Wilgenhaege has collaborated with Société Générale for its latest Athena autocall.

Wilgenhaege is marketing ASM International 13.8% in the Netherlands.

Several [Athena's] have autocalled this year, so it makes sense for investors to rollover the released monies into a new one - Tjerk Smelt

The five-year note is subject to annual early redemption, providing the underlying share of ASM International (ASMI) closes at or above its initial level on any annual valuation date. In that case, the product returns 100% of the nominal invested, plus a coupon of 13.8% for each year elapsed.

At maturity, a European barrier for capital protection of 70% applies.

The product is issued on the paper of SG Issuer with Société Générale acting as the guarantor. It is the sixth Athena autocall distributed by Wilgenhaege in the Netherlands this year, and their third linked to a single stock.

“In recent years, clients have started at Wilgenhaege specifically for our Athena's,” said Tjerk Smelt (pictured), director relationship management, asset management & private investments, Wilgenhaege.

“Several [Athena's] have autocalled this year, so it makes sense for investors to rollover the released monies into a new one.”

This year, two of the fund managers’ Phoenix autocalls, Easy Coupon 12.8% and Easy Coupon 11.8% – both of which featured ASMI as one of the underlying stocks – redeemed early too, and, according to Smelt, many clients that invested in these Easy Coupon’s also have or have had Athena’s.

“Given the height of the coupon, [right now] preference is given to the latter category.”

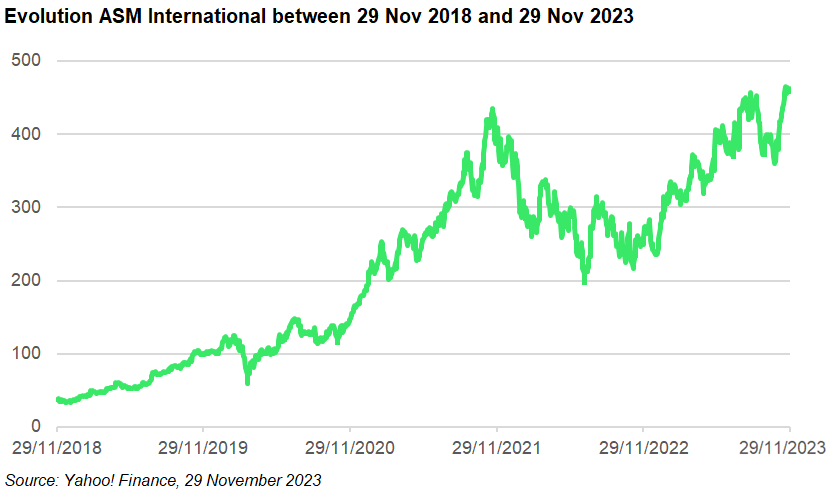

The underlying share of ASMI, a Dutch multinational company that specialises in the design and manufacturing of semi-conductors, is fundamentally supported by Wilgenhaege, according to Smelt.

“ASMI is increasingly finding itself in the sweet spot in the chip value chain and its technology is crucial for the latest generation of chips to function properly […] this means that the company is well positioned for the coming years.”

The SRP Netherlands database lists 11 publicly offered live products from Wilgenhaege – including 10 autocalls and one participation note – all of which put full capital at risk, and although Smelt insists the market for capital protection is interesting and he keeps a keen eye on it, at this moment in time investors favour the high coupons attached to the Athena’s.

“Products with 100% protection are often aimed at growth rather than the direct income preferred by our clients.

“Capital protection products in the more distant future will also be discounted net, which, with a longer term and higher interest rates, is not what our target group is looking for,” Smelt added.

It has been a good year for Wilgenhaege, which has seen a strong growth in structured products during 2023, partly thanks to successful redemptions.

“Six very positive, two with a small negative, and soon two more that could potentially redeem with a big plus.

“Added up, good results, which means released capital plus a lot of interest income to roll over, satisfied clients who often make additional deposits for new clients, and a list of results that forms a nice showcase for new clients,” said Smelt.

Including ASM International 13.8%, Wilgenhaege has placed six structured products this year, and Smelt expects more of the same in 2024. “However, we only place a product when we see it has potential, it is not a goal in itself to launch six products per year,” he concluded.

ASM International 13.8% is open for subscription until 15 December 2023.