Thematic indices provide exposure to broad investment themes evolving around the adoption of forward-looking structural changes that are expected to transform social and economic affairs.

Quite often these indices track constituents based in emerging markets or companies in sectors undergoing dramatic overhaul due to the emergence of innovative technologies such as AI or cybersecurity.

The index construction of thematic indices overlaps with other types of indices such as factor-based although thematic indices tend to draw eligible constituents from wider indices - usually constructed by the same index provider - and rank the companies based on historical volatility and dividend yield, as those companies scoring less on the former criteria and more on the latter tend to be favoured.

Within SRP’s index classification the thematic index sector is comprised by several sub-sectors including demographics, founders, emerging markets, luxury goods and megatrends such as cybersecurity, robotics, efficient energy, social trends, demographics, faith-based indices.

The thematic index sector comprises 187 thematic indices used between 1 Jan 2019 and 31 Dec 2022 indices featured in the structured products market.

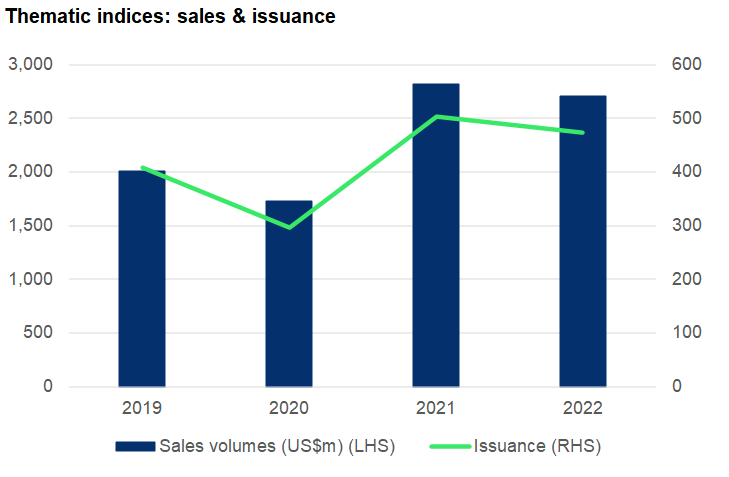

Some US$2.7 billion was collected from 475 structured products linked to a thematic index in 2022, slightly down from the previous year when US$2.8 billion was gathered from 500 products. However, sales volumes were up 57% and 35%, respectively, compared to 2020 and 2019.

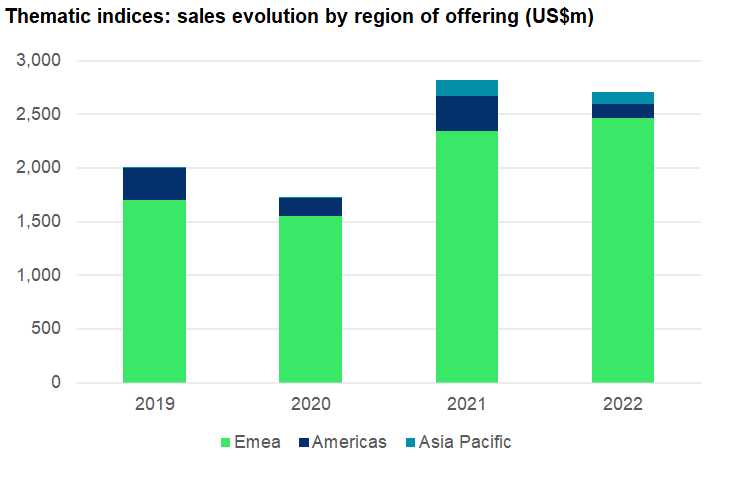

Demand for thematic indices has always been the highest in Europe, Middle East & Africa (Emea) with interest from investors in the Americas and in Asia Pacific only marginal.

Emea’s market share peaked at 91% in 2022 and has never been lower than 83% in the period 2019-2021. The market share for Americas and Asia Pacific in 2022 stood at five percent and four percent, respectively.

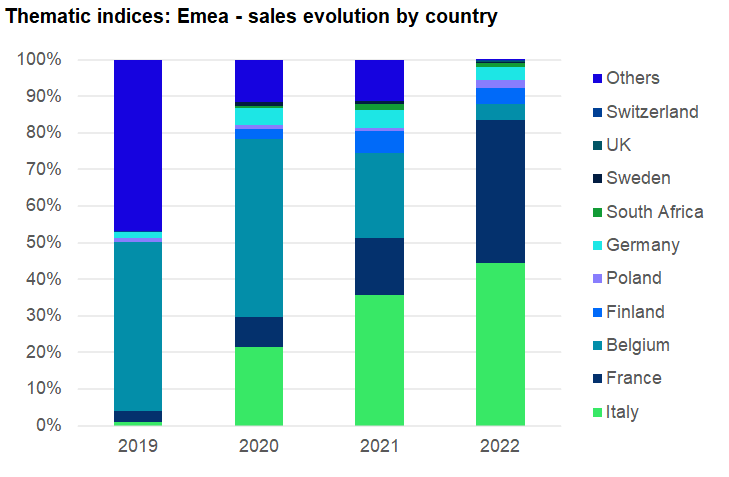

In Emea, Italy has become the main market for thematic indices, with volumes increasing from US$20m in 2019 to more than US$1 billion in 2022.

Another market with sufficient demand was France where sales reached US$900m in 2022. In Belgium on the other hand, where approximately US$800m was invested in products on thematic indices during both 2019 and 2020, sales dropped to US$100m in 2022, partly driven by new recommendations on the use of proprietary indices from the Financial Services and Markets Authority (FSMA).

According to the Belgian regulator, custom-made indices, which are often related to one or more investment themes and are determined by algorithms with complex mathematical calculations based on volatility and dividends, significantly increase the risk that investors not (fully) understand these structures.

In the Americas, the main market for thematic indices was the US, although there too a sharp decline in sales was noticed: from US$325m in 2021 to US$75m in 2022. Volumes in Canada stood at US$35m in 2022 while in Brazil US$30m was invested.

Hong Kong SAR was the main market for thematics in Apac, selling around US$150m in 2022, with South Korea and Taiwan, despite no sales in 2022, the only other markets in the region where there was some appetite from investors.

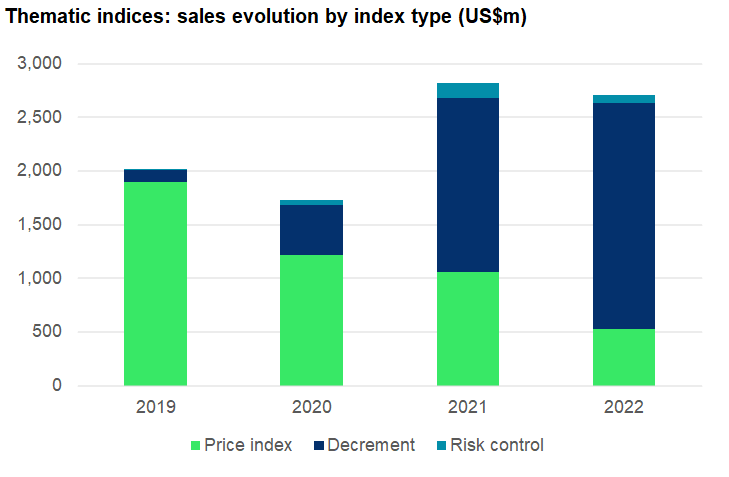

Thematic indices can be divided in three types: price indices, decrement indices and risk-control indices. The former was the dominant type in 2019, but since then its market share has rapidly declined, mostly due to the increased demand for decrement indices. The market share for risk control indices has remained stable.

In 2022, 78% of all volumes came from products linked to thematic indices with a decrement feature (2021: 58%); 20% came from products on price indices (37.5%); and the remaining two percent was tied in products on risk-control indices (4.5%).

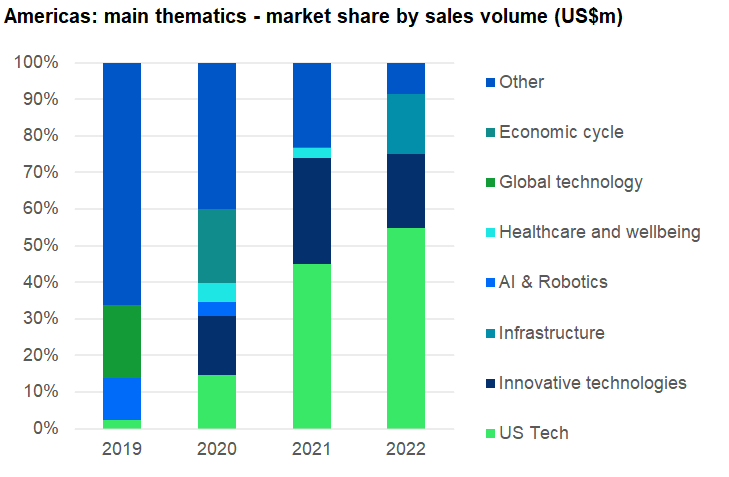

In the Americas, US Tech, represented mostly by the MerQube US Tech+ Vol Advantage Index (US$75m from 246 products), was the main thematic in 2022.

Another theme that grasped the attention of investors was innovative technologies, with Solactive XP Indice de Acoes Americanas de Tecnologia VT 19% the preferred option for investors in Brazil while their US counterparts opted for the Technology Select Sector Index.

Infrastructure (Solactive US Select Infrastructure AR index) was also a theme, but only in 2022, while there was also a smattering of products linked to AI & Robotics (Motif Capital Artificial Intelligence 8 ER Index) and healthcare and wellbeing (Solactive BBVA Health & Wellness SIC MXN Hedged Risk Control 10% Index).

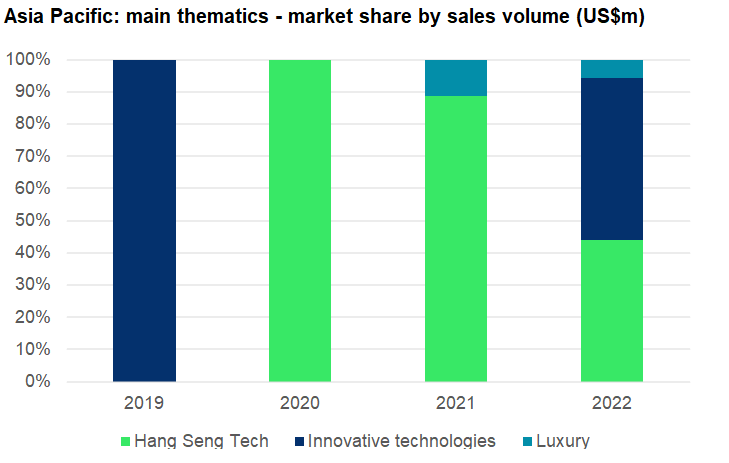

In Apac, only three thematics were seen in 2019-2022: Hang Seng Tech, innovative technologies, and luxury goods. Of these, Hang Seng Tech, courtesy of the Hang Seng Tech Index, achieved the highest volumes (US$185m) in the period.

Sales volumes for innovative technologies, at US$65m, were mainly linked to the Morningstar Exponential Technologies ESG Screened Target Volatility 7% Index, while those for luxury goods (US$25m) came solely from structures on the Solactive Luxury Dynamic Factors 10% Daily Risk Control TR Index.

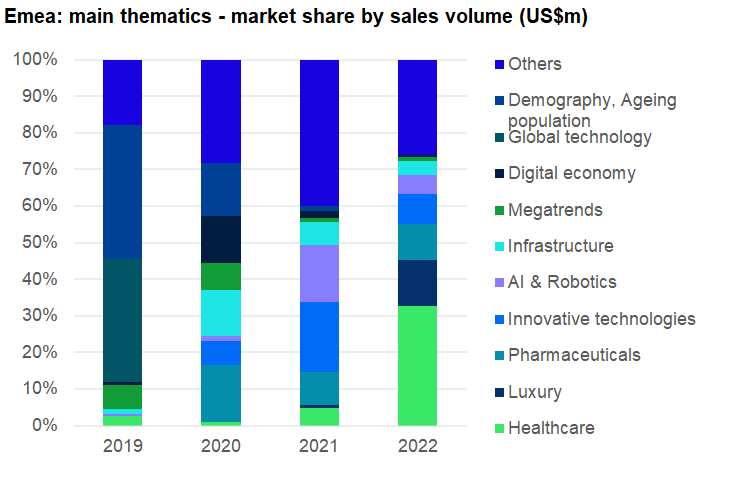

Of the three regions, Emea was the most diverse, with different 27 different themes used in 2022 alone.

Looking at 2019-2022, it is noticeable that every year has a new main thematic. In 2022, healthcare was number one, mostly due to high volumes invested in three products linked to the Euro iStoxx 50 Future Healthcare Tilted NR Decrement 5% EUR Index, which collected a combined US$410m from investors in Italy.

Luxury goods and healthcare & wellbeing were the thematics that saw the highest year-on-year (YoY) growth in 2022, registering a 7.6-fold increase and 5.4-fold increase in market share, respectively, according to SRP data.

Innovative technologies were the main theme in 2021, with estimated sales of US$450m, a third of which came from products tied to the Nasdaq Yewno Global Innovative Tech Ex Idx EUR ER 5% Index that were sold in four different markets, including France (12) and Belgium (two).

In 2020, it was mostly pharmaceuticals (US$240m), with the biggest volume, at US$130m, invested in a capital protected structure on the Solactive US Pharma 10% Risk Control 3% Decrement Net EUR Index that was issued by Intesa Sanpaolo in Italy, while another Solactive index, the Europe & US Top Pharmaceuticals 2020 AR 5% Index also caught the eye (US$100m from 25 products sold in seven different markets).

Demography and the ageing population was the most popular theme in 2019 with sales totalling US$620m. The bulk of those volumes (US$545m) came from 14 products linked to the iStoxx Europe Demography 50 index that were issued by Belfius in Belgium. They included Belfius Invest Accelerator 03-2027, an eight-year life wrapped structure that offers 200% participation in the upside performance of the index, capped at 32%. The product sold US$165m at inception.

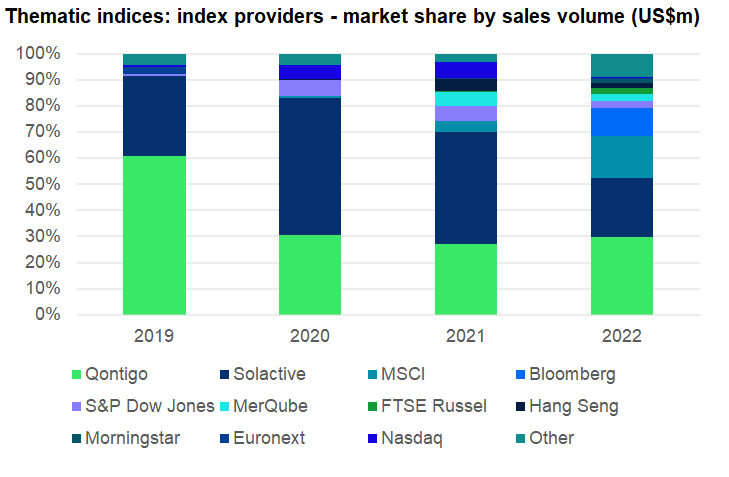

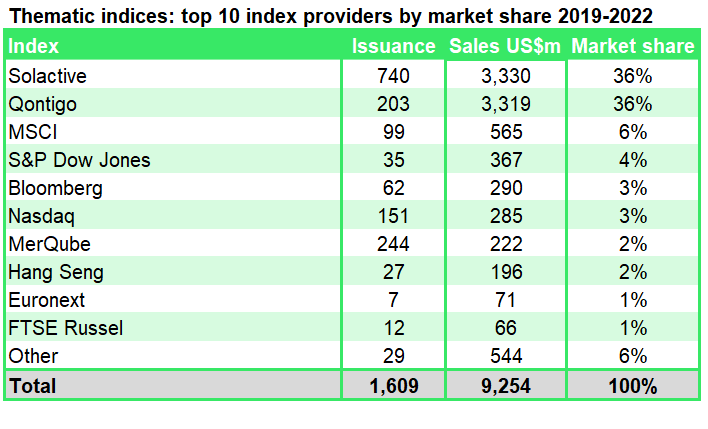

Ten different index providers were active in 2019-2022. Of these, Qontigo achieved the highest volumes, although its market share did shrink noticeable during the period.

In 2022, some US$800m was invested in products linked to Qontigo’s thematic indices – the equivalent of a 30% share of the market.

Solactive, which had claimed a market share of more than 50% in 2020, captured 22.5% of the market in 2022, with MSCI achieving a 16% share.

Bloomberg made its first appearance in the thematic sphere in 2022, selling an estimated US$290m from 64 products issued in France (54), Italy (six), Finland (three) and Sweden (one). Most of its sales came from products linked to the Bloomberg Luxury 2021 Decrement 50 Point EUR Index (US$205m from 44 products) and the Bloomberg Inflation European Equity Winners 2022 Decrement 5% EUR Index (US$50m from five products).

S&P Dow Jones Indices held a 2.8% market share in 2022, just ahead of MerQube with 2.7%.

During the period under review (2019-2022), US$6.6 billion (or US$3.3 billion each) was invested in structured products linked to thematic indices from Solactive and Qontigo, with both companies having a market share of 36% each.

MSCI, which achieved sales of US$565m (from 99 products) followed at some distance, as did S&P Dow Jones (US$367m from 35 products), Bloomberg (US$290m from 62 products) and Nasdaq (US$285m from 151 products).

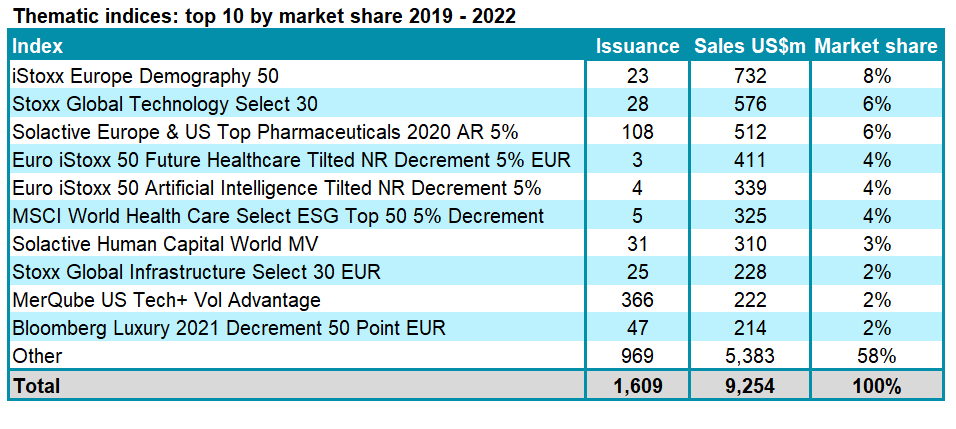

At €732m, products linked to the iStoxx Europe Demography 50 Index achieved the highest sales volumes during 2019-2022. The index was exclusively used by Belfius as the underlying for 23 products issued in the Belgian market between January 2019 and December 2021.

The Stoxx Global Technology Select 30 Index (US$576m from 28 products) was available via five different issuer groups, but mainly via J.P. Morgan (13 products) and HSBC Bank (12). The index last appeared on the SRP database in June 2020 as the underlying for an Express Certificate issued in Italy via Société Générale.

Solactive’s Europe & US Top Pharmaceuticals 2020 AR 5% Index gathered sales of US$512m from 108 products that were available in nine different European markets, with the highest sales coming from France (US$250m from 40 products), Finland (US$140m from 45 products) and Italy (US$75m from four products). Some 87% of all products on the index was issued on the paper of BNP Paribas.

Far less products were linked to the Euro iStoxx 50 Future Healthcare Tilted NR Decrement 5% EUR Index (three) and Euro iStoxx 50 Artificial Intelligence Tilted NR Decrement 5% Index (four), but their combined sales still reached a respectable US$411m and US$339m, respectively. Intesa Sanpaolo was the issuing company for products on both indices which were available to retail investors in Italy.

Products on the MSCI World Health Care Select ESG Top 50 5% Decrement Index sold a combined US$325m, with the largest chunk (US$300m) invested in Corralium Santé, an eight-year fund that was issued in June 2022 by Natixis in France.

By issuance, MerQube US Tech+ Vol Advantage Index was the most successful. The index, which was licensed to J.P. Morgan, was seen in 366 products (US$222m) that were targeted at investors in the US.

*All charts and tables are based on data from SRP.

Main image: Miha Creative/Adobe Stock.

This article is an abstract from the SRP Index Report 2023: Thematic/Decrement indices. The full report is available for download here.