year from the note’s purchase; leveraged upside participation if the note is not called at year one (underlying index performance was negative), against the price performance of the underlying index from the note’s purchase until maturity; and downside principal protection.

‘Catapult’ notes provide an interesting case study around the strategy’s value add vs off-the-shelf structured notes. We'll use growth notes where and only if it makes sense - If growth pricing does not make sense or if market valuations are too expensive, we will not use a growth note. I will always refer to the fact that consistency of return is the core objective.

Is there scope to expand the choice of underlying exposure within the SNAP strategy?

Dooley: It’s hard not to stick to well-known indices, and we are not interested in alternative indices such as S&P futures-linked instead of S&P traditional link. I approach those types of underlyings with a lot of hesitancy, because they might look good on a pricing level without really understanding what's going to happen with that index. Again, the importance if you're going to go mass market is to keep it simple enough that the client understands.