The NYSE-listed insurer has published a whitepaper about the role of structured annuities in portfolios targeted at near-retirees.

Structured annuities can be viewed as an alternative to investing in other fixed income assets (bonds) but with higher potential returns, better Sharpe ratios and greater upside capture, according to a research report published by Equitable in collaboration with Wade Pfau (below right), professor of practice at The American College of Financial Services.

This paper in particular was motivated by the idea that we already recognise retirees face more risks - Wade Pfau, The American College of Financial Services

In light of recent interest rates rises, near-retirees that depend on bond funds to maintain the value of their assets may be vulnerable to having their financial plan steered off course.

Recent innovations with structured annuities ‘offer an alternative distribution of returns through guarantees that offer both the opportunity for growth and protection against loss,’ according to the paper ‘Improving financial outcomes for household portfolios’.

“This paper in particular was motivated by the idea that we already recognise that retirees face more risks,” Pfau told to SRP. “But even in the context of pre-retirement, this opportunity to move away from the bell curve distribution to a structured product changes the shape of the downside risk and the upside potential.”

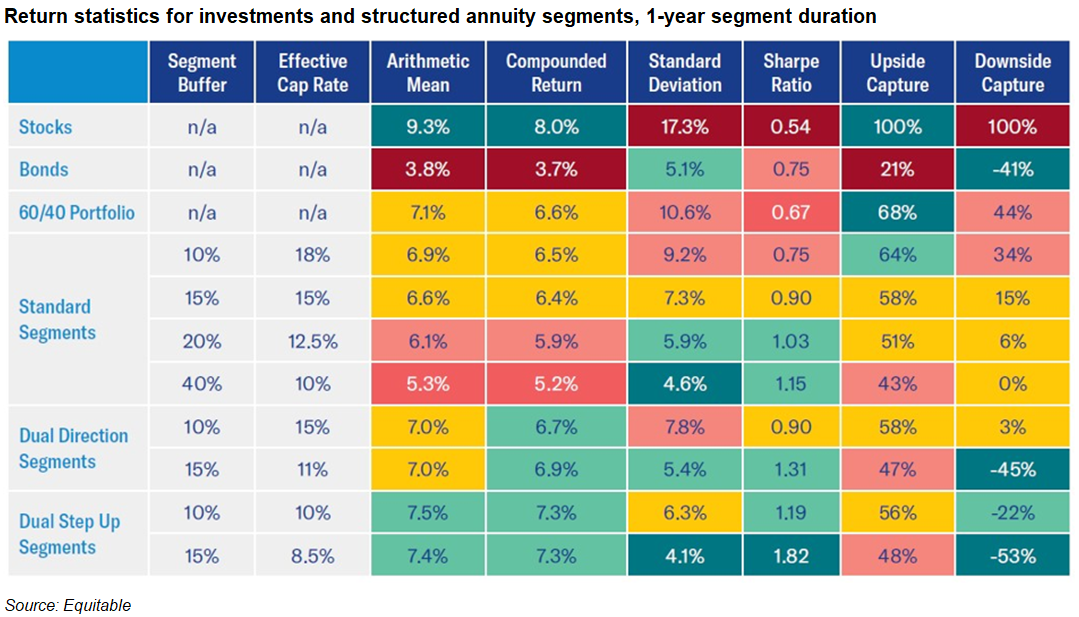

To explore the point, Pfau compares stocks and bonds with three types of registered index-linked annuities (Rilas) that have a one-year duration - standard, dual direction and dual step-up. The investment outcomes are demonstrated by performance metrics, including the average arithmetic return, annualised return, standard deviation, Sharpe ratio, upside capture and downside capture.

Rila, which is a type of annuity that combines some features of fixed-index annuities (FIAs) and variable annuities, known as structured or buffered annuities, have made a splash on the back of interest rate hikes in the US market.

“In the US, Rilas became quite popular around the time of the pandemic when FIAs hardly offered any upside as it took pretty much all the assets to protect principle given the extremely low interest rate environment,” said Pfau.

Headquartered in New York, Equitable made its foray in the Rila space in 2010 as the first mover, according to the insurer. Back then, “Rila was a completely new concept by putting structured product type payoffs inside of a variable annuity,” said Pete Golden (pictured), managing director, individual retirement at Equitable.

Following some initial quiet years, Rilas enjoyed a take-off point around 2013.

“What advisors realised was that clients were looking for that partial downside protection and didn’t need principal guarantee completely,” said Golden.

Financial advisors in the US started understanding the attractiveness of this product in 2018 and 2019, according to Golden.

“What is important to Equitable is the ongoing innovation with options like dual direction and dual step-up that didn't exist even four years ago,” he said.

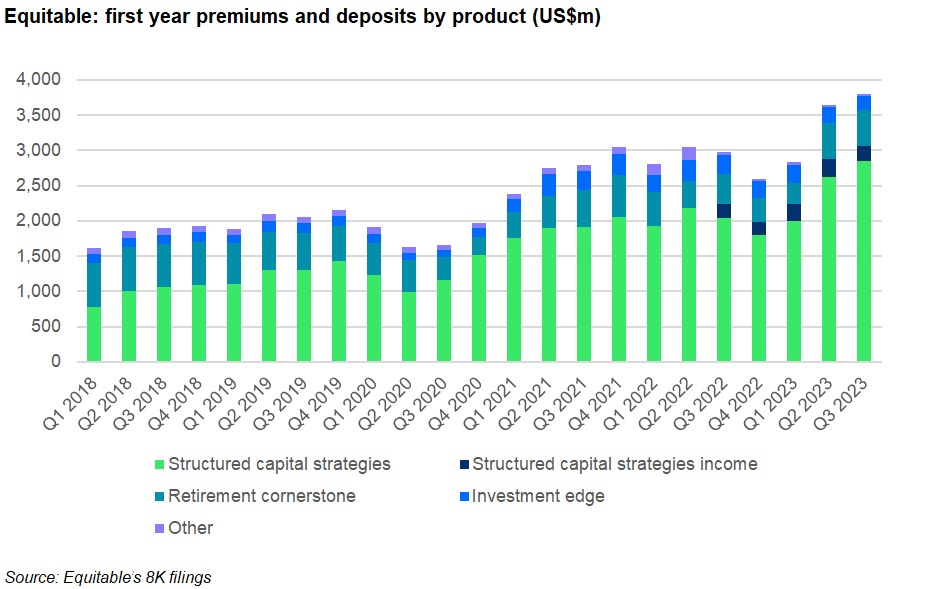

Since its spinoff from AXA in January 2020, Equitable has enjoyed an overall boost from Rila activity. In the past quarter, Equitable saw its first year premiums and deposits of variable annuities reach a peak at US$3.8 billion, in which its flagship Rila - structured capital strategies (SCS) - accounted for US$2.8 billion, or 74.8% of the total for the individual retirement division, according to the company’s Q3 23 earnings report.

In the meantime, SCS Income, which was introduced in November 2021 offering guaranteed lifetime income, contributed US$214m in Q3 23, a 4.9% increase from the prior-year period.

Groupwide, the higher SCS asset balances were also a main driver for net investment income along with higher interest rates, which led to a 14.8% increase in operating earnings at US$210m in Q3 23 year-on-year.

Findings

The whitepaper’s analysis uses 100,000 Monte Carlo simulations for stock and bond returns differentiated between income and price returns, which are based on the S&P 500 and an aggregate U.S. bond index. Returns and standard deviations are taken from BlackRock’s capital market assumptions last updated in February 2023.

The standard segment features a buffer, an effective cap rate and an annual re-set. In contrast, the dual direction segment provides a positive price return at the opposite value of the index loss rather than being credited with 0% when the underlying performance breaches the buffer.

Additionally, the dual step-up segment provides a fixed return whenever the price return exceeds the buffer at a cost of lower upside participation compared with the dual direction.

Pfau noted that Rilas are also an interesting proposition because they offer tax deferral, unlike investment assets held in taxable accounts which face ongoing taxes on their growth.

In terms of arithmetic means, the dual step-up segment offers the next highest arithmetic means, 7.5% for the 10% segment buffer and 7.4% for the 15% segment buffer despite having the lowest caps. For the standard deviation, the least volatility is experienced by the dual step-up segment with the 15% buffer.

Additionally, the standard segment with a 10% buffer provides a comparable Sharpe ratio as bonds. However, all the structured annuities provide a higher reward ratio than any of the traditional investments.

The research findings also show that the cap rates are correlated with the upside capture, which is calculated by first identifying all the simulations in which the total return for stocks was positive, for these rankings. The exception is the dual step-up, which outperforms what is implied by its lower caps.

‘Financial products that use options to create structured returns offer the potential to produce a more attractive range of investment returns and can be treated as asset classes available for the asset allocation decision’, concluded the paper.

The research consists of two chapters with the second scheduled to be released in December, which will focus on protected lifetime income.

“One issue with traditional variable annuities is that it gives a lot of discretion to the investor,” said Pfau. “The insurance company is on the hook to make good on the promise, even if there’s a bad investment decision. With Rilas, the client has more opportunity to maintain a contract value with living benefits, alongside death benefits.”