The new product has been issued by UniCredit using the actively managed certificate wrapper.

CrossBorder Capital has revived the Kintore XAU/FX strategy which was developed in 2015 via a new actively managed certificate (AMC), issued by UniCredit Bank.

Cost, transparency, liquidity – these are the top concerns for investors, and that is why we found the AMC to be the best way to deliver our strategy - Christopher Cruden, Kintore Limited

The CrossBorder Kintore strategy which is owned by Kintore Limited is a systematic, bidirectional trading system that trades gold as a currency versus seven of the largest and most liquid currencies in the world.

The strategy is "trend following" in nature and fully automated in terms of trade implementation and execution - buy and sell signals are generated from price breakouts, volatility and other proprietary signals. The strategy is agnostic regarding position side and leverage is limited to a maximum of 2:1.

When the two firms started discussing their options to collaborate, they looked at the AMC and found that there were some substantial benefits for both companies.

“First of all, AMCs are easier to do, and they’re quicker to do. From the investor's point of view, this has several very substantial benefits,” said Christopher Cruden (pictured), managing director at Kintore Limited.

“The first is that there are no extraneous add on fees in an AMC, because all of the other fees are, in effect, met by the participants - UniCredit, Crossborder and Kintore Limited - there are no formation costs to be reclaimed, there is no administration or audit or anything like that, because the bank does it all and they are taken from the known fees.”

The other benefit, from an investor’s point of view, according to Cruden, is that the AMC is a balance sheet item for the bank and therefore carries the bank's credit rating.

“This means that everyone pays attention. That provided great comfort to us as well as to end investors. In terms of being able to invest and redeem, it is done through an ISIN, because an AMC is a security and not a fund. This makes it far simpler to invest and disinvest for the investor, and far more liquid and transparent,” said Cruden.

Cruden noted that AMCs are “streets ahead of the traditional fund structure which involves all sorts of form filling and expensive admin” and provide a far more convenient way for investors to participate.

“Cost, transparency, liquidity – these are the top concerns for investors, and that is why we found the AMC to be the best way to deliver our strategy,” he said.

Crossborder Capital liked the strategy because it fitted its philosophy as a fund manager and a research house.

The main appeal of the AMC is that it trades currencies with substantial interest rate differentials from which considerable trading profits can be earned - David Straker-Smith, Crossborder

“We analyse central banks’ balance sheets as one of our main investment themes and this strategy fits very well with currencies and gold,” said David Straker-Smith, director of Crossborder. “Everything we do - macro-overlays, managing duration – it’s all done by futures, options and spot. We don't do anything in the equity or private equity markets. The new AMC has exactly the same approach in terms of liquidity.”

The most important thing, according to Straker-Smith, is that as far as the investor is concerned, AMCs are easy and cheaper to package and manage.

“There are no hidden costs, no custodian fees, no depository fees, no exchange fees, no regulatory platform fees, no board meetings, which cost yet another €100,000 a year,” he said. “This is all done by methods of an exchange-traded fund managed by a bank. And from that point of view, it's simple, easy to use, and it has a lot of appeal both to our investors, and to the market in general.”

What is the main selling point of the Kintore strategy?

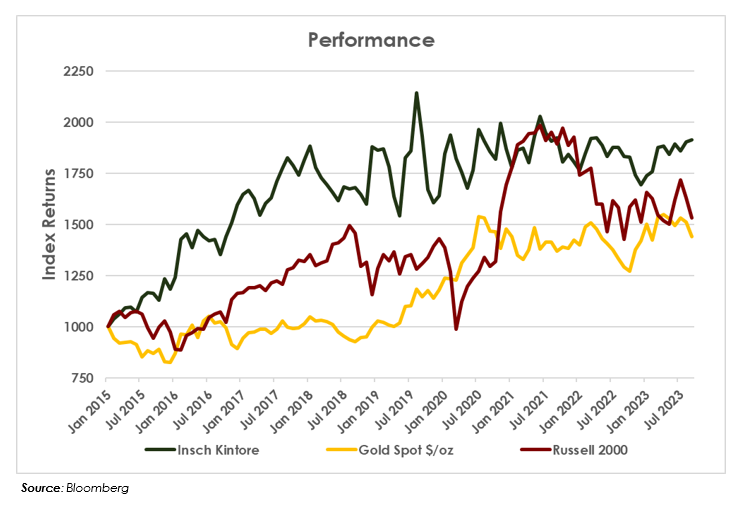

Straker-Smith: In our view, the main appeal of the AMC is that it trades currencies with substantial interest rate differentials from which considerable trading profits can be earned. Profiting from interest rate differentials is something that people are currently interested in because it doesn’t involve the market risks of equity and fixed income. There is no comparison between their liquidity and the liquidity of gold and currencies. YTD, the Kintore strategy is the third best-performing out of more than 6,000 strategies. It has an enviable track record.

Cruden: Currency programmes, in the main, are driven by interest rate differentials and when interest rates are at zero, it is very hard to make money. That's why there has been such a bloodbath among currency specialists recently.

The Kintore strategy itself has run since February 2015 and has a nearly nine-year track record. The strategy uses gold as the base currency versus major FX cross-rates. This allows us to retain the primary advantage of currencies: They tend to trend. The reason for this phenomenon is they are capital flows markets. Not uncoincidentally, the liquidity of capital flow markets is the specialism of CrossBorder.

Low correlation of price streams and their algo returns is what makes this strategy work so well. Using gold as a currency, which many people do already regard as a currency, has provided a very successful outcome. And employing gold, as a currency, is becoming increasingly more topical as government debt increases.

Is there scope to expand the collaboration with other AMCs?

Cruden: We are also considering deploying our straight currency programme into another AMC because it's a straightforward process. AMCs seem to be far better known and accepted now as a vehicle whereas previously if the vehicle wasn't a Ucits or an offshore fund, no one would even look at it.

Straker-Smith: This is the first AMC we have done and we’re now working with UBS to bring to market a different strategy. We have done Ucits funds in the past, but we think AMCs provide a suitable alternative that seems to be popular with clients. We’re in discussions with Kintore which has another FX strategy that we would like to explore.

From our point of view, the AMC is much easier to manage, because it doesn't involve an enormous amount of administration. Simplicity is a great thing. We are dealing with foreign exchange and gold, so it's all very simple. The AMC improves the bottom line enormously. All these costs can add another 1.5% TER (total expense ratio) per year.

Click the link to view the latest Crossborder/Kintore factsheet.