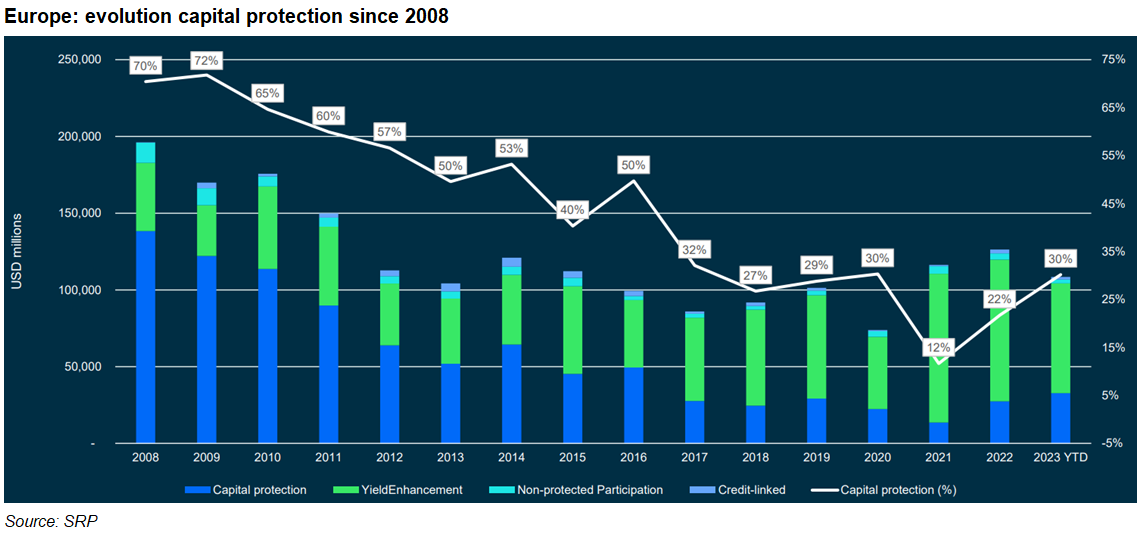

Capital protected products increased their market share for the second year in a row.

An estimated US$108.4 billion was collected from 191,637 structured products in Europe during the first nine months of 2023.

Sales volumes are on track to beat last year’s total of US$126.3 billion, which was the highest level seen across Europe since 2011, when around US$150m was gathered from 18,639 products.

Yield enhancement products sold an estimated US$72 billion in 2023 year to date (US$71 billion of which was equity-linked) with a further US$2.5 billion invested in participation products and US$1.7 billion linked to credit.

Thirty percent of this year’s volumes, or US$32.7 billion, came from products repaying at least 90% of capital, including an estimated US$16 billion invested in equity-linked products and US$10.4 billion invested in products tied to interest rates.

The market share for capital protected products has been on the up since 2021, when, driven by the zero or sometimes even negative interest rate environment, it reached an all-time low of 12%, according to SRP data.

However, prior to 2021, capital protected products claimed a market share of at least 50% in eight of the last 15 years, recording their highest level in 2009, when it reached 72% from US$122 billion invested – split between products tied to equity (46%), interest rates (17%), and other (9%).

The highest levels of capital protection, by market share, was seen in Belgium, were US$3.2 billion was invested in capital protected products – the equivalent of a 99% share of the total market (FY2022: 94%).

Another market with high levels of capital protection was Poland, where US$837m, or 89% of all sales volumes, was invested in this product type (FY2022: 93%) while in Italy US$5.7 billion was linked to products offering to return 100% or more of the nominal invested (45% market share, up from 39% in FY2022).

The best-selling capital protected structure of the year was KBC’s Perspective World Timing 100-1, a six-year fund that offers 100% capped participation in a basket of 30 global stocks. It collected €595m (US$631m) during its subscription period in February.