The German investment bank stopped issuing structured products in the US market during 2020.

Deutsche Bank has stopped new issuance of structured products in the US market with SRP data recording no activity throughout 2020 after three years of diminishing sales volumes. These reached a record low of US$17.5m in 2019 compared to US$618m in 2018, and US$1.1 billion in 2017.

Deutsche Bank’s chief executive officer, Christian Sewing (pictured), announced the sale of its equity derivatives book in a move to de-risk its balance sheet in 2019. Shortly after Goldman Sachs acquired Deutsche Bank’s Asian equity derivatives portfolio while Barclays and Morgan Stanley took over the European and US trading books, respectively.

As part of the shift in its strategy, the German bank also transferred its global prime finance to BNP Paribas, dismantled its Jaguar equities strats platform and the quantitative investment strategies (QIS) team.

In 2019, the German bank launched seven products in the US market tied to four underlyings including the S&P500 and iShares MSCI EAFE ETF (US$3.7m).

Deutsche Bank’s US issuance in 2018 consisted of 94 registered unlisted notes linked to a total of 52 underlyings, including the Eurostoxx 50 (US$170.6m) and the Bloomberg Commodity Index (US$25m), among others.

Popular distributors of products issued by the German bank included J.P. Morgan Chase (US$165.8m), Incapital (US$3.5m), Raymond James (US$3.5m), Merrill Lynch (US$62.8m), Bank Leumi (US$2.5m), and UBS Financial Services (US$26.7m).

In 2017, the bank issued 198 structured products in the US market wrapped as warrants, unregistered and registered notes.

Europe

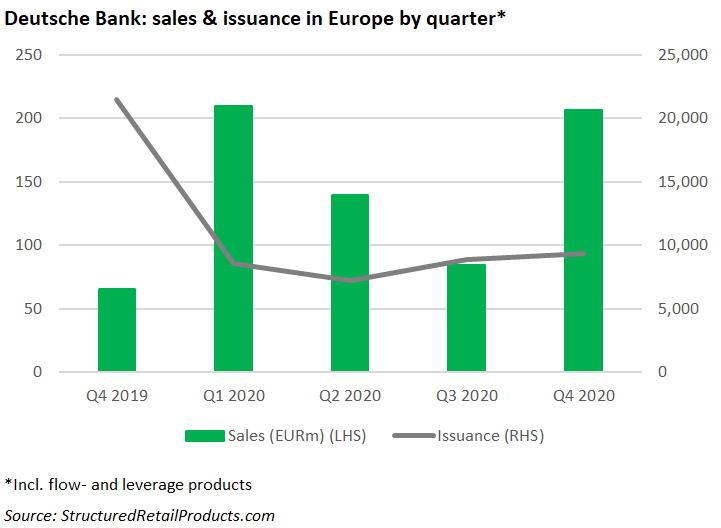

In Europe, the bank rebounded during the fourth quarter of 2020 to issue 9,384 structured products worth €206.7m compared to 8,906 products worth €84.5m in the previous quarter.

The bank’s structured product issuance in 2019 which included only four tranche products has fluctuated - having rolled out 21,423 products valued at €65.7m in Q4 19 - with its sales volumes more than doubling in the first quarter of 2020 to €209.6m on the back of 8,582 products.

Sales volumes hit their lowest levels of the year during the third quarter of 2020 while issuance remained steady, having increased from the second quarter’s figure of 7,238 products.

International

In 2020, Deutsche bank issued 34,110 products across multiple regions including Germany (34,065/US$78.2m), Austria (34,063/US$46m), Belgium (14/US$157.8m), Italy (10/US$46.7m), and Spain (4/US$289.2m).

This can be compared with 2019 when the bank issued a total of 134,558 products across 13 regions, most of which overlap with the following year with Japan emerging as the stand-alone market for the Apac region (eight/US$26.5m)

The majority of the products in 2020 are wrapped as warrants (20,329/US$124.4m), medium-term notes (27/US$215.3m), certificates (12/US$220.3m) and leverage certificates (13,735/US$82.6m).

The most popular underlying in 2020 was gold with a total of 5,878 products valued at US$23.6m, compared to 2019 when the German blue-chip stock index DAX was the preferred underlying with 36,651 products worth US$121.8m.

Earnings

Deutsche Bank’s profits for FY2020 were €624m, with profit before tax of €1 billion, versus a loss of €5 billion, and a loss before tax of €2.6 billion euros in 2019.

Group profit in Q4 20 was €189m, compared to €1.5 billion in the fourth quarter of 2019.

Investment banking net revenues were up 32% to €9.3 billion in 2020 while revenues in fixed income & currencies (FICC) sales & trading rose by 28%, reflecting four consecutive quarters of double-digit growth.

Fourth quarter net revenues increased by 24% to €1.9 billion, driven by a 52% rise in origination & advisory to €532m and a 17% rise in FICC sales & trading revenues to €1.4 billion, supported by strong growth in credit, emerging markets and FX revenues.

Asset Management net revenues were €2 billion, down 4% in 2020 while in the fourth quarter, net revenues were €599m, down 11%, or 9% on a currency-adjusted basis.

Assets under management varied by region with the Americas having €28 billion in Q4 20, remaining steady from Q4 19, Apac with €62 billion compared with €61 billion in the previous year, Germany holding €85 billion, and Spain with the lowest amount at €13 billion.

Click here to view the bank’s Q4 20 earnings.