Local cooperative bank Pohjola increased its market share by more than 30% YoY in a quarter which saw Morgan Stanley impress and Danske go missing.

An estimated €135m ($133.7m) was collected from 49 structured products in the third quarter of 2022 – a 29% decrease by sales volume compared to the same period last year (Q3 2021: €191m from 68 products) and down 39% quarter-on-quarter (Q2 2022: €221m from 80 products).

Average volumes, at €2.7m, were also down, albeit slightly, compared to both Q3 2021 and Q2 2022 when products sold on average €2.8m.

Seven issuer groups – a mixture of Nordic providers, European and US investment banks – were active during the quarter (Q3 2021: nine; Q2 2022: 10).

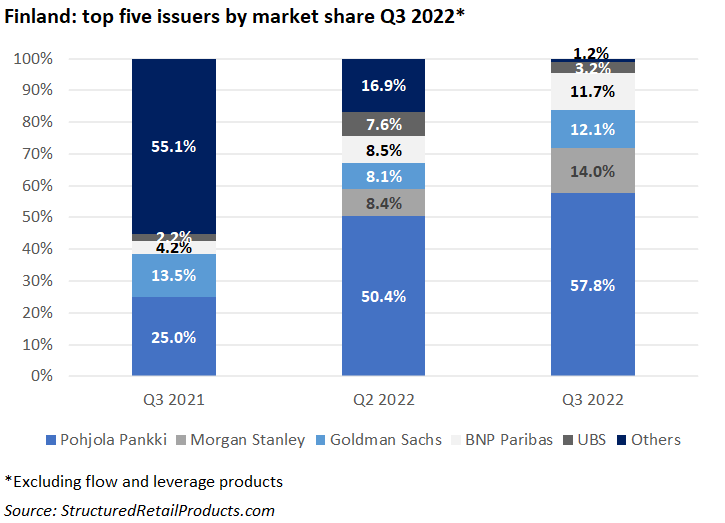

Pohjola Pankki was the number one issuer in the quarter with a 57.8% share of the market – a staggering 32.8% increase year-on-year (YoY) and up more than seven percent from the previous quarter.

The Finnish cooperative bank generated sales of approximately €75m from 16 products that included OP Säästöobligaatio Terveys X/2022, a five-year capital protected note on the Solactive Europe & US Top Pharmaceuticals 2020 AR 5% Index, which, with sales of €22.4m, became the best-selling product of the quarter, according to the SRP Finland database.

Morgan Stanley, in second with a 14% market share, accumulated an estimated €20m from nine products that were exclusively distributed via Alexandria Markets.

Another US investment bank, Goldman Sachs, was the third most active provider, capturing 12.1% of the market from selling eight products, seven of which were linked to a basket of equities. Like Morgan Stanley, Goldman’s products were only available via Alexandria.

BNP Paribas and UBS completed the top five, claiming a market share of 11.7% and 3.2%, respectively. The formers offering included eight credit-linked notes and five structures on a single index, while UBS achieved its market share from just one product, a six-year bonus autocall on the shares of Nokia and Nordea that sold €4.3m during its subscription period.

Danske Bank was the most notable absentee. The Danish bank, which was the number one provider in Q3 2021 with a 33.3% market share, did not issue any products this time around. In fact, even though it has issued 32 products in 2022 to date, its most recent product struck in the beginning of June, with no new products seen since.

Société Générale, which held 3.1% and 0.9% market share in Q3 2021 and Q2 2022, respectively, was also absent in the quarter.