The US interval fund invests in 31 autocallable notes on different single stocks that offer an average coupon of 24.3% pa, with a targeted AuM of US$1 billion.

Following the relaunch of the SCG Asset Management's (SCG AM) Alternative Strategies Income Fund, SRP spoke to Ian Merrill, managing director at the US provider of derivative-based investment solutions, about the strategy's goal and its place in retail investors' portfolios.

The Alternative Strategies Income Fund, which is regulated under the Investment Company Act of 1940, is “the first registered fund in the US to use solely equity-linked structured notes for income” based on the firm’s market research, according to Ian Merrill (pictured), president of SCG Asset Management.

The fund is protecting against material down swings in a single stock and caters to investors who hold a moderately bullish view on the US equity market - Ian Merrill

“There are a number of separately managed account products that buy individual structured notes in the US, but this is a single actively managed interval fund with one Nasdaq ticker,” the former Barclays banker added.

An interval fund is a type of investment company that periodically offers to repurchase its shares from shareholders, generally every three, six, or 12 months. The new fund offers quarterly repurchases of shares and requires a respective minimum investment amount of US$5,000, US$2,500 and US$100,000 for class A,C, I.

Through its proprietary Selector model, the Alternative Strategies Income Fund seeks to provide low to moderate volatility and low correlation to the broader markets by investing in a portfolio of structured notes that provide high income with consistent quarterly distribution.

“The Selector is a quantitative proprietary system that combs through thousands and thousands of structured notes to source a basket of notes with a target income level,” said Merrill.

The active management is provided by the team, led by CEO Gregory Sachs, based on its research on the underlying stocks before the final investment decisions are made.

With a track record since 2010, the Illinois-registered fund is a relaunch with brand new underlying assets and investment objectives. SCG Asset Management became its investment advisor in December 2021 when the fund predominantly invested in private real estate investment trust (REITs).

“[The fund] has distribution agreements in place with custodians already. The chassis of an interval fund makes sense for structured notes,” said Merrill.

With a primary target on registered investment advisors (RIAs), the fund recorded close to US$17m assets under management (AuM) upon the reconstitution of the fund that was completed on 1 October.

Ultimus Fund Solutions serves as the administrator, accounting agent and transfer agent of the fund

“We’ve seen very strong demand in the US for the defined outcome products,” said Merrill. “The concept of 60/40 has morphed into multiple investing themes within a portfolio.”

SCG Asset Management aims to scale the AuM to over US$1 billion over time.

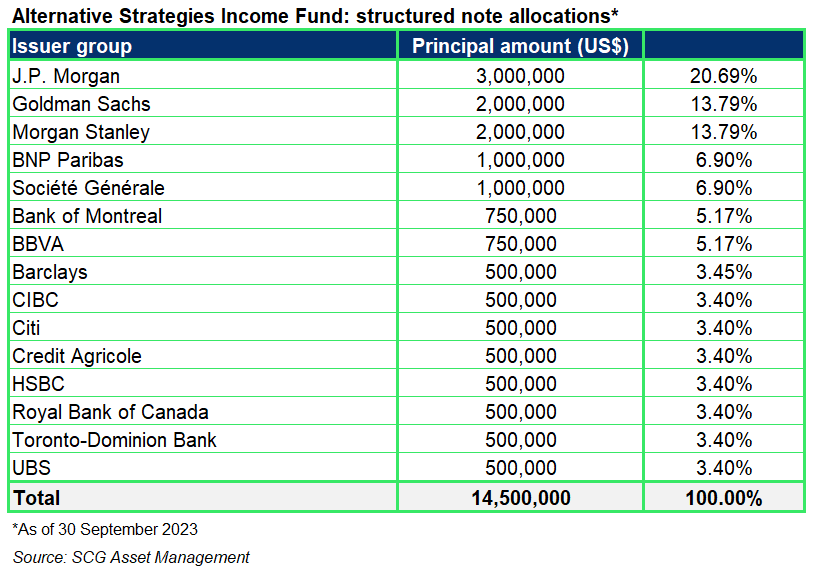

As of 30 September, approximately 87.6% of the assets, or US$14.5m, were invested in a basket of 31 phoenix autocallable notes with varied maturities issued by a total of 15 banks in the US. The US$2.3m remaining was allocated to a money market fund – the First American Government Obligations Fund Class X, 5.26%.

The proceeds are added to the cash allocation when any structured note in the portfolio matures, is called, or pays a coupon.

“The fund is protecting against material down swings in a single stock and caters to investors who hold a moderately bullish view on the US equity market,” said Merrill.

The fund's portfolio had J.P. Morgan as the top issuer on the back of six structured notes among 15 issuers featured as of 30 September.

By sector, internet media & services, application software and renewable energy equipment were the most favoured by accounting for 13.0%, 9.8% and 7.4% of the entire structured note principal, respectively.

A 3(a)(2) bank note (ISIN: US83370BD751) linked to the performance of Peloton Interactive shares offers the highest coupon at 35% pa. with Société Générale acting as the issuer.

Four of the structured notes have been replaced following their maturity after 30 September, including the Equity-Linked Notes - Coinbase Global (40057LZP9), Yield Note - Callon Petroleum (90279FWX5) and Equity-Linked Notes - Chewy (40057PJ37).

“The fund can be a high yield sleeve, as a complement to any growth investments. It’s not meant to replace any one existing position but is simply a complementary piece of a diversified portfolio,” said Merrill. “The challenge will be the education around the mechanics of internal funds and portfolio incorporation.”

SCG Asset Management, which had US$129.6m total AuM as of 8 March 2023 as its ADV filing shows, has “a number of other fund ideas” for next year, including strategies for lower income level and growth.

Those funds will still seek to leverage its Selector model, which is set to cover more structures including worst-of indices, exchange-traded funds (ETFs) and non-US equities.

“We also hope to create white label solutions for clients who want a particular income level or target investment,” said Merrill, adding that the firm is developing separately managed account (SMAs) ideas that allow for customised index development.