The index provider is promoting research-driven index-based investment approaches to address sector risk.

Morningstar continues to make progress in its plan to increase its footprint in the structured products market.

Whether single- or multi-sector focused, recent deployment of sector-based strategies has mirrored market shifts - Julien Thibaud

In 2023, the index provider saw some 250 structured products linked to 16 different Morningstar indices across several jurisdictions including France (131 products), China (54), USA (34), Switzerland (19), Finland (nine) and Sweden (three). These products raised an estimated US$879m and were sold across three different jurisdictions: France (89 products), China (23), and Finland (three).

The main providers of Morningstar underlyings include Citi (77 products), Goldman Sachs (70), HSBC (54), BNP Paribas (34), Morgan Stanley (14) and Credit Mutuel Arkea (one).

This compares to 68 products linked to seven different Morningstar indices (sold across five different jurisdictions) which raised an estimated US$170m.

SRP caught up with Julien Thibaud (pictured), global head of derivatives & exchange business development for Morningstar Indexes to discuss the index provider’s current focus at a product development level, the tactical use of sector strategies to benefit from new market trends and why sector indices remain in high demand in the structured products market.

In recent years, investors have increasingly turned to equity sector indexes within structured product wrappers with sector-specific strategies being used by investors to amplify exposure to favoured areas, hedge risk or make tactical bets, according to Thibaud.

“Whether single- or multi-sector focused, recent deployment of sector-based strategies has mirrored market shifts,” he said, adding that the sector landscape witnessed a noticeable change in 2023.

“Technology stocks, after suffering a sharp downturn in 2022, staged a dramatic turnaround in 2023, and now represent their highest share of the US equity market since 2000. Within the technology sector, semiconductor stocks have benefited from a wave of enthusiasm for artificial intelligence (AI) in 2023. Meanwhile, the consumer cyclicals and communication services sectors have also benefitted from AI.”

On the other hand, noted Thibaud, some of the best performing sectors of 2022, including energy and defensive areas such as healthcare and utilities, underperformed in 2023.

“In this market environment, we’ve witnessed tactical use of sector strategies to benefit from these trends,” he said. “To profit from changing sector dynamics, investors must be fast and nimble. Index-based tools can help in this process.”

Addressing exposures and bias

By nature, broad beta indexes are weighted by market capitalization – this means that constituent weighting favours top-performing stocks, while laggards receive less weight.

According to Thibaud, the technology sector has surpassed its 2021 market share and now represents close to 30% of the Morningstar US Market Index although the index excludes companies such as Meta Platforms & Alphabet, which are classified in the communication services sector.

“Investors are therefore subject to significant single-sector risk while investing in broad market vehicles,” he said. “As we’ve seen in recent years, sector exposures can be an important driver of return.

Mitigating sector bias and sector risk can be achieved through index methodology – mostly by integrating caps, alternative weighting schemes and other approaches.

“However, there are additional index-based approaches that can more fully address sector distortions,” said Thibaud.

“[Our] indexes systematically incorporate forward-looking valuation signals into some of the index methodologies.”

Wide moat approach

These include fair value estimates from Morningstar’s equity research team which are based on a discounted cash flow model incorporating in-depth knowledge and expectations for future growth.

“This valuation assessment reflects long-term cash flow forecasts (as opposed to traditional valuation metrics such as price to earnings) and can be used as an index selection criterion,” he said, pointing at the Morningstar Wide Moat Focus index as a good example of a rules-based index strategy that incorporates valuation signals.

“The index is designed to systematically highlight stocks with durable competitive advantages and attractive relative valuations. This index is unconstrained by traditional style classifications and sector allocations, so can move wherever the most attractive valuations are found in the parent benchmark.”

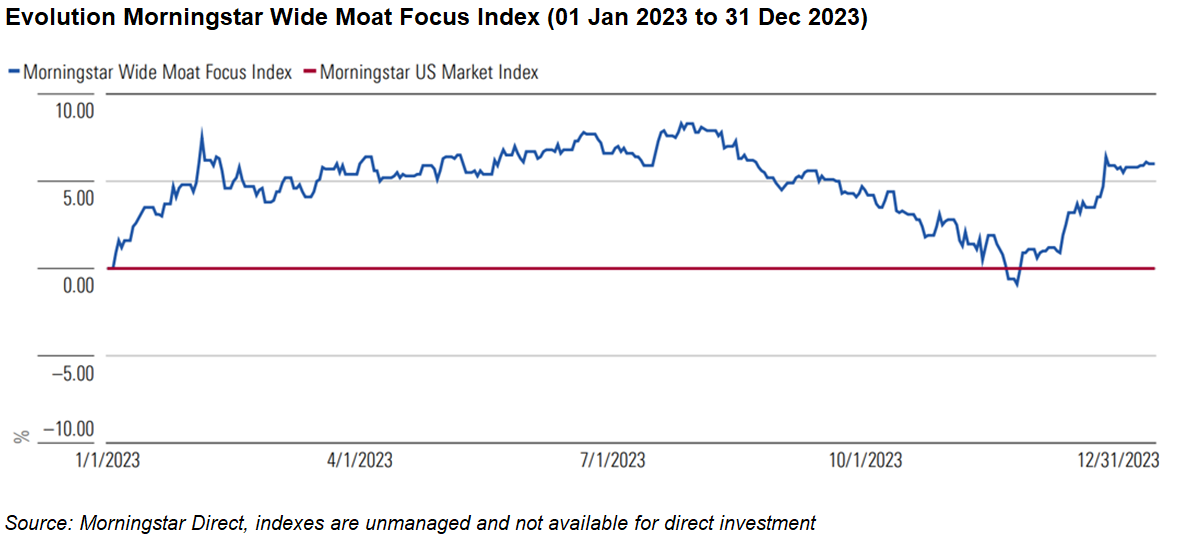

According to Thibaud, the recent performance of the index helps illustrate how a valuation-driven approach can help avoid sector risk.

“Due to its dual focus methodology, which uses a research-based approach to find companies with long-term competitive advantages along with attractive valuations, the index had below market exposure to the high performing technology sector in 2023, yet still managed to outperform the broad market by six percentage points,” he said.

Going forward the index provider expects a busy year ahead in the sector space, with the deployment of tactical index solutions via structured products driven by market trends and sentiment.

“Index-based strategies will require streamlined methodologies and speedy time to market to respond to sharp market movements,” said Thibaud. “Investors looking to take longer-term views should consider valuation-driven index solutions.”