In 2023, 168 of the 225 indices tracked by The Index Standard (TIS) posted a positive return, adding to the momentum for fixed index annuities (FIAs).

In the field of FIAs, the dataset is live for at least one year with best-performers concentrated on the technology and US large-cap indices, according to TIS’s 2023 Index Report.

Indexers take a single, recognisable benchmark as the underlying index, then apply a modern intraday volatility control mechanism - Laurence Black

“After a rocky 2022, benchmark indices recovered in 2023 leading to either new or close to all-time high levels,” said Laurence Black (pictured), who founded the company in 2020. “Artificial intelligence (AI) mania and enthusiasm for the ‘Magnificent Seven’ drove US benchmark returns and indices linked to these themes.”

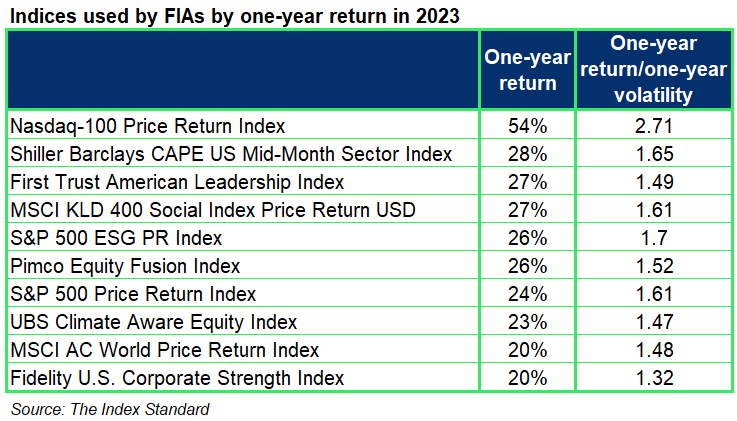

Led by the Nasdaq 100 Price Return Index, the respective average annual return of the top 10 and top 50 indices used in FIAs came to 27.5% and 13.8% in 2023.

In the US, FIAs are tax-deferred long-term investment plans featuring a minimum guaranteed rate and capped or uncapped participation of their underlying indices. They are 100% principal-protected and regulated at a state level, unlike registered index-linked annuities (Rilas).

Meanwhile, the report states that 120 of 164 indices that have been live for no less than three years delivered a positive annualised three-year return.

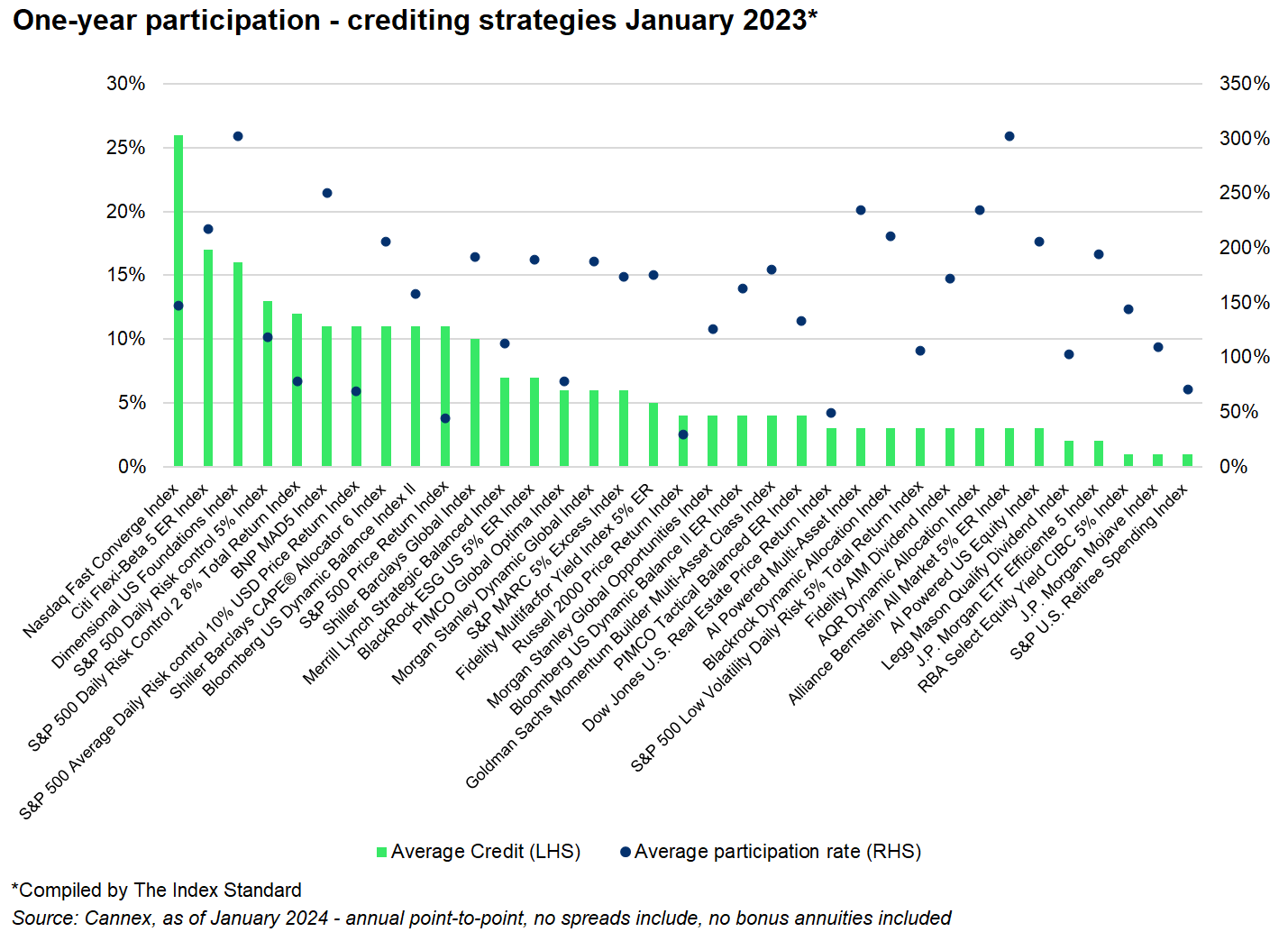

Accordingly, approximately 85% of the indices with an annual point-to-point without a spread crediting method - the most common and simplest type for FIAs - had a positive credit in 2023, the report shows.

A spread is a percentage deducted before investors’ gains are credited, which sometimes are added to uncapped crediting strategies.

The Nasdaq Fast Convergence Index, powered by BofA Securities, stands out as the products linked to this index have posted the highest average credit at 26%l. With a 12.5% annualised volatility target, the index is exclusively licensed to Athene Annuity & Life.

Next in line is the Citi Flexi-Beta 5 Excess Return Index with an average credit of 17%, which is exclusively licensed to Western & Southern member company Integrity Life Insurance Co.

“We noticed a new trend in indices used in insurance products – we call it a ‘back-to-basics’ approach,” said Black. “Indexers take a single, recognisable benchmark as the underlying index, then apply a modern intraday volatility control mechanism.”

‘Explainability’ is the main driver for the wide adoption of the headline benchmarks while the risk control overlay aims to bring higher and more stable participation, added Black.

By underlying asset class, equity-cash, equity-bonds and multi-asset indices posted a respective average one-year return of 7.4%, 2.5% and 2.2%.

With a typical volatility target mechanism, these indices are often blended in to provide some diversification while the S&P 500 is clearly a critical index option for almost every insurance carrier, according to the former Barclays’ index strategist.

Features in demand

The Index Standard, dubbed by Black as ‘little Morningstar’, provides research, ratings and asset allocation forecasts with a goal of ‘demystifying complex index concepts’.

Based in New York, the start-up centres on the domestic annuity market, particularly the FIA segment which is worth nearly US$100 billion, by serving industry players including insurance marketing agents, registered investment advisors, insurance carriers and broker-dealers.

The company currently tracks a total of 251 indices used across FIA, Rila and indexed universal life (IUL) products, including 57 indices added in 2023.

Black pointed out in the report that the average target volatility level of the newly-added indices has edged up from 5.6% in 2020 to 7.0% in 2022 and 7.6% in 2023 mainly due to the rise of US interest rates.

“The level is likely to gently begin to decline this year as the market expects interest rates to come down,” said Black.

In the meantime, US assets continue to win favour, chalking up 75% of the indices added in 2023, as a result of investors’ home preference and the strong US stock market.

“It’s probably a hindsight bias. I would think that if you’re choosing the S&P 500, you’d want to blend in some international indices, like Japan and Europe,” said Black.

“Most people just focused on the US market without realising that you can get good returns elsewhere. That's what we’re trying to do,” he said, citing the firm’s model allocations that are designed to enhance diversification.

The increasing number of indices launched for FIAs has benefited the business at TIS in the past year.

Meanwhile, a fiduciary rule being proposed by the US Department of Labour, which “could have serious disruption for the industry“, are presenting new opportunities for the research company.

“A lot of people in the insurance space will need to behave like fiduciaries and demonstrate a process to evaluate these products,” said Black.

Do you have a confidential story, tip or comment you’d like to share? Write to summer.wang@derivia.com