The Swiss firm specialising in the design, selection and brokerage of custom structured products partnered with Marex to target professional investors seeking crypto exposure in their portfolios.

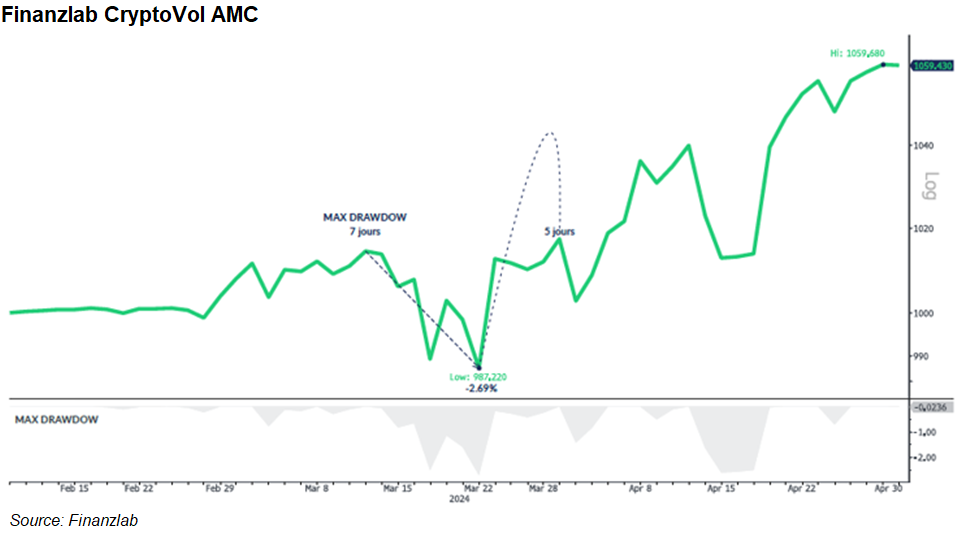

FinanzLab's new actively managed certificate (AMC) CryptoVol has hit its highest level since its launch on 2 February.

The AMC follows a similar strategy to that of the Finanzlab barrier reverse convertible-based Multi Index Fund, and seeks to collect volatility premiums to deliver an attractive return by capitalising on the high volatility of Bitcoin and Ethereum.

We deal directly with options, not structured products, and all orders are placed via a slack channel, which is used for both history and confirmations - Gilles Corbel, Finanzlab

"By using options with low barriers and short maturities, the volatility of the AMC is drastically reduced compared to its two underlying assets," Gilles Corbel (pictured), chief executive and co-founder at Finanzlab, told SRP.

"This makes it easier to integrate cryptocurrencies into a portfolio without taking on too much risk."

The introduction of Ethereum alongside bitcoin in the underlying and the use of options instead of structured products gives the new AMC a unique edge - the Swiss provider trades options that include barriers of about 25% to 30% and conditional coupons every week directly with Marex.

"We deal directly with options, not structured products, and all orders are placed via a slack channel, which is used for both history and confirmations," said Corbel. "Maximum agility and traceability, just like on a blockchain. The innovation brought by this AMC is in the set-up as much as in the strategy."

Finanzlab approached Marex with a request for a digital assets solution with limited exposure to the volatility of these assets at the beginning of the year when cryptos had picked up significantly and the short-term volatility on crypto assets offered opportunity.

The CryptoVol AMC was designed to extract value from short term volatility while maximising protection and limiting the maximum maturity of each product. To maximise the probability of early redemption, the product applies a step down, meaning that the redemption trigger is lower every week (typically 2000/3000 points lower every week on BTC for example).

The AMC was the most suitable wrapper structure as the strategy was too complex to implement within the classic notes lifecycle and the OTC derivatives route offered a more efficient set up as otherwise the product would have required new notes issued every week, which would have made it expensive for both parties.

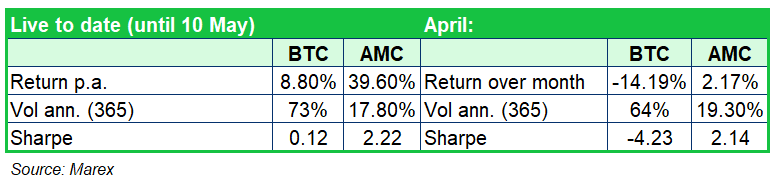

The AMC was launched at the beginning of February, and in just over two months has delivered a 39.6% performance – in April, the AMC traded nine products.

Finanzlab's experience with funds that implement a systematic sale of exotic options to capture overvalued risk premiums came handy to target independent asset managers "with tailored products that they can understand".

"We are talking to several independent asset managers that are interested in investing in Bitcoin and allocating crypto assets into their portfolios to replace gold for example," said Corbel.

"Independent asset managers are looking for a way to put cryptos in their allocation and want products that minimise the drawdown. We think there is scope to develop reverse convertible notes with conditional coupons on Bitcoin/USD and Ethereum/USD as well as double currency units or gold/USD products."

Demand for crypto assets continues to grow with up to 20% of asset managers in Switzerland willing to incorporate Bitcoin in their portfolios - 50% to 40% are reluctant and the rest are thinking about it, notes Corbel.

"Structured products can deliver the right solution to invest in cryptos with protection," he said. "I'm convinced that is the way forward to access this new asset class. Our job is to complete the market and offer alternatives to listed products with solutions for independent asset manager that offer different payoff structures."

Do you have a confidential story, tip or comment you’d like to share? Write to info@structuredretailproducts.com